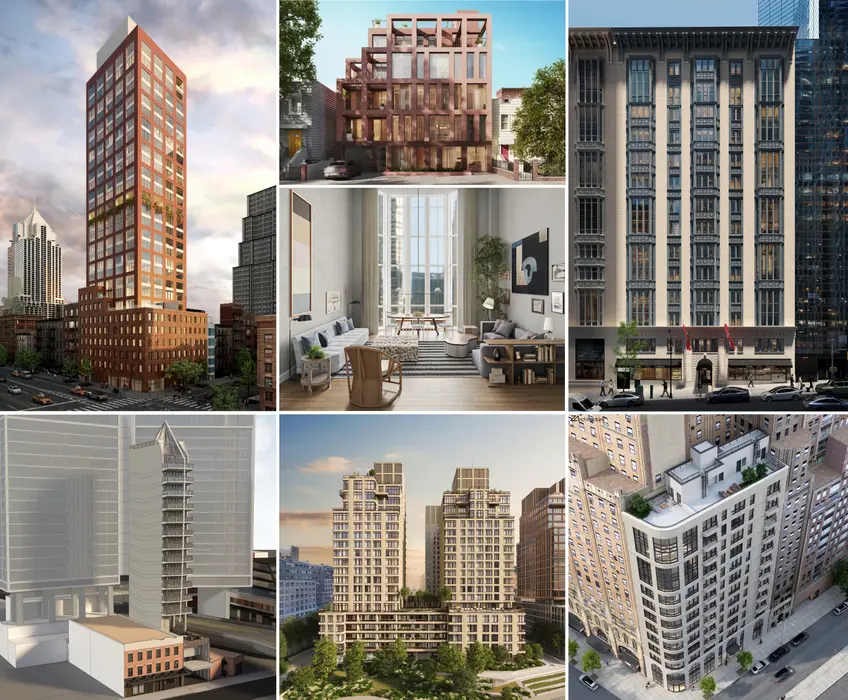

Various new development condo projects in the works throughout NYC

Various new development condo projects in the works throughout NYC

In New York State, buyers must contract with an attorney to close any real estate deal. When purchasing a new construction condo, contracting with an experienced real estate attorney is particularly important due to the fact that these purchases present unique risks to buyers and nearly always take much longer than the average resale close.

To learn more about the essential role played by real estate attorneys in condo purchases, Market Insight talked to veteran New York City real estate attorney Robert J. Smith of the Law Office of Robert J. Smith. Smith has been practicing real estate law in New York City for over three decades and is co-author of the standard form condo contract. We also look at new and forthcoming condos for putting his advice into practice.

To learn more about the essential role played by real estate attorneys in condo purchases, Market Insight talked to veteran New York City real estate attorney Robert J. Smith of the Law Office of Robert J. Smith. Smith has been practicing real estate law in New York City for over three decades and is co-author of the standard form condo contract. We also look at new and forthcoming condos for putting his advice into practice.

In this article:

The unique risks of purchasing a new construction condo

Although all real estate purchases present risks, purchasing a new construction condo presents additional risks to buyers. This is largely due to the fact that in new construction condo deals, there are certain costs that the sponsor transfers to buyers that normally would not be the buyer’s responsibility, including New York City and New York State transfer taxes. Still, the higher cost associated with closing a new construction condo deal is not the only reason these deals often entail additional risks for buyers.There are at least two other key reasons that new construction condo purchases pose unique risks. As Smith emphasizes, “Where a building has not yet been constructed or is being constructed, we need to be certain that the finished product is substantially similar to what was represented, in terms of layout and materials provided.” Timing is also a concern: “Sponsors will often provide estimates of when construction will be completed but are not willing to codify that in a contract.” For this reason, Smith says that he always works to include a “drop dead” date in condo contracts—in essence, if the deal has not closed by the “drop dead” date, the purchaser has the right to walk away from the deal. This is important, Smith adds, because it ensures that purchasers and their funds can’t be held hostage by slow-moving developers.

