Astoria is among the New York City neighborhoods experiencing increased residential development. (PACS)

Astoria is among the New York City neighborhoods experiencing increased residential development. (PACS)

New York City is suffering from a shortage of residential units and, by at least one estimate, will need to add more than half a million new units to its supply by 2030 to meet growing demand. This article drills down on where housing units are growing and declining most rapidly and what it means for the city's future.

NYC residential development pre-pandemic

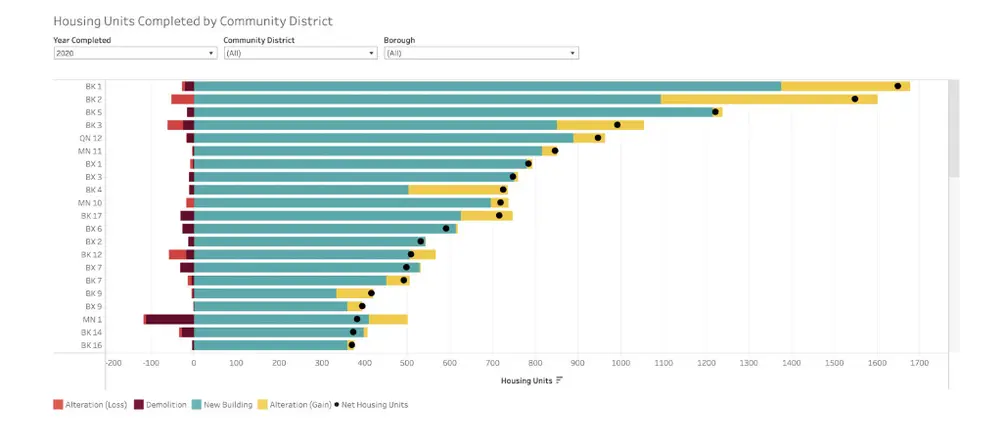

Up to the pandemic's start, Brooklyn was the epicenter of new development, with one cluster of Brooklyn neighborhoods far outpacing all others. Between 2010 and 2020, Greenpoint, Williamsburg, East Williamsburg, Northpoint, and Southpoint added more than 18,500 units of housing to the New York City market, with 1,300 units added in 2020 alone. Housing units completed by community district, 2020 (NYC Department of City Planning)

Housing units completed by community district, 2020 (NYC Department of City Planning)

While attractive tax incentives for developers brought at least some additional affordable housing units to Williamsburg and adjacent neighborhoods between 2010 and 2020, the boom didn’t necessarily result in greater affordability. A 2021 Furman Center report found that the median gross rent in Greenpoint and Williamsburg increased from $1,090 in 2006 to $2,120 in 2019, leaving roughly a quarter of the neighborhood's residents rent burdened by the start of the pandemic. This sharp spike in housing costs, which has also driven up tax assessments in the neighborhood, may explain why both renters and developers have migrated to several new and previously undervalued neighborhoods since 2020.

Residential development since the pandemic

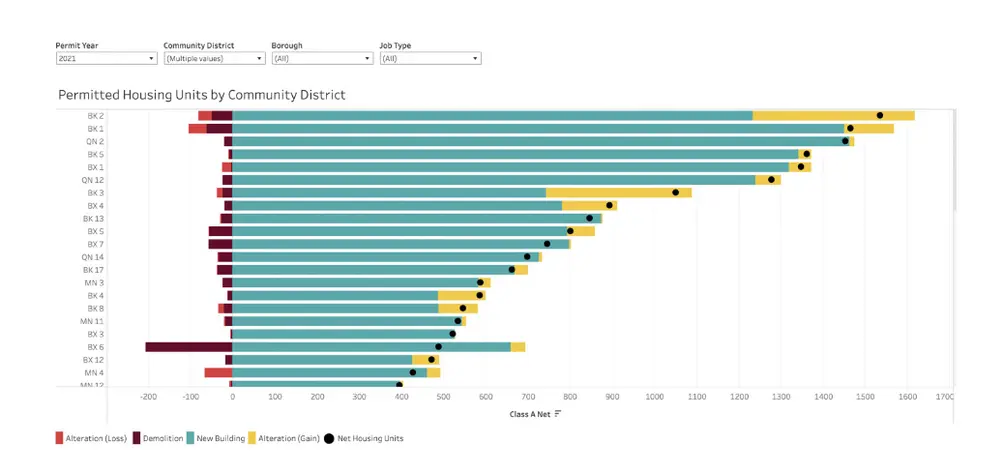

By 2021, a cluster of Queens neighborhoods across the bridge from Williamsburg and Greenpoint, including Blissville, Hunters Point, Long Island City, Sunnyside, Sunnyside Gardens, and Woodside were home to the highest number of new residential developments. Housing units completed by community district, 2021 (NYC Department of City Planning)

