Buying as a foreigner is complex but not impossible. (The Hampshire House, #1204/1206 - Sotheby's International Realty)

Buying as a foreigner is complex but not impossible. (The Hampshire House, #1204/1206 - Sotheby's International Realty)

As pandemic-era travel restrictions lifted, New York City’s real estate market has experienced renewed interest from foreign buyers. For industry insiders, the growing interest from foreigners is no surprise. In recent times, high interest rates have caused many domestic buyers to put their buying plans on hold. As a result, foreign buyers returning to New York City are being met with slightly higher inventory, less competition, and more attractive prices. Despite the increasingly favorable market conditions, however, buying and selling as a foreigner remains more complex than it does for U.S. citizens and permanent residents.

In this article:

Considerations when buying as a foreigner

Securing financing

For foreign buyers who can pursue cash-only deals, there are currently plenty of great listings to be had, especially on the luxury side of the market. For foreigners who require financing, however, the process of buying a property can be challenging. As a rule, foreign buyers seeking financing, with the exception of those who already have permanent residency (i.e., a Green Card), are still expected to bring much more to any deal than their domestic counterparts. While expectations vary from lender to lender, as a rule, foreigners should be prepared to bring at least 40 percent to any deal. In addition, foreign buyers are often expected to produce additional paperwork and nearly always face a much longer underwriting process.

For foreign buyers who can pursue cash-only deals, there are currently plenty of great listings to be had, especially on the luxury side of the market. For foreigners who require financing, however, the process of buying a property can be challenging. As a rule, foreign buyers seeking financing, with the exception of those who already have permanent residency (i.e., a Green Card), are still expected to bring much more to any deal than their domestic counterparts. While expectations vary from lender to lender, as a rule, foreigners should be prepared to bring at least 40 percent to any deal. In addition, foreign buyers are often expected to produce additional paperwork and nearly always face a much longer underwriting process.

Condos, like this one at No. 33 Park Row, traditionally have fewer restrictions for foreign buyers than co-ops. (#14B - Compass)

Condos, like this one at No. 33 Park Row, traditionally have fewer restrictions for foreign buyers than co-ops. (#14B - Compass)

Navigating coop and condo boards

Although many New York City coops are foreign-buyer friendly, depending on the board, being a foreign buyer can work against you. Coops can't discriminate based on one's national origin, but they can legally conclude that a foreign buyer poses a higher financial risk. While this may or may not be true, one thing is certain — it is substantially more difficult for coop boards to assess a foreign buyer's credit history. After all, while most domestic buyers have credit histories dating back to their early twenties, foreign buyers may have no available U.S. credit history to share or only have a history spanning a few years. For this reason, foreign buyers who are approved to purchase coops are often also required to put anywhere from a few months to several years of coop fee payments in an Escrow.

Fortunately, buying a condo, especially directly from a developer, is generally easier for foreign buyers. Additionally, several condops have more liberal policies than a traditional cooperative, especially pertaining to international buyers.

Although many New York City coops are foreign-buyer friendly, depending on the board, being a foreign buyer can work against you. Coops can't discriminate based on one's national origin, but they can legally conclude that a foreign buyer poses a higher financial risk. While this may or may not be true, one thing is certain — it is substantially more difficult for coop boards to assess a foreign buyer's credit history. After all, while most domestic buyers have credit histories dating back to their early twenties, foreign buyers may have no available U.S. credit history to share or only have a history spanning a few years. For this reason, foreign buyers who are approved to purchase coops are often also required to put anywhere from a few months to several years of coop fee payments in an Escrow.

Fortunately, buying a condo, especially directly from a developer, is generally easier for foreign buyers. Additionally, several condops have more liberal policies than a traditional cooperative, especially pertaining to international buyers.

ITIN or Tax ID

If you’re not already living and working in the U.S., in which case you'll have a Social Security number, you'll need to obtain an Individual Tax Identification Number (ITIN) to purchase a property. An ITIN can be obtained from the IRS by submitting a W-7 and all the necessary identification documents.

If you’re not already living and working in the U.S., in which case you'll have a Social Security number, you'll need to obtain an Individual Tax Identification Number (ITIN) to purchase a property. An ITIN can be obtained from the IRS by submitting a W-7 and all the necessary identification documents.

FIRPTA regulations

In addition to the many regulations that govern foreign buyers, foreign sellers face a unique regulation — the Foreign Investment in Real Property Tax Act (FIRPTA). FIRPTA is a federal law that regulates the sale of real estate by foreign persons or entities. In summary, when a foreign person sells a property, the buyer must withhold 15 percent of the sale and transfer the funds to the IRS. The goal of FIRPTA is to ensure that foreign sellers pay all taxes owed to the IRS, whether they stay in the country or not.

Fortunately, there are a few exceptions to FIRPTA. If the buyer is an individual who is purchasing a property for personal use and the sale price is under $300,000, then tax withholding is not required. It is imperative that the buyer (or one of their immediate family members) does intend to live in the property. If they rent out the property instead, their failure to withhold and transfer taxes will be viewed as an IRS violation. Another exception to the default FIRPTA regulations maintains that if the sale price of the real estate sold is equal to or greater than $300,001 but equal to or less than $1 million, sellers are only obligated to withhold 10 percent rather than the standard 15 percent.

Fortunately, there are a few exceptions to FIRPTA. If the buyer is an individual who is purchasing a property for personal use and the sale price is under $300,000, then tax withholding is not required. It is imperative that the buyer (or one of their immediate family members) does intend to live in the property. If they rent out the property instead, their failure to withhold and transfer taxes will be viewed as an IRS violation. Another exception to the default FIRPTA regulations maintains that if the sale price of the real estate sold is equal to or greater than $300,001 but equal to or less than $1 million, sellers are only obligated to withhold 10 percent rather than the standard 15 percent.

A great time for foreign buyers to return to New York City

Despite the challenges some foreigners face obtaining financing and navigating coop boards, this is an excellent time for foreigners to return to New York City. Whether one is looking for an investment opportunity or to relocate, with inventory building and softer competition than we saw in late 2020 to early 2022, foreign buyers returning to New York City in the second half of 2023 can look forward to more options and even attractive price cuts, especially on the luxury side of the market.

Would you like to tour any of these properties?

Just complete the info below.

Or call us at (212) 755-5544

Ritz Tower, #34E (Douglas Elliman Real Estate)

The Victorian, #9B (Brown Harris Stevens Residential Sales LLC)

The Aristocrat, #6A (Sothebys International Realty)

The Beekman, #407 (Compass)

150 East 61st Street, #5G (Coldwell Banker Warburg)

205 East 63rd Street, #11EF (Compass)

Southmoor House, #4F (R New York)

Lincoln Towers, #7K (Douglas Elliman Real Estate)

105 East 38th Street, #PH9 (Compass)

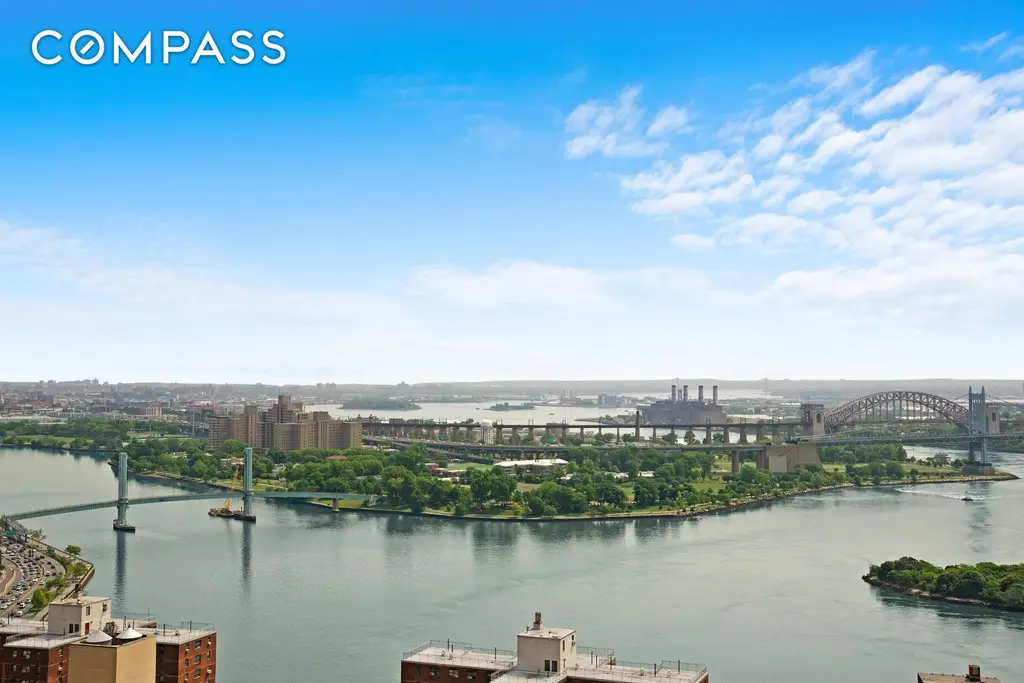

870 United Nations Plaza, #10E

$2,200,000

Turtle Bay/United Nations | Cooperative | 2 Bedrooms, 2 Baths | 1,685 ft2

870 United Nations Plaza, #10E (Serhant LLC)

The Alwyn Court, #11A (Brown Harris Stevens Residential Sales LLC)

39 East 75th Street, #4E (Sothebys International Realty)

130 East 63rd Street, #14E (Sothebys International Realty)

480 Park Avenue, #14E (Douglas Elliman Real Estate)

The Hampshire House, #1204/1206 (Sothebys International Realty)

The Stanhope, #11N (Sothebys International Realty)

Would you like to tour any of these properties?

Just complete the info below.

Or call us at (212) 755-5544

Would you like to tour any of these properties?

Contributing Writer

Cait Etherington

Cait Etherington has over twenty years of experience working as a journalist and communications consultant. Her articles and reviews have been published in newspapers and magazines across the United States and internationally. An experienced financial writer, Cait is committed to exposing the human side of stories about contemporary business, banking and workplace relations. She also enjoys writing about trends, lifestyles and real estate in New York City where she lives with her family in a cozy apartment on the twentieth floor of a Manhattan high rise.

6sqft delivers the latest on real estate, architecture, and design, straight from New York City.

6sqft delivers the latest on real estate, architecture, and design, straight from New York City.