One Williamsburg Wharf, #9D (Serhant)

One Williamsburg Wharf, #9D (Serhant)

Reviewing condo offering plans

Among other tasks, when you contract with a real estate attorney in preparation to make an offer on a new construction condo, you’re trusting them to thoroughly review the condo’s offering plan. An offering plan is a document that discloses information about a condo to a prospective buyer, including the price, buying procedures, and the building bylaws. When a building is still under construction, the offering plan also includes details on what the building will look like, what services it will offer, and how it will operate once it is completed. While this may sound straightforward, offering plans are often several hundred pages in length (for example, search the New York State Offering Plan Database).As a buyer, even if you do have the time to review an offering plan, it is important to have an experienced real estate attorney review the plan on your behalf. As Smith told Market Insight, “The due diligence process in a new construction revolves almost exclusively around a review of the Offering Plan and any amendments. The Plan is what sets forth the terms being offered by the Sponsor, and the purchase agreement should reflect what is in the Plan.” Among other items, real estate attorneys ensure sponsors haven’t included any clauses that give them the right to download additional costs at closing and ensure the sponsor is legally obliged to deliver the unit on time and in the promised conditions. Although many buyers take such conditions for granted, attorneys don’t. In a sense, attorneys are there to ensure that anything buyers assume should or will happen is written into the offering plan.

Lots to review in a condo's offering plan (Pixabay - advogadoaguilar)

Lots to review in a condo's offering plan (Pixabay - advogadoaguilar)

Negotiating contingencies

In real estate deals, contingencies are always important, but when purchasing a unit in a building that doesn’t yet exist, contingencies take on additional import. As already noted, timing is a key factor in any condo deal, as buyers and their attorneys naturally want to ensure that the unit in question will be finished by a certain date. In new construction condo deals, financing contingencies are also important. As Smith explained, “With regard to financing, most purchase agreements will indicate that they are not contingent on financing. If the purchaser needs financing, we have to push back and insist that the purchase agreement be amended to reflect a financing contingency.Exceptional cases

Most readers have likely come across stories about buyers taking legal action against condo developers due to delayed project completions or construction flaws. Fortunately, Smith says that in his experience, buyers rarely need to take legal action. “Disputes with developers are common,” he admits, “but I wouldn’t say that legal actions are common.” That said, when developers fail to deliver a unit as or when promised, and it affects the ability of the unit owners to enjoy the property, owners may seek redress. In these exceptional circumstances, Smith has observed that owners are almost always more successful if they band together. Consulting with an attorney is especially important at new construction condos (Pexels - Pavel Danilyuk)

Consulting with an attorney is especially important at new construction condos (Pexels - Pavel Danilyuk)

Forthcoming new developments

Downtown

269 Water Street, Financial District

Developed by

Mott & Prince Management

Design by SM Tam Architect

7 stories | 76 feet

Six two- to three-bed condos

Developed by Mott & Prince Management

Design by SM Tam Architect

7 stories | 76 feet

Six two- to three-bed condos

269 Water Street via Landmarks Preservation Commission presentation

269 Water Street via Landmarks Preservation Commission presentation

In December 2025, Landmarks approved an application to demolish a garage at 269 Water Street in the South Street Seaport Historic District and build a new boutique condominium in its place. The seven-story structure seen in renderings is harmonious with its nearest neighbors, and its red brick facade and cornice offer a modern take on the historic architecture. All units will feature direct elevator access, open kitchens, split bedroom floor plans, and in-unit laundry.

256 East 4th Street, East Village

Developed by

89 Development LLC

Design by StudiosC Architecture

6 stories | 60 feet

Six condos

Developed by 89 Development LLC

Design by StudiosC Architecture

6 stories | 60 feet

Six condos

256 East 4th Street (Credit: StudioSC)

256 East 4th Street (Credit: StudioSC)

It may be possible to trace the demographics of the East Village/Alphabet City through the building at 256 East 4th Street. In 1925, it was built as a shul/synagogue for the Ukrainian Lemberger Congregation. In the 1970s, as the neighborhood's Puerto Rican population grew, it became Iglesia Evangelica Bautista, a Spanish Baptist church. Most recently, at a time when luxury condominiums are on the rise, permits have been filed to turn it into a six-story, six-unit boutique condominium. Sadly, the neo-Gothic facade was too damaged to be preserved; in its place will be a streamlined red brick facade with punched windows and planted areas beneath them.

A history of 256 East 4th Street

A history of 256 East 4th Street

Rothko House, East Village

313 East 6th Street

Developed by Florida Man Development

Design by Michael House Architect (renovation)

4 stories | 55 feet

Two two- to three-bedroom condos from $5.8 million

313 East 6th Street

Developed by Florida Man Development

Design by Michael House Architect (renovation)

4 stories | 55 feet

Two two- to three-bedroom condos from $5.8 million

Rothko House (CityRealty)

Rothko House (CityRealty)

In the 1930s, artist Mark Rothko rented a room at 313 East 6th Street in the East Village, and his painting "Thru the Window" was inspired by his time living there. Nearly 100 years later, the house has been converted to a boutique condominium and renamed in his honor. One of the two triplex units has a private garden, another is topped with a private roof terrace, and all interiors are to feature white oak floors, high-end appliances and fixtures, smart thermostats, and in-unit laundry.

51 Little West 12th Street, Meatpacking

Developed by Jerry Noury

Design by Marin Architects

14 stories | 203 feet

12 residential units

Developed by Jerry Noury

Design by Marin Architects

14 stories | 203 feet

12 residential units

Over in the Meatpacking District, the owner of the vacant lot at 51 Little West 12th Street (between the Brass Monkey and the High Line) is asking for zoning variance to build a 14-story, 203′ tall residential tower with commercial space on the lower floors and 12 two-bedroom units on floors three to 14.

The developer is seeking a variance from the NYC Board of Standards and Appeals (BSA) because residential use is not permitted as of right at the site’s M1-5 zoning district, which would otherwise limit development to a smaller commercial or manufacturing building. The applicant argues the variance is necessary due to the site’s unusual physical constraints, including its 25-foot width, high groundwater table, flood zone location, and high foundation costs, which make as-of-right development financially infeasible. The plan was rejected by Community Board 2, and a follow up hearing is planned with the BSA next year.

The developer is seeking a variance from the NYC Board of Standards and Appeals (BSA) because residential use is not permitted as of right at the site’s M1-5 zoning district, which would otherwise limit development to a smaller commercial or manufacturing building. The applicant argues the variance is necessary due to the site’s unusual physical constraints, including its 25-foot width, high groundwater table, flood zone location, and high foundation costs, which make as-of-right development financially infeasible. The plan was rejected by Community Board 2, and a follow up hearing is planned with the BSA next year.

246 West 18th Street, Chelsea

Developed by Prime Builders

Design by RyDE Design

11 stories | 120 feet

21 residential condos Completion: 2027

Developed by Prime Builders

Design by RyDE Design

11 stories | 120 feet

21 residential condos

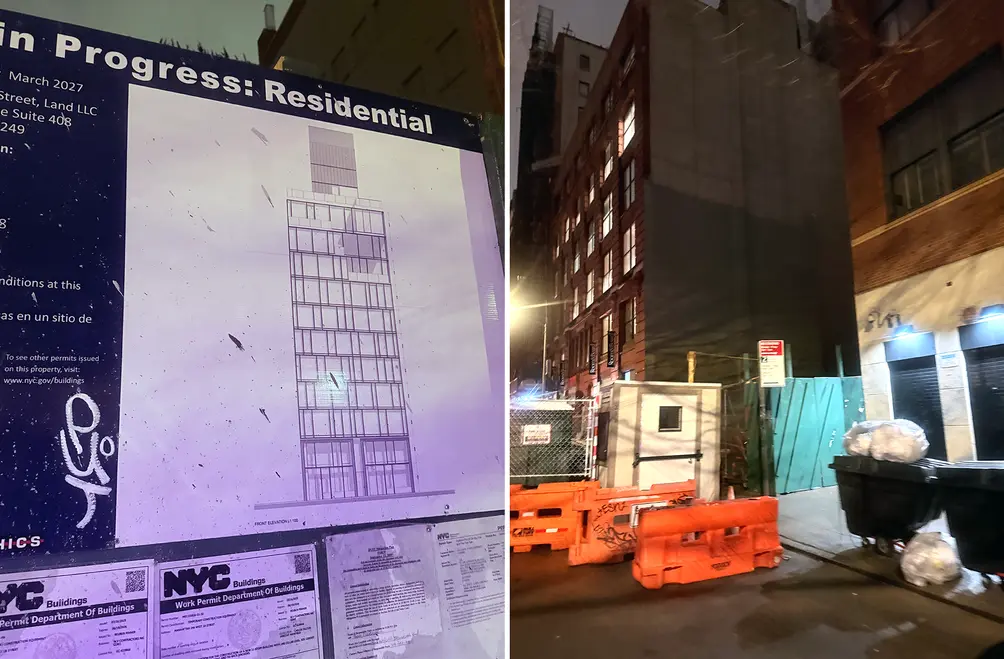

246 West 18th Street | Credit: RyDE Design

246 West 18th Street | Credit: RyDE Design

Credit: RyDE Design

Credit: RyDE Design

Developer Reuben Pinner has begun construction on a 11-story, 19-unit condo development at 246 West 18th Street, off Eighth Avenue in Chelsea. Brooklyn-based RyDE designed the 27,540 square foot project which will have floor-to-ceiling windows, vertical louvers in an offset arrangement, some setback terraces, and a cantilevering portion of the penthouse floor. The project replaces two classic walk-up tenement buildings, one of which used to house Westville Chelsea on its ground floor. Completion is targeted for 2027.

Unfortunately, a classic downtown tenement building where Westville Chelsea used to be was demo'd

Unfortunately, a classic downtown tenement building where Westville Chelsea used to be was demo'd

Foundation work at 246 West 18th Street underway as of mid December 2025

Foundation work at 246 West 18th Street underway as of mid December 2025

227 West 19th Street, Chelsea

Developed by Round Square Builders

Design by DXA Studio

11 stories | 120 feet

8 condo units

Developed by Round Square Builders

Design by DXA Studio

11 stories | 120 feet

8 condo units

227 West 19th Street | Credit Round Square Builders and DXA Studio

227 West 19th Street | Credit Round Square Builders and DXA Studio

Now topped out, developer Round Square Builders, in collaboration with architects DXA Studio, are building an 11-story condominium at 227 West 19th Street, between Seventh and Eighth Avenues in Chelsea. The red-brick building is distinguished by deeply inset windows and planted areas beneath them, and will house eight condominium residences along with amenities that include a private fitness center, landscaped rooftop terrace, and concierge services.

Midtown

Casoni, Midtown West

989 Sixth Avenue

Developed by 989 Sixth Realty LLC

Design by C3D Architecture

69 stories | 785 feet

27 condos

989 Sixth Avenue

Developed by 989 Sixth Realty LLC

Design by C3D Architecture

69 stories | 785 feet

27 condos

Casoni | Credit: C3D Architecture

Casoni | Credit: C3D Architecture

In summer 2025, construction topped out on Casoni, a new tower soaring above the historic Haier Building. The residential units on top will include a mix of condos and rentals, and amenities are set to include an attended lobby, pool, spa lounge, gym, children's playroom, coworking space, a speakeasy-inspired recreational area, and outdoor terraces on the 23rd, 58th, and 70th floors. Sales are expected to launch in early 2026.

November 2025

November 2025

Casoni (Fall 2025)

Casoni (Fall 2025)

8 West 45th Street, Midtown West

8-16 West 45th Street

Developed by Hiwin Group

Design by Nexus Architect

69 stories | 785 feet

113 residential units

8-16 West 45th Street

Developed by Hiwin Group

Design by Nexus Architect

69 stories | 785 feet

113 residential units

Hiwin Group, led by Xiaogang Wang, is planning a 32-story, 379-foot-tall mixed-use residential tower that will replace four low-rise commercial buildings at 8-16 West 45th Street, between Fifth and Sixth Avenues in Midtown West. In addition to apartments, the 108,000-square-foot development will include ground-floor retail along its midblock lot with 92 feet of frontage. The site has been cleared of its pre-war low rises that once held shops such as Ambrosia Deli, the Point Break bar, and Jean's Silversmiths.

401 East 51st Street, Beekman-Sutton Place

930 First Avenue

Developed by Cimbra Partners, SK Development/ CBSK Developers

Design by Selldorf Architects and SLCE

30 stories | 369 feet

83 condos

930 First Avenue

Developed by Cimbra Partners, SK Development/ CBSK Developers

Design by Selldorf Architects and SLCