Phyllis Hattis laments the impending loss of direct sunlight on her Picasso. Casting a literal shadow on her apartment is a proposed 90-storey condominium tower, reaching almost 1,000 feet into the sky. “To see this painting without light and without air is to lose it,” she explained in a recent article on Bloomberg Business.

Almost every Manhattanite has feared what would happen if a new construction blocked the sun or a view from a cherished window. And with rampant development taking place, this concern is more warranted than ever. How do developers seem to squeeze ever more building onto small lots? The key to understanding is simple: air rights.

Almost every Manhattanite has feared what would happen if a new construction blocked the sun or a view from a cherished window. And with rampant development taking place, this concern is more warranted than ever. How do developers seem to squeeze ever more building onto small lots? The key to understanding is simple: air rights.

"For whoever owns the soil, it is theirs up to Heaven and down to Hell."

So what are air rights and how can a developer get them?

It all began with the 1797 Slate vs. David court decision that involved two stolen barrels of herrings buried 15 feet under the accused’s yard. The court determined that anything above or below the soil belonged to the possessor of the soil. This legal concept of air rights was based in the Latin phrase Cuius est solum, eius est usque ad caelum et ad inferos, "For whoever owns the soil, it is theirs up to Heaven and down to Hell." In the early 1900s, after the invention of airplanes and increase of air traffic, the space above the soil was amended to “within the range of actual occupation.”

Every lot in Manhattan has a maximum density restriction. Air rights, sometimes referred to as Transferable Development Rights (TDRs), allow landowners to sell any unused development rights to adjacent lots. The new owner of those air rights can build the greater density desired and exceed their "as-of-right" floor area allowances but still must comply with underlying height and setback requirements.

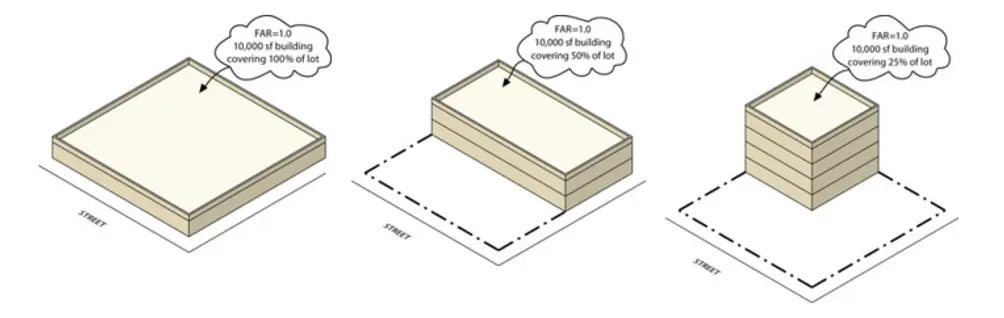

The density restrictions, determined by the zoning laws, are known as Floor Area Ratio (FAR), which is the ratio of floor area to lot size. Nyc.gov gives the example that on a 10,000 square foot zoning lot in a district with a maximum FAR of 1.0, the floor area on the zoning lot cannot exceed 10,000 square feet. If a building has a 20,000 square foot zoning lot in a zoning district with a maximum FAR of 5, it cannot exceed 100,000 square feet of floor area.

It all began with the 1797 Slate vs. David court decision that involved two stolen barrels of herrings buried 15 feet under the accused’s yard. The court determined that anything above or below the soil belonged to the possessor of the soil. This legal concept of air rights was based in the Latin phrase Cuius est solum, eius est usque ad caelum et ad inferos, "For whoever owns the soil, it is theirs up to Heaven and down to Hell." In the early 1900s, after the invention of airplanes and increase of air traffic, the space above the soil was amended to “within the range of actual occupation.”

Every lot in Manhattan has a maximum density restriction. Air rights, sometimes referred to as Transferable Development Rights (TDRs), allow landowners to sell any unused development rights to adjacent lots. The new owner of those air rights can build the greater density desired and exceed their "as-of-right" floor area allowances but still must comply with underlying height and setback requirements.

The density restrictions, determined by the zoning laws, are known as Floor Area Ratio (FAR), which is the ratio of floor area to lot size. Nyc.gov gives the example that on a 10,000 square foot zoning lot in a district with a maximum FAR of 1.0, the floor area on the zoning lot cannot exceed 10,000 square feet. If a building has a 20,000 square foot zoning lot in a zoning district with a maximum FAR of 5, it cannot exceed 100,000 square feet of floor area.

