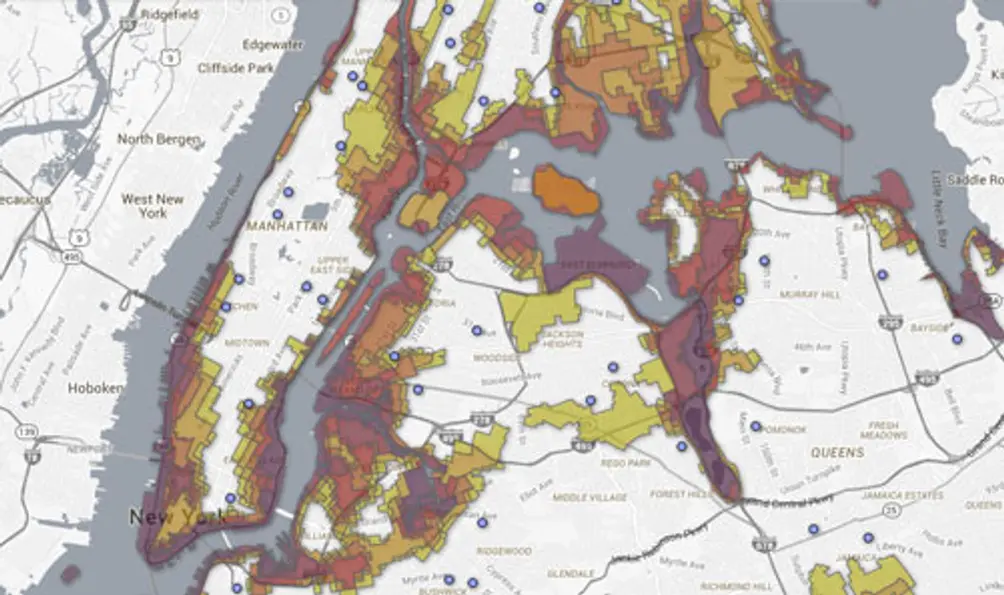

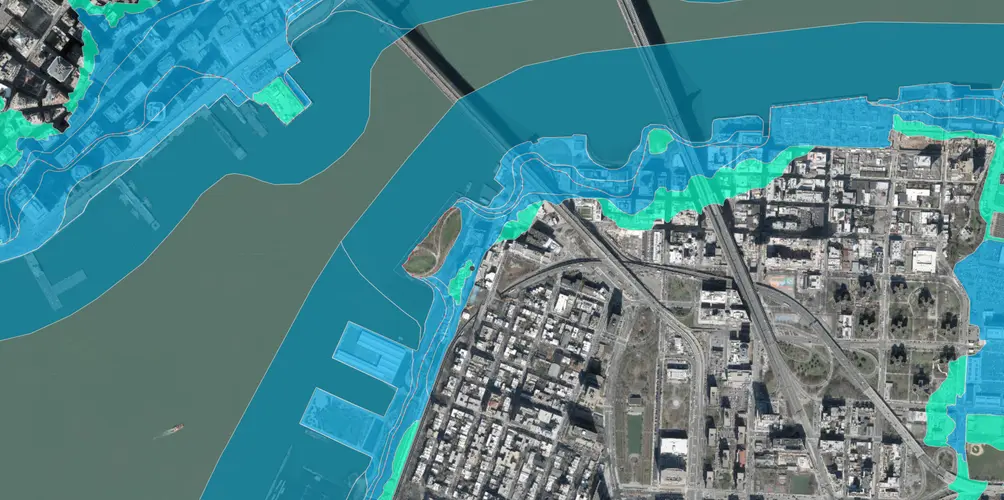

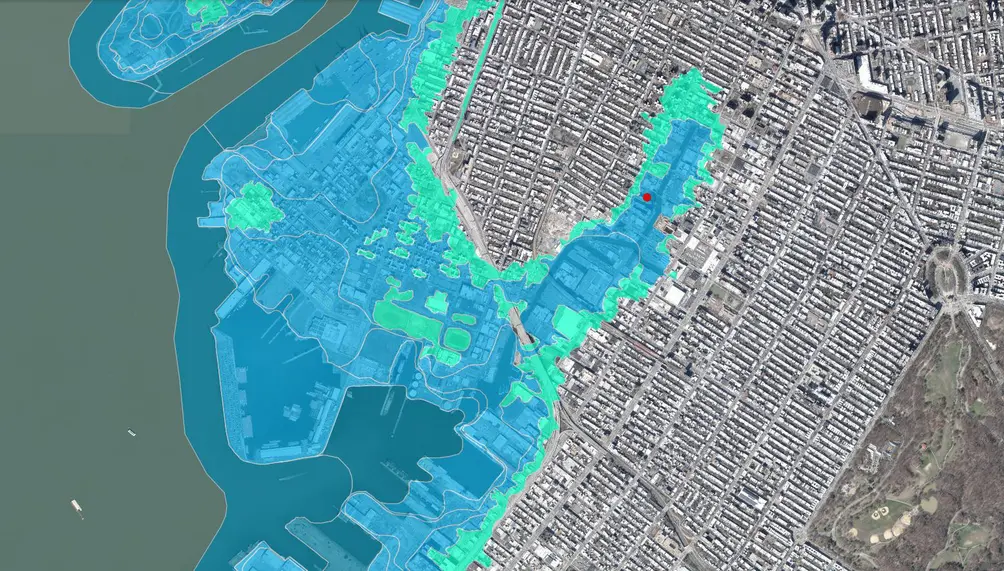

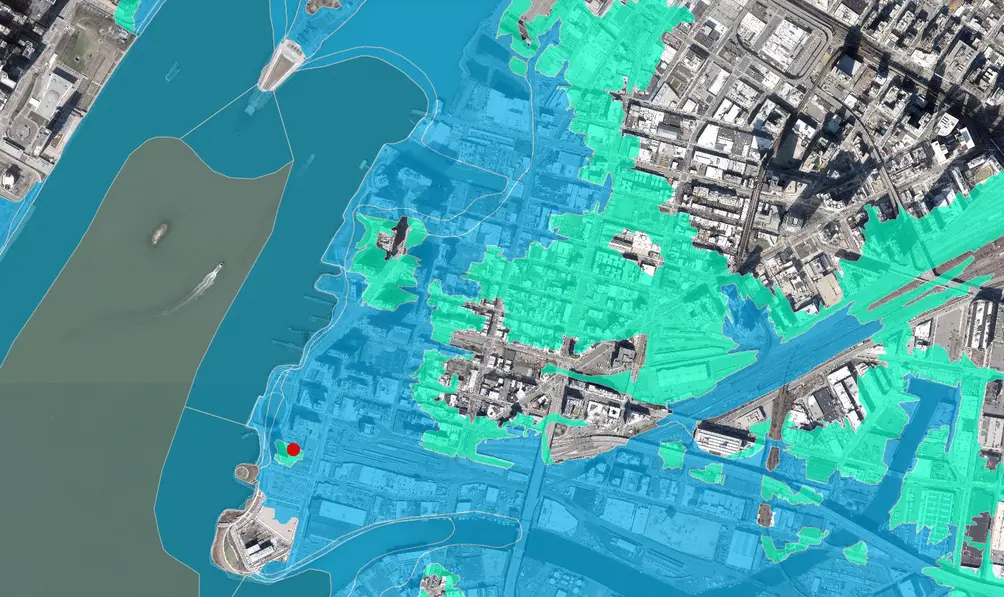

This map shows areas vulnerable to flooding from 1% annual chance storm (aka Special Flood Hazard Area or 100-year floodplain) and the 0.2% annual chance floodplain, also known as the 500-year floodplain.

This map shows areas vulnerable to flooding from 1% annual chance storm (aka Special Flood Hazard Area or 100-year floodplain) and the 0.2% annual chance floodplain, also known as the 500-year floodplain.

Superstorm Sandy has become shorthand for natural disasters in New York, but it has faced some serious competition since it made landfall in 2012 – see Tropical Storm Fay in 2020, Hurricane Ida in 2021, and the recent storm that flooded streets, subways, and homes in New York City. This is only expected to get worse as storms are predicted to increase in strength and frequency due to the effects of climate change.

It can be scary to see torrential rainfall through a window, but many New Yorkers experienced a far more unpleasant surprise in the wake of Sandy: the discovery that their home insurance policies do not cover damage to their homes caused by flooding. Flood damage is generally excluded from home insurance policies that cover many other types of natural disasters, but floods can cause all sorts of trouble from loss of personal property to foundation damage and everything in between.

