Capture from 2020's CityRealty 100 Report

Capture from 2020's CityRealty 100 Report

The CityRealty 100

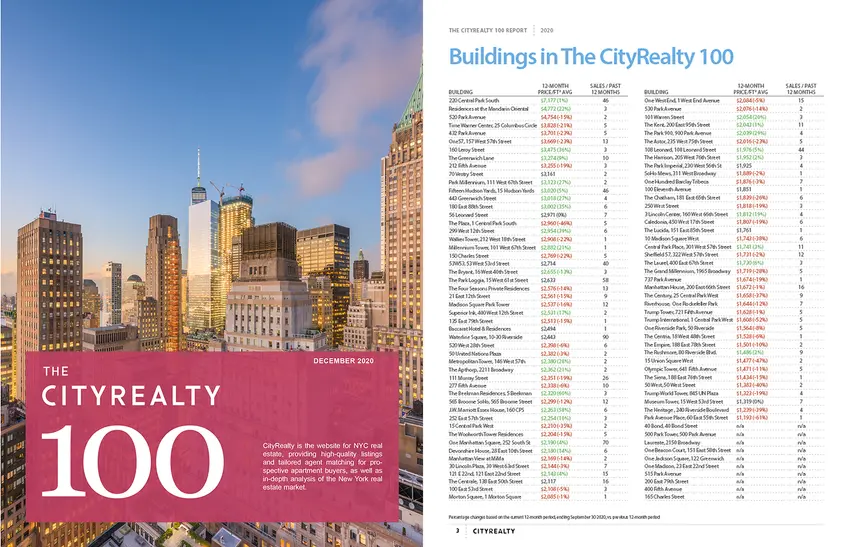

is an index comprising the top 100 condominium buildings in Manhattan. Several factors—including a building’s sales history, prominence, and CityRealty’s rating for the property—are used to determine which buildings are included in the index. This report tracks the performance of those buildings for the one-year period ending September 30, 2020.

Manhattan real estate, as viewed through the lens of this report, focuses on the city's top tier of buildings, which are seen as a relatively stable and good investment. The stagnation of prices and dip volume, especially in buildings not new to the market, reflects a market that has been saturated with high-end product, and prices in the 3rd quarter of 2020 reflect an overall downward trend.

Manhattan real estate, as viewed through the lens of this report, focuses on the city's top tier of buildings, which are seen as a relatively stable and good investment. The stagnation of prices and dip volume, especially in buildings not new to the market, reflects a market that has been saturated with high-end product, and prices in the 3rd quarter of 2020 reflect an overall downward trend.

In this article:

After falling in 2018 from all-time highs achieved in 2016 and 2017, the index’s average price / foot and total sales volumes were roughly flat in 2020 as compared to 2019, with the average price per square foot increasing 2% to $2,649. For the 12 months ending Sep 30, there were 846 sales which accounted for $4.94 billion in sales volume.

During the period from October 1, 2019 to September 30, 2020, the average price per square foot of the CityRealty 100 was $2,649, a year-over-year increase of 2%. Prices were stable compared to 2019 due to a large number of closings being recorded in top-tier new developments such as 15 Hudson Yards, The Park Loggia, and Waterline Square. This helped offset a substantial decline in overall transaction volume in Manhattan.

Over the past decade, the average price per square foot of properties in The CityRealty 100 has increased at a Compound Annual Growth Rate (CAGR) of 3.8% per year (non-inflation adjusted). This is higher than the 10-year CAGR for oil (-5.7%) but behind the ten-year growth rate of the S&P 500 (11.4%) and gold (+5.4%).

Would you like to tour any of these properties?

Just complete the info below.

Or call us at (212) 755-5544

Reflecting an unprecedented volume of new luxury condominiums opening recently in Manhattan, a total of 25 new buildings have been added to the CityRealty 100. These new additions are shown above.

The report also shows that one building, 220 Central Park South, kept the super high-end market afloat, accounting for the top 22 sales during the 12 month period of this report. With $1.52 billion in cumulative sales (in 46 units), 220 Central Park South accounted for an astounding 30% of all transaction volume among the CityRealty 100. The Vornado-developed property appears to have decreased transaction volume in nearby Billionaires' Row condos such as

432 Park Avenue and 15 Central Park West. With only two recorded sales 15 CPW had its lowest number of sales since its completion in 2008. Moreover, as both were modest sized, lower floor units, their relatively low sales prices have had the effect of giving the illusion that the building's overall price/ft2 has dropped by close to 35%. Several other prestigious buildings that recorded few sales and traded only smaller units, similarly reflect a marked drop in prices. It remains to be seen if these price decreases will be manifest in larger, higher floor units.

The best price-gainers over the past decade have been post-war condos near Lincoln Center and in the West Village.

The best price-gainers over the past decade have been post-war condos near Lincoln Center and in the West Village.

Would you like to tour any of these properties?

Just complete the info below.

Or call us at (212) 755-5544

Would you like to tour any of these properties?

6sqft delivers the latest on real estate, architecture, and design, straight from New York City.

6sqft delivers the latest on real estate, architecture, and design, straight from New York City.