To privatize or to not privatize, that is the question that all Mitchell–Lama moderate- and middle-income residential buildings in New York City face. Built from 1955 through the 1970s, the planned evolution for all Mitchell-Lama housing was always eventual privatization. Under the program’s founding law, Mitchell-Lama cooperatives have the right to buy their way out of the program after 30-40 years of being built. All buildings need extensive repairs at a certain age which would make any affordable housing financial equation difficult to sustain without market rate investment.

The struggle to evolve

Vocal battles between the cooperatives' boards, residents and landlords over their desire to privatize or not have been long and brutal. A total of 269 Mitchell-Lama developments with over 105,000 apartments were built under the program. From 1990 to 2005, 22,688 of those units, or 34% of its housing stock, were privatized. As the real estate market in New York continued to thrive, the battles to privatized have kept pace.

Under the Mitchell-Lama program, the buildings were given real estate tax breaks and access to low-interest loans and mortgages in return for maintaining affordable rents and purchase prices. After the set period, the cooperatives could opt out of the program with two sets of votes. The first vote must approve a feasibility study (which can cost upwards of $100K) and must pass by 51% of the shareholders/residents. For the second vote, the shareholders must hold an election to decide if they want to buy out and this requires a two-thirds majority. If approved, they then file a "notice of dissolution" with the state to officially declare they want to leave the program.

In this article:

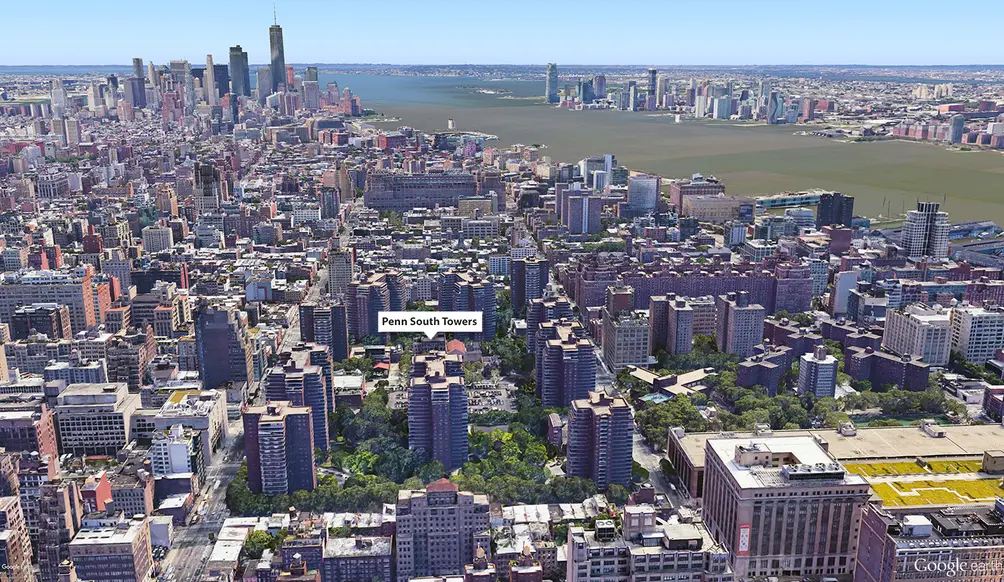

With 2,820 co-op apartments Penn Station South is one of the largest Mitchell Lama developments in the city

With 2,820 co-op apartments Penn Station South is one of the largest Mitchell Lama developments in the city

The result of privatization

When a Mitchell-Lama building goes private, it loses all tax abatements and the owners must refinance under current market rates. For those who want privatization in order to cash out, they will surely profit. For those who still want to remain in the building, going private most definitely increases maintenance costs and interest rates. Additionally, the more units that sell off at market rate, the fewer affordable housing options exist in the city. But forcing a building to remain in the program can lead to deferred maintenance that can become quite dangerous, as seen with the disintegrating garages and balconies that collapsed in the Bronx’s Co-op City.

The Mitchell-Lama program was intended to generate profits from the buy out of the program that were supposed to fund new Mitchell Lama projects. That would make a self-sustaining affordable housing program and a constant new supply of low-income housing in the city. This has never happened.

"...the more units that sell off at market rate, the fewer affordable housing options exist in the city."

East Midtown’s Privatization Efforts

Built in 1968, the Mitchell-Lama cooperative East Midtown Plaza has 748 units from studio to four bedrooms and is comprised of six different buildings, three high rises and three low-rises, between First and Second avenues and 23rd to 25th streets. In addition to the residences, the complex offers security guards in the lobby as well as roving security, on site laundry facilities, a gym, playground, parking garage, and a community/event rooms.

Currently, East Midtown Plaza has an extremely long waiting list and is not currently accepting any new applications. According to their website, as of September 24, 2018, there were 2091 applications for studio apartments, six applications for one bedroom apartments and 196 applications for two bedroom apartments. Despite the massive demand for its units, the board is continuing a decade's-long battle to privatize.

East Midtown's board has previously attempted to privatize with little success. In 2002 The Real Deal reported, “New York State’s Highest Court has ruled that East Midtown Plaza will remain affordable, ending years of feuding between residents over whether the six-building co-op complex should get privatized.” After a feasibility study and a second vote in 2004, the entire process was nullified because of a difference in the interpretation of how votes were to be counted: one vote per share versus one vote per apartment. It was determined that East Midtown’s certificate of incorporation specified that each shareholder is entitled to one vote at shareholder meetings, regardless of the number of shares owned. Again, in 2008, the board attempted to privatize unsuccessfully. There was another vote in 2009 where both sides claimed they had won a majority and again, no conclusion was reached - and many lawsuits followed. A unanimous Court of Appeals panel sided with the anti-privatization group, upholding decisions from two lower courts. Another judgment against privatization was made in 2012.

In 2016, the Town & Village blog reported that East Midtown was back at it again. They reported the co-op board received a petition from more than 250 shareholders supporting privatization. According to Town & Village, Jeanne Poindexter, who had lived in East Midtown Plaza at the time for 42 years and opposed privatization “ said she was frustrated by this on-and-off struggle. A big reason, she explained, is the cost of the legal fees the last time the issue was raised.”

East Midtown Plaza (photo via New York State Senator Brad Hoylman )

East Midtown Plaza (photo via New York State Senator Brad Hoylman )

In January 2018, NY State Senator Brad Hoylman, Congress Member Carolyn Maloney, City Comptroller Scott Stringer, Manhattan Borough President Gale Brewer, and Council Member Carlina Rivera submitted joint testimony on East Midtown Plaza Housing Company’s application requesting a carrying charge increase. The application described a need for up to $22,797,488.16 for various repairs and improvement work. Hoylman believes that a carrying charge increase could push the complex out of the Mitchell-Lama program and stated there was alternative funding available to cover those costs and therefore secure the Mitchell-Lama status. The group strongly recommended denying East Midtown Plaza Housing Company’s request for a carrying charge increase until the applicant has demonstrated its best efforts to secure alternative, public financing expressing particular concerns for the seniors with fixed incomes who lived in East Midtown.

Hoylman and his group added that because of East Midtown Plaza Housing Company’s determination to privatize, the complex has consciously refused to explore alternative funding, specifically grants and low-cost loans from the city government.

Under Mayor de Blasio’s Mitchell-Lama Reinvestment Program, East Midtown Plaza can receive funding and low-interest loans through HPD and the Housing Development Corporation and reduce carrying costs and keep rents low.

The fate of the privatization status is unclear and the future of the Mitchell-Lama buildings is uncertain. The battle continues as both sides adamantly defend their rights. New York City Buildings’ Department is trying to crack down on landlords in gentrifying neighborhoods who are making their tenants lives a misery as a way to rid themselves of residents protected under programs like Mitchell-Lama and bring in higher-paying tenants.

The correct answer to the question of privatizing or not is unclear but what is clear is that as more Mitchell-Lama building privatize, there are fewer and fewer options for all of those on the waiting list seeking affordable housing options in a real estate market unsuited for mere mortals.

East Midtown Plaza photo via Wikipedia, credit of AIA Guide

East Midtown Plaza photo via Wikipedia, credit of AIA Guide

Would you like to tour any of these properties?

Contributing Writer

Michelle Sinclair Colman

Michelle writes children's books and also writes articles about architecture, design and real estate. Those two passions came together in Michelle's first children's book, "Urban Babies Wear Black." Michelle has a Master's degree in Sociology from the University of Minnesota and a Master's degree in the Cities Program from the London School of Economics.

6sqft delivers the latest on real estate, architecture, and design, straight from New York City.

6sqft delivers the latest on real estate, architecture, and design, straight from New York City.