Housing units completed by community district, 2021 (NYC Department of City Planning)

While Queens’ housing gains were initially confined to neighborhoods bordering Greenpoint and Williamsburg, in 2022, some of the borough's more affordable and even outlying neighborhoods, including Jamaica, Elmhurst, Astoria, and Kew Gardens also started to see increased development. A March 2023 article in The Real Deal reported that combined these four neighborhoods added over 2,400 units of residential housing in 2022.

However, even as some Queens' neighborhoods development outpaces Brooklyn, Brooklyn’s residential development hasn't ceased so much as it has shifted. The Real Deal report also found strong growth in Fort Greene, which added 1,061 new residential units between Q4 2021 and Q4 2022, and somewhat surprisingly, also found strong growth at the end of the subway line in Coney Island, where 1,047 new units were added in 2022.

While no Bronx or Staten Island neighborhoods were among the neighborhoods adding the most residential units in 2022, a few Manhattan neighborhoods did make the cut, including South Harlem, Murray Hill, Grand Central, and Inwood.

However, even as some Queens' neighborhoods development outpaces Brooklyn, Brooklyn’s residential development hasn't ceased so much as it has shifted. The Real Deal report also found strong growth in Fort Greene, which added 1,061 new residential units between Q4 2021 and Q4 2022, and somewhat surprisingly, also found strong growth at the end of the subway line in Coney Island, where 1,047 new units were added in 2022.

While no Bronx or Staten Island neighborhoods were among the neighborhoods adding the most residential units in 2022, a few Manhattan neighborhoods did make the cut, including South Harlem, Murray Hill, Grand Central, and Inwood.

Where residential units are disappearing

While nearly all New York City neighborhoods continue to report increases in residential units, there are a few neighborhoods where unit losses have offset any additions. Between 2010 and 2020, for example, the Upper East Side added fewer units than 57 or 58 other New York City community districts. While this may come as a surprise to anyone who lives in the neighborhood and has spent the past decade surrounded by what seems to be endless construction for new luxury high-rise condos, there is an explanation. In addition to breaking new ground on many luxury high-rise developments since 2010, the Upper East Side has also seen a higher-than-average number of apartment conversions, which has resulted in one or more apartments becoming a single unit. While this trend was already happening pre-pandemic, during the pandemic as residents sought out larger units, the trend accelerated. Moreover, residential growth has also slackened on the Upper West Side, Greenwich Village, and Chelsea.What residential development trends mean for the future

With new residential units being added at a much lower pace in most Manhattan neighborhoods below 96th Street and some of these Manhattan neighborhoods experiencing a net loss in units, it seems that New Yorkers are increasingly living further away from the city's work centers. This is supported by evidence that since the pandemic, several far-reaching neighborhoods, including Jamaica and Coney Island, have experienced strong residential unit growth.In the past, this would have placed growing pressure on the city’s public transit system. But with more people working remotely or only coming into the office a few days a week, the growing distance between work and home may have a different impact. One possibility is that as residential units are added to the city’s outlying neighborhoods, these neighborhoods may be positively impacted as new services, including co-working spaces, arrive to serve new residents, especially those working remotely. On the flip side, however, this also raises questions about the future of many Manhattan neighborhoods, including those that continue to struggle to rebound post-pandemic.

Contributing Writer

Cait Etherington

Cait Etherington has over twenty years of experience working as a journalist and communications consultant. Her articles and reviews have been published in newspapers and magazines across the United States and internationally. An experienced financial writer, Cait is committed to exposing the human side of stories about contemporary business, banking and workplace relations. She also enjoys writing about trends, lifestyles and real estate in New York City where she lives with her family in a cozy apartment on the twentieth floor of a Manhattan high rise.

6sqft delivers the latest on real estate, architecture, and design, straight from New York City.

6sqft delivers the latest on real estate, architecture, and design, straight from New York City.