This one-bedroom at 243 Mulberry in NoLita is listed for a fraction of its market rate price (Corcoran)

This one-bedroom at 243 Mulberry in NoLita is listed for a fraction of its market rate price (Corcoran)

In New York City, marked-down apartment listings naturally attract a lot of attention. After all, why would anyone price an apartment hundreds of thousands of dollars below local market averages? You might assume these spectacular bargains are priced below-market because they were once crime scenes, but this is highly unlikely. With few exceptions, in New York City, severely underpriced units are Housing Development Fund Corporation units or HDFCs.

While HDFCs might be inexpensive, most of these units are not exactly affordable due to the specific conditions under which they are bought and sold. In fact, over time, HDFC units have become the most and least affordable housing option on the New York City Housing market, raising a lot of questions. This article tackles four questions frequently asked about HDFC units.

While HDFCs might be inexpensive, most of these units are not exactly affordable due to the specific conditions under which they are bought and sold. In fact, over time, HDFC units have become the most and least affordable housing option on the New York City Housing market, raising a lot of questions. This article tackles four questions frequently asked about HDFC units.

In this article:

Can anyone buy an HDFC Unit?

The short answer is no, but understanding why is a bit more complex and varies from building to building. To begin, consider this two-bedroom unit on Mott Street in Nolita for $875,000. If this sounds like a great deal, it is. In October 2018, two-bedroom condos in the neighborhood were selling for $3.72 million. Unfortunately, if you are looking to take advantage of this great deal, you likely make too much money to qualify: The income cap on this specific unit is $34,992. How can someone who makes less than $35,000 annually get a mortgage for $700,000? In reality, they can’t and if they could, it still seems unlikely they could easily meet the combined monthly mortgage and coop payments of $4,556, which coincidentally exceeds the income restriction on the unit by approximately $20,000 annually. The only way to purchase this unit would be in a cash-only deal and even then, the buyer would need to have an extremely low-income or be leaving primarily off of donations and gifts.

Of course, not all HDFC units are located in luxury neighborhoods. In fact, many of these units are located in moderately priced neighborhoods such as Harlem, Hamilton Heights, and Crown Heights. In these neighborhoods, it is often still possible to find a one- to two-bedroom HDFC unit in the $200,000 to $300,000 range. Also, in most cases, the income restrictions are much higher than they are on the Mott Street unit because they are based on the area median income (AMI). Still, even many of these moderately priced units remain out of reach but for a different reason: When the units go on the market, they are often priced below market averages but either don’t permit financing or only permit 20% to 40% financing, which means buyers must both meet the AMI and be in the position to bring a large amount of cash to the deal.

223 East 4th Street, #512 | East Village

— $699,000 | 1 bed, 1 bath 223 East 4th Street, #512 (Douglas Elliman)

223 East 4th Street, #512 (Douglas Elliman)

223 East 4th Street, #512

223 East 4th Street, #512

Located on a central, tree-ined street in the East Village, this beautifully renovated one bedroom features a washer/vented dryer, dishwasher, vented hood, and southern exposures. The building has a common roof deck, a shared garden with barbeque grills, and a upgraded building security system.

Contact CityRealty for income restrictions.

Contact CityRealty for income restrictions.

Why have affordable units on the market if most New Yorkers—even those with modest incomes—don’t qualify to purchase them?

To appreciate why HDFC units exist, you have to go back to a very different New York City—the New York of the late 1970's when the economy was sluggish and thousands of landlords had abandoned their properties or had them seized by the city. To prevent the mass relocation of low-income residents, especially in the Lower East Side, Upper Manhattan, Brooklyn, and the South Bronx, the city decided to make modest improvements to create a program that enabled tenants to buy their units for just $250—yes, $250 not $250,000. To ensure the units stayed affordable, the city also imposed income ceilings and a huge flip-tax that essentially made selling the units undesirable.

For most the 1980's and 1990's, the HDFC plan worked well. It meant that people who would have otherwise been displaced not only got to stay in their neighborhood but to own their own home. Then the housing situation in New York City started to rebound and strange things started to happen on the HDFC market. By the 2000's, units once purchased for $250 were coming on the market in gentrifying neighborhoods below market prices but still well above anything the original tenants had paid. While this was great news for many low-income tenants looking to retire and relocate, HDFC units priced at $300,000 and even above $800,000 were no longer attracting low-income tenants. Instead, these units, once meant for people living on low incomes, were increasingly only viable for retirees, young people with big gifts from their families, and occasionally, modest-income people who had just come into an inheritance.

Who determines prices, income caps and restrictions, and financing terms on HDFC units?

According to NYC HDFC, HDFC cooperatives have “no statutory or regulatory restrictions on HDFC resale prices.” However, reforms are expected in the next decade that will create controls on resale prices.