The city and state have embarked on a series of storm protections, but the onus remains on individuals to protect their property. Taking out a flood insurance policy today may ease a homeowner’s pain and losses down the line.

The city and state have embarked on a series of storm protections, but the onus remains on individuals to protect their property. Taking out a flood insurance policy today may ease a homeowner’s pain and losses down the line.

In this article:

Superstorm Sandy flood map (FEMA)

Superstorm Sandy flood map (FEMA)

When to Purchase Flood Insurance

If you live in a high-rise in the middle of Midtown, you can probably safely skip flood insurance. But for many New Yorkers, flood insurance is highly advised, if not required - those who live in a FEMA-defined floodplain and have a federally-backed mortgage must purchase flood insurance. But even if neither applies to you, you may want to purchase flood insurance.To determine whether you’re at risk, visit the Federal Emergency Management Agency (FEMA) website to find out if your home is located in a flood zone. The colored areas on the map are taken from FEMA's Preliminary Flood Insurance Rate Maps (PFIRMs), released in 2015 as part of a citywide flood map update, are the best available flood hazard data for building code and planning purposes. These show areas vulnerable to flooding from 1% annual chance storm, sometimes called the 100-year flood plain.

However, it is important to note that simply being in the 100-year floodplain may not be an accurate assessment of your risk. When Hurricane Sandy struck, most affected New York City property owners did not have flood insurance. In part, this reflects the fact that more than half of all buildings impacted, including about half of all residential units flooded by Sandy, were not even located in FEMA’s 100-year floodplain.

NYC flood risk map via http://maps.nyc.gov/hurricane/

NYC flood risk map via http://maps.nyc.gov/hurricane/

Why to Purchase Flood Insurance

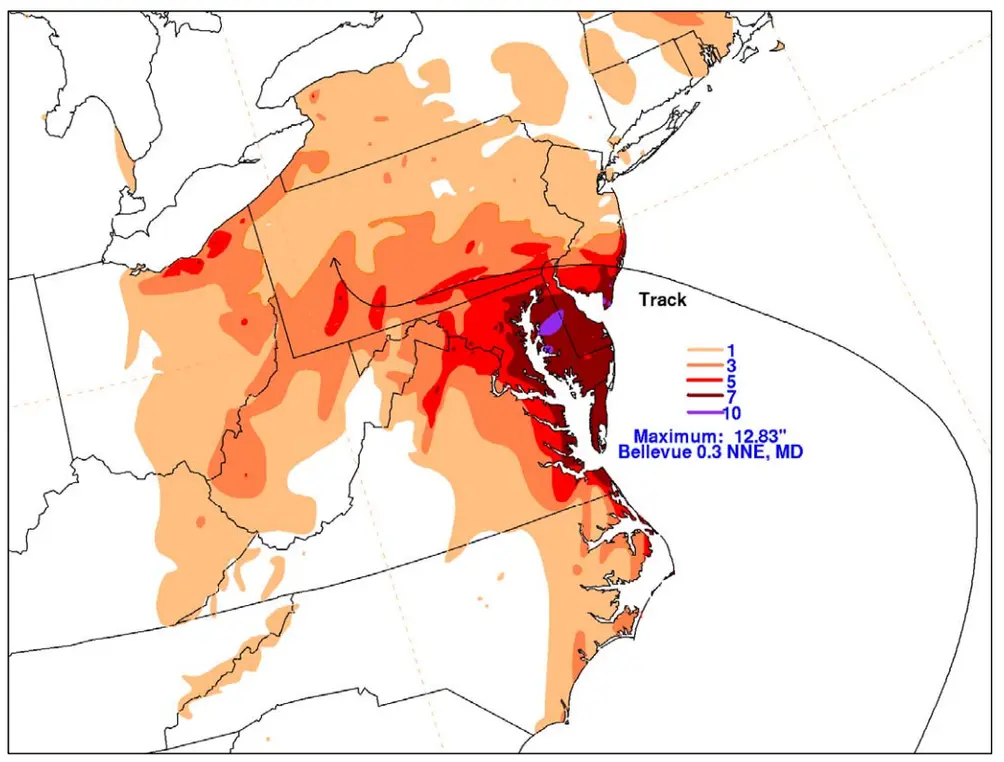

The reasons to purchase flood insurance are obvious: Repairing flood-related damage can be and usually is extremely costly. FEMA estimates that just one inch of water in a home can cause $25,000 damage. In most cases, flood damage leads to much higher repair costs. A post-Hurricane Sandy study carried out by the City of New York concluded that the storm cost the city $19 billion in damages. While the city has slowly recovered from Sandy over the years, many homeowners lost their homes and some continue to struggle to access the funds needed to complete repairs. Rainfall (in inches) associated with Hurricane Sandy and its extratropical remnants (Hydrometeorological Prediction Center)

Rainfall (in inches) associated with Hurricane Sandy and its extratropical remnants (Hydrometeorological Prediction Center)

How to Purchase Flood Insurance

If you want or need to take out a flood policy, the process is similar to purchasing any other types of home insurance. The difference is that flood insurance—more specifically, a National Flood Insurance Program (NFIP) policy—is a separate policy at an additional cost to your regular home insurance. In most cases, you can purchase the insurance through your existing insurer (to find out if they offer NFIP policies, visit the FEMA website). While this may sound easy, there are a few essential things to consider before purchasing flood insurance.First, NFIP policies are only available in participating communities. Most communities do participate (you can find out by looking up your location in FEMA’s community status book), but this is an important factor. Second, you’ll need to know what flood zone you live in and your level of risk. While your agent can look up this information, doing your homework in advance will help you shop around for the best rate. Third, if a hurricane is about to land and you haven’t yet purchased a policy, you’re likely out of luck. Most policies take 30 days to come into effect. Fourth, if you have a policy, pay attention to what it covers. If you’ve purchased a building/structure flood policy, it will cover damage to your building but not to the contents of your building (e.g., your furniture, clothing, appliances and other personal items). To be fully covered, you’ll also need to take out a separate policy covering your home’s contents.

Flood Insurance for Renters

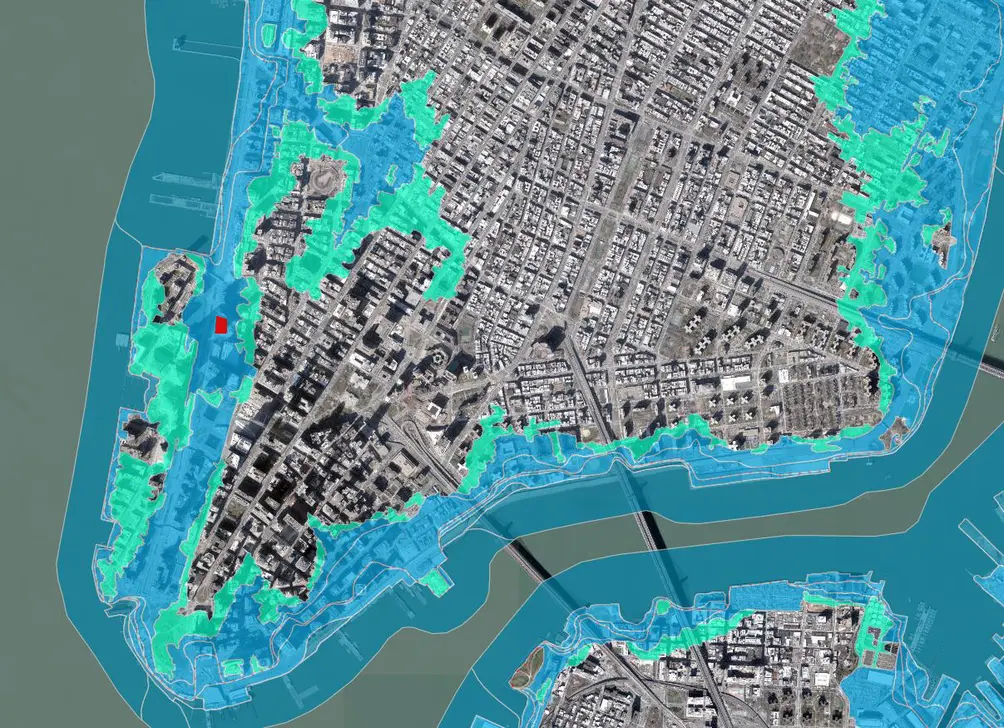

In most cases, discussions of flood insurance focus on homeowners’ needs alone, but this doesn’t mean that flood insurance isn’t also a potential concern for renters. Renters insurance or HO-4 policies cover the loss or destruction of personal belongings from a total to sixteen events that include everything from windstorms and hail to riot or civil commotion and volcanic eruption. What renters insurance policies don’t cover is flood damage. For this reason, if you are a renter who lives in an at-risk area, you may also want to purchase an NFIP policy. Renters policies cover up to $100,000 in damages to a home’s contents. Rates are determined based on multiple factors, including your flood zone, the building’s year of construction, and number of floors. Projected high-tide flooding in the 2100s