Illustration credit NYC gov

Illustration credit NYC gov

The revamped 1961 zoning laws state that any properties that share at least 10 feet of their lot line can purchase the air rights of those adjacent properties. If an adjacent investor buys the air rights of a property they share 10 feet of lot line with, they are then able to purchase the air rights adjacent to the newly acquired property, and so on.

Thomas Kearns, Partner at Olshan Law Firm, points out that since the regulations state that the lots only have to touch for 10 feet, “it’s like putting pieces of a puzzle together. You can be really creative the way you snake your way around the block.”

Landmark and certain historic buildings have more flexibility with air rights. The Landmark Preservation Law allows landmarked buildings to transfer their air rights across the street and, in some cases, even a few blocks away. Although this is legal, it has been quite complicated due to restrictions and approvals.

Even more flexible rights are granted to Broadway theaters. Broadway theaters are allowed to sell their air rights to anyone in the Theater Subdistrict, whether or not the lots are adjacent (the district is located between 40th and 57th streets between Sixth and Eighth Avenues). The air rights sales can go beyond those of landmark and historic buildings. The Broadway district was deemed worthy of this special designation because the industry generates over $2 billion every year and accounts for 250,0000 full- and part-time jobs.

A Midtown East rezoning steering committee proposal is trying to build on the Broadway district status and pass regulation to allow landmarks between the mid-East 30th streets to the upper East 50th streets to sell their air rights to anyone in that zone. Although not yet passed, some supporters have even advocated landmarks should be able to sell those air rights citywide. Unrestricting churches and other landmarked building to sell their air rights, beyond adjacent or across the street lots, would provide extra income to those landmarks.

Although unlikely, if the steering committee could sell their air rights unrestricted, the opportunity for an open market of air rights is enormous.

Thomas Kearns, Partner at Olshan Law Firm, points out that since the regulations state that the lots only have to touch for 10 feet, “it’s like putting pieces of a puzzle together. You can be really creative the way you snake your way around the block.”

Landmark and certain historic buildings have more flexibility with air rights. The Landmark Preservation Law allows landmarked buildings to transfer their air rights across the street and, in some cases, even a few blocks away. Although this is legal, it has been quite complicated due to restrictions and approvals.

Even more flexible rights are granted to Broadway theaters. Broadway theaters are allowed to sell their air rights to anyone in the Theater Subdistrict, whether or not the lots are adjacent (the district is located between 40th and 57th streets between Sixth and Eighth Avenues). The air rights sales can go beyond those of landmark and historic buildings. The Broadway district was deemed worthy of this special designation because the industry generates over $2 billion every year and accounts for 250,0000 full- and part-time jobs.

A Midtown East rezoning steering committee proposal is trying to build on the Broadway district status and pass regulation to allow landmarks between the mid-East 30th streets to the upper East 50th streets to sell their air rights to anyone in that zone. Although not yet passed, some supporters have even advocated landmarks should be able to sell those air rights citywide. Unrestricting churches and other landmarked building to sell their air rights, beyond adjacent or across the street lots, would provide extra income to those landmarks.

Although unlikely, if the steering committee could sell their air rights unrestricted, the opportunity for an open market of air rights is enormous.

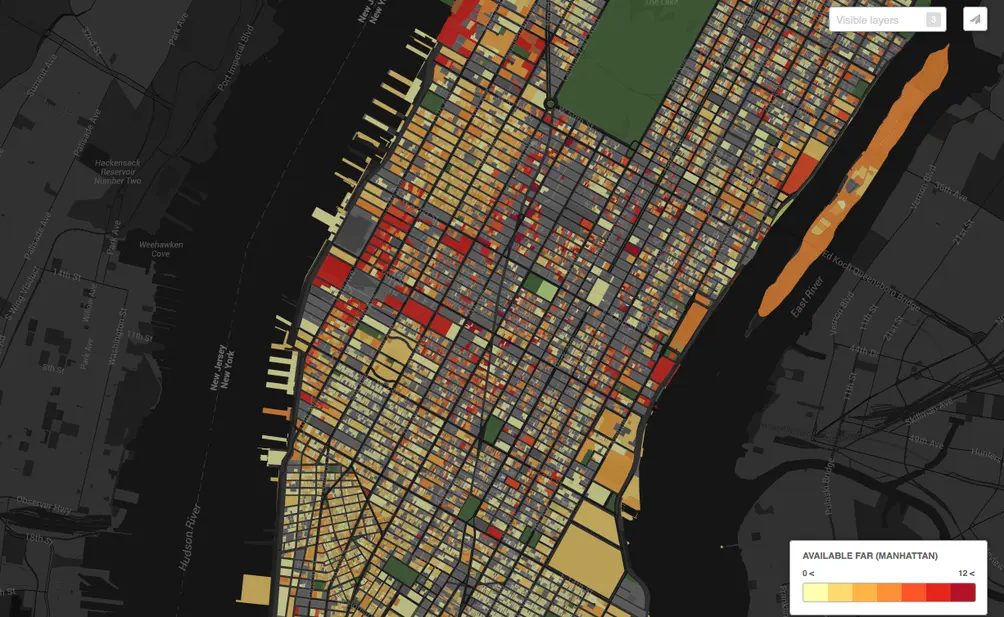

This map created by the Musicipal Art Society reveals the untapped development potential of every Manhattan property

This map created by the Musicipal Art Society reveals the untapped development potential of every Manhattan property

Average price per square foot

- For a Manhattan condo: $1,781

- For Manhattan air rights: $225

- For national housing: $64.44

Gary Barnett, the President and Founder of Extell Development Corporation, famously took 15 years to assemble the property and air rights for the One57, the slender 90-story tower on 57th street, which is quickly becoming known as Billionaire’s Row. Reports suggest that Extell has several tens of thousands of leftover air rights from One57 to build on another site on the block.

The Municipal Arts Society of New York’s (MAS) map, titled “Accidental Skyline,” shows all available air rights in Manhattan. According to MAS “The thought process behind the project was that by raising awareness, neighborhood residents could decide to take a more active role, if they so choose, in the approval process that a potential developer would need to go through,” since most air rights transactions are private transactions between developers and property owners.

The average price per square foot for condos in Manhattan last month was $1,781. That’s finished condos that you can move into. How much is air? According to the Department of City Planning, Manhattan air rights average $225 per square foot citywide. (To put the price of NYC air rights in perspective, the national housing average price per square foot is $64.44, according to the US Census Bureau. So, yes, NYC air is more than three times as expensive than a house in most of the country.)

And these prices have been rising fast: Tenantwise, a New York real-estate services company, says that air rights rose 47 percent in one year to 2013. M. Myers Mermel, chief executive of Tenantwise, told the Wall Street Journal: “Air rights have matured into an indispensable financial component to a number of large developments. In some cases, developers have paid the same price a square foot for air rights as they did to buy the land… [air rights] are the top revenue producers in any building because they become the new upper floors.”

If these prices leave you gasping, you might need to look for something other than air (rights) to breathe.

The Municipal Arts Society of New York’s (MAS) map, titled “Accidental Skyline,” shows all available air rights in Manhattan. According to MAS “The thought process behind the project was that by raising awareness, neighborhood residents could decide to take a more active role, if they so choose, in the approval process that a potential developer would need to go through,” since most air rights transactions are private transactions between developers and property owners.

The average price per square foot for condos in Manhattan last month was $1,781. That’s finished condos that you can move into. How much is air? According to the Department of City Planning, Manhattan air rights average $225 per square foot citywide. (To put the price of NYC air rights in perspective, the national housing average price per square foot is $64.44, according to the US Census Bureau. So, yes, NYC air is more than three times as expensive than a house in most of the country.)

And these prices have been rising fast: Tenantwise, a New York real-estate services company, says that air rights rose 47 percent in one year to 2013. M. Myers Mermel, chief executive of Tenantwise, told the Wall Street Journal: “Air rights have matured into an indispensable financial component to a number of large developments. In some cases, developers have paid the same price a square foot for air rights as they did to buy the land… [air rights] are the top revenue producers in any building because they become the new upper floors.”

If these prices leave you gasping, you might need to look for something other than air (rights) to breathe.

Contributing Writer

Michelle Sinclair Colman

Michelle writes children's books and also writes articles about architecture, design and real estate. Those two passions came together in Michelle's first children's book, "Urban Babies Wear Black." Michelle has a Master's degree in Sociology from the University of Minnesota and a Master's degree in the Cities Program from the London School of Economics.

6sqft delivers the latest on real estate, architecture, and design, straight from New York City.

6sqft delivers the latest on real estate, architecture, and design, straight from New York City.