Income restrictions are another matter and depend on the HDFC’s original agreement with the City. Most HDFCs have a regulatory agreement with the City of New York and as such, establish income maximums at either 120% or 165% of the area median income (AMI). However, some HDFCs use a different and more convoluted formula. This formula essentially maintains that shareholders can’t earn more than 6 or 7 times (depending on family size) the monthly maintenance, plus utilities, plus six percent of the original $250 purchase price of the apartment, all multiplied by 12 to represent every month of the year. (This formula might possibly account for the particularly low-income cutoff on the Mott Street unit mentioned earlier in the article).

Finally, there is the question of financing terms. Like all coops, HDFC coops have a lot of say over financing terms and tenant selection. Because HDFCs are often in desperate need of cash to cover overdue repairs or debt, boards often demand all-cash deals or deals that at the very least ask the buyer to bring a lot of cash (often 60% to 80% of the deal).

Income restrictions are another matter and depend on the HDFC’s original agreement with the City. Most HDFCs have a regulatory agreement with the City of New York and as such, establish income maximums at either 120% or 165% of the area median income (AMI). However, some HDFCs use a different and more convoluted formula. This formula essentially maintains that shareholders can’t earn more than 6 or 7 times (depending on family size) the monthly maintenance, plus utilities, plus six percent of the original $250 purchase price of the apartment, all multiplied by 12 to represent every month of the year. (This formula might possibly account for the particularly low-income cutoff on the Mott Street unit mentioned earlier in the article).

Finally, there is the question of financing terms. Like all coops, HDFC coops have a lot of say over financing terms and tenant selection. Because HDFCs are often in desperate need of cash to cover overdue repairs or debt, boards often demand all-cash deals or deals that at the very least ask the buyer to bring a lot of cash (often 60% to 80% of the deal).

243 Mulberry Street, #3L | NoLita-Little Italy

— $$899,000 | 1 bed, 1 bath 243 Mulberry Street, #3L

243 Mulberry Street, #3L

Is buying an HDFC unit a good investment?

While most New Yorkers will never even qualify for an HDFC unit, some do; and, in the current market, money can be made on HDFC units. For example, a currently listed HDFC unit on the Upper West Side at 145 West 105th Street is asking $895,000. While this may sound a bit steep, bear in mind that this is a 1500 square-foot five-bedroom unit. The unit also appears to be rapidly gaining value. The unit was listed for $375,000 in May 2016, sold well above the asking price for $435,000 in September 2016, and is now being put back on the market for $895,000. In just over two years, this HDFC unit has more than doubled its market value. But can you make money off an HDFC?

In the past, HDFC units were only considered good long-term investments, but with prices surging, this rule of thumb is no longer the case. Indeed, if the seller of 145 West 105th Street does get the asking price, they will likely see a good return on their investment, even after paying their building’s flip-tax, which in most HDFC buildings is 30 percent but can be as high as 50 percent in some buildings, especially when I buyer chooses to turn around their unit in less than five years.

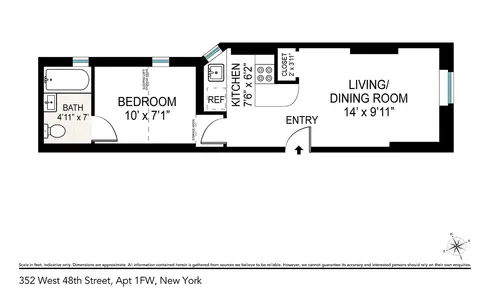

352 West 48th Street, #1FW

— $325,000 | 1 bed, 1 bath All images of 352 West 48th Street via Corcoran

All images of 352 West 48th Street via Corcoran

Kitchen

Kitchen

Floor plan

Floor plan

Centrally located one-bedroom is filled with light from windows in all rooms, including the kitchen and bath. Additional features include 10' ceilings and a lofted area in the bedroom that can be used for sleeping or storage. Building amenities include laundry room, bike room, and communal backyard patio.

$34,444 income cap

$34,444 income cap

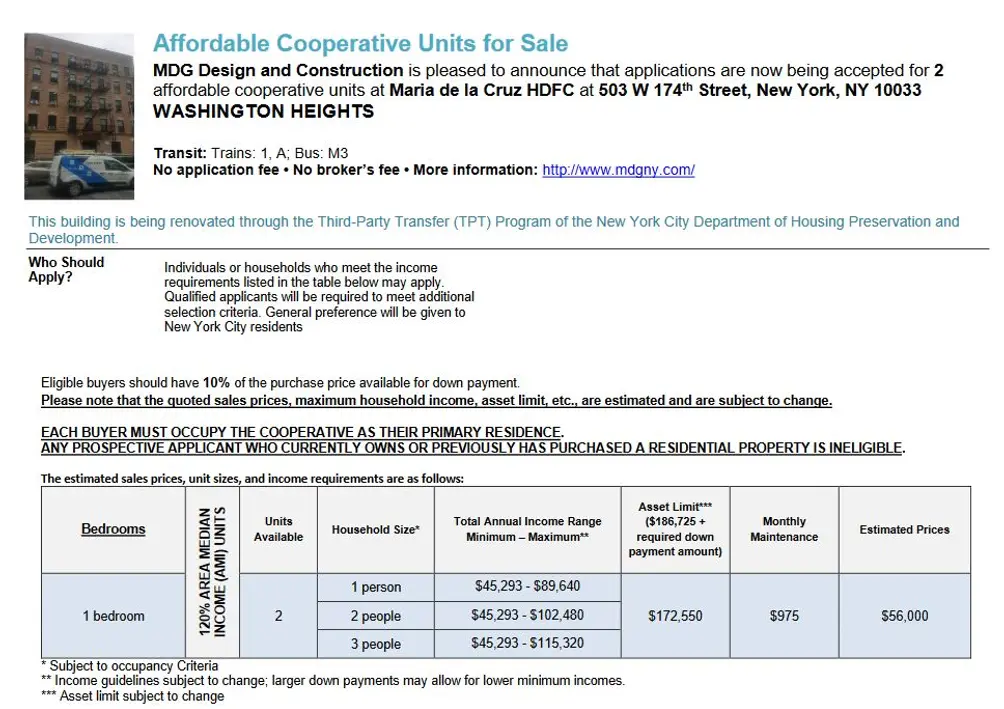

So, if you're still interested in an HDFC unit, where do you go from here? For starters, we've compiled a list of HDFC apartments in highly desirable neighborhoods at a fraction of the typical price. It has also been announced that at 503 West 174th Street in Washington Heights, an affordable housing lottery has launched for two one-bedroom apartments for $56,000. The deadline to apply is December 13, 2019, and further information can be found at Housing Connect.

Would you like to tour any of these properties?

Just complete the info below.

Or call us at (212) 755-5544

Lottery criteria for 46 East 129th Street via Housing Connect

Lottery criteria for 46 East 129th Street via Housing Connect

↓ 4 West 101st St, #21 | Central Park West

$349,000 | 1 bed, 1 bath↓ The Raleigh, 7 West 92nd St., #53 | Central Park West

$699,000 | 2 beds, 1 bath 4 West 101st Street, #21

4 West 101st Street, #21

The Raleigh, 7 West 92nd Street, #53

The Raleigh, 7 West 92nd Street, #53

↓ 55 Avenue C, #12 | East Village

$795,000 | 1 bed, 1 bath↓ 108 Seigel Street, #17 | Williamsburg

$300,000 | 2 beds, 1 bath 55 Avenue C, #12

55 Avenue C, #12

108 Seigel Street, #17

108 Seigel Street, #17

↓ 327 East 3rd Street, #3E | East Village

$495,000 | 1 bed, 1 bath↓ 133 West 140th Street, #46 | Harlem

$375,000 | 3 beds, 1 bath 133 West 140th Street, #46

133 West 140th Street, #46

133 West 140th Street, #46

133 West 140th Street, #46

↓ 353 West 47th Street, #2R | Midtown West

$725,000 | 2 beds, 1 bath↓ 464 West 51st Street, #5W | Midtown West

$380,000 | Studio, 1 bath 353 West 47th Street, #2R

353 West 47th Street, #2R

464 West 51st Street, #5W

464 West 51st Street, #5W

↓ 498 West 55th Street, #5S | Midtown West

$425,000 | 1 bed, 1 bath↓ 501 West 138th Street, #5 | Hamilton Heights

$645,000 | 2 beds, 2 baths Entry foyer

Entry foyer

501 West 138th Street, #5

501 West 138th Street, #5

↓ 532 Graham Avenue, #16 | Williamsburg

$395,000 | 2 beds, 1 baths↓ 616 West 137th Street, #5B | Hamilton Heights

$675,000 | 4 beds, 2 baths 501 West 138th Street, #5

501 West 138th Street, #5

Bedroom

Bedroom

↓ 648 Grand Street, #2D | Williamsburg

$375,000 -6.3% | 1 bed, 1 bath↓ 849 St. Nicholas Avenue, #1D | Hamilton Heights

$275,000 -8.3% | 1 bed, 1 bath 648 Grand Street, #2D

648 Grand Street, #2D

849 St. Nicholas Avenue, #1D

849 St. Nicholas Avenue, #1D

↓ 3692 Broadway, #22 | Hamilton Heights

$299,000 | 2 beds, 1 bath↓ 3115 Broadway, #2 | Morningside Heights

$450,000 | 2 beds, 1 bath 3692 Broadway

3692 Broadway

3115 Broadway, #2

3115 Broadway, #2

Enjoyed this Article? Like CityRealty on Facebook and follow @CityRealty on Instagram. You can also tweet us at @CityRealtyNY.

Would you like to tour any of these properties?

Just complete the info below.

Or call us at (212) 755-5544

Would you like to tour any of these properties?

6sqft delivers the latest on real estate, architecture, and design, straight from New York City.

6sqft delivers the latest on real estate, architecture, and design, straight from New York City.