Projected high-tide flooding in the 2100s

Storm protections post-Sandy

In the years since Superstorm Sandy, waterfront Manhattan neighborhoods like Tribeca, Battery Park City, the Lower East Side, the Far West Side, and Yorkville have blossomed in popularity and value. Additionally, outer borough neighborhoods like Long Island City, DUMBO, Greenpoint, Gowanus, Coney Island, and Mott Haven have experienced building booms during that time. The new buildings were designed to make the most of beautiful waterfront vistas, but have taken shape in known flood zones.However, elected officials, developers, and designers have taken the lessons of that time to heart. The Battery Park City Authority is in the midst of a massive resilience project to reshape the coastline from The Battery to Tribeca so as to protect from flooding, and it is not unthinkable to imagine that waterfront parks like Hudson River Park could be next. At a smaller level, the new buildings in vulnerable areas have taken shape with new resiliency standards and building codes in place, as well as resilient design features like ground floors elevated above the floor plain, mechanical and electrical equipment situated out of the basement and onto higher floors, and extra protections for basement equipment. Additionally, new waterfront developments are being designed with such features as flood breaks, sea walls, marshes, and raised esplanades to protect the city from rising sea levels.

Waterfront listings in buildings with notable flood protection systems

111 Murray Street, Tribeca

Design by Kohn Pedersen Fox

Developed by Fisher Brothers

Condo | 58 stories | 157 units

Completed in 2018

10 availabilities from $2,190,000

All images of 111 Murray Street via Douglas Elliman

All images of 111 Murray Street via Douglas Elliman

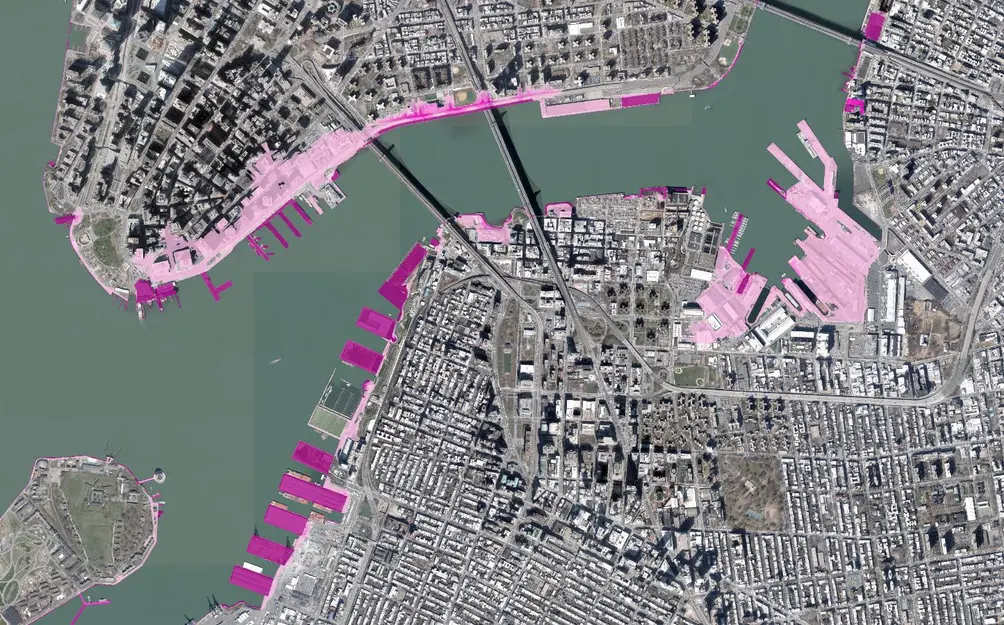

With much of far lower Manhattan built on landfill, large swaths of the Financial District and most of Battery Park City are at risk for flooding (111 Murray Street highlighted in red)

With much of far lower Manhattan built on landfill, large swaths of the Financial District and most of Battery Park City are at risk for flooding (111 Murray Street highlighted in red)

The mechanical spaces and lobby level are elevated above the 100-year flood plain, and flood mitigation systems have been installed.

111 Murray Street, #30A (Douglas Elliman Real Estate)

Would you like to tour any of these properties?

Just complete the info below.

Or call us at (212) 755-5544

Pierhouse at Brooklyn Bride Park, Brooklyn Heights

Design by Marvel Architects

Developed by Toll Brothers City Living and Starwood Capital Group

Condo | 10 stories | 106 units

Completed in 2015

3 availabilities from $2,550,000

Pierhouse at Brooklyn Bridge Park (Compass)

Pierhouse at Brooklyn Bridge Park (Compass)

Nearly all of Brooklyn Heights' new waterfront real estate is at risk for storm surge flooding

Nearly all of Brooklyn Heights' new waterfront real estate is at risk for storm surge flooding

The building was set 3.55 feet higher and the mechanicals were raised up to the roof to protect from flooding.

Pierhouse at Brooklyn Bridge Park, #N405

$2,550,000

Brooklyn Heights | Condominium | 1 Bedroom, 1.5 Baths | 1,525 ft2

Pierhouse at Brooklyn Bridge Park, #N405 (Compass)

One Sixteen, Rockaway Park

Design by Fischer + Makooi Architects

Developed by The Marcal Group

Condo | 8 stories | 86 units

Completed in 2018

3 availabilities from $615,000

All images of One Sixteen via Douglas Elliman

All images of One Sixteen via Douglas Elliman

A broker for the development said in a statement that, "One Sixteen is built to the highest standards of post-Sandy building codes for flood zone protection."

One Sixteen, #3M (Douglas Elliman Real Estate)

363 Bond Street, Gowanus

Design by Hill West

Developed by Atlantic Realty Development Corporation

Rental | 12 stories | 270 units

Completed in 2018

3 availabilities from $3,025/month

All images of 363 Bond Street via Douglas Elliman

All images of 363 Bond Street via Douglas Elliman

363 Bond Street, #263 (363 Gowanus Developers LLC)

363 Bond Street, #263 (363 Gowanus Developers LLC)

Nearly all of Red Hook, the Columbia Waterfront District, and the low-lying areas along the banks Gowanus Canal are at serious risk of flooding. Gowanus is in the process of being rezoned where future buildings will be elevated and have flood mitigation measures in place.

Nearly all of Red Hook, the Columbia Waterfront District, and the low-lying areas along the banks Gowanus Canal are at serious risk of flooding. Gowanus is in the process of being rezoned where future buildings will be elevated and have flood mitigation measures in place.

Floodgates were incorporated into the building design and operation to provide flood protection of the facility up to an elevation of 3.17 feet above the base flood elevation and one foot above the Hurricane Sandy flood level.

52-41 Center Boulevard, Long Island City

Design by ODA Architecture

Developed by TF Cornerstone

Rental | 46 stories | 394 units

Completed in 2021

8 availabilities from $4,120/month

All images of 52-41 Center Boulevard via TF Cornerstone

All images of 52-41 Center Boulevard via TF Cornerstone

Long Island City is one of New York's most at-risk flood zones, but all new construction is up to new building code

Long Island City is one of New York's most at-risk flood zones, but all new construction is up to new building code

Flood mitigation systems have been installed, and the building's mechanical spaces and lobby are elevated above the 100-year flood plain.

5241 Center Boulevard, #4301 ()

Would you like to tour any of these properties?

Just complete the info below.

Or call us at (212) 755-5544

Would you like to tour any of these properties?

Contributing Writer

Cait Etherington

Cait Etherington has over twenty years of experience working as a journalist and communications consultant. Her articles and reviews have been published in newspapers and magazines across the United States and internationally. An experienced financial writer, Cait is committed to exposing the human side of stories about contemporary business, banking and workplace relations. She also enjoys writing about trends, lifestyles and real estate in New York City where she lives with her family in a cozy apartment on the twentieth floor of a Manhattan high rise.

6sqft delivers the latest on real estate, architecture, and design, straight from New York City.

6sqft delivers the latest on real estate, architecture, and design, straight from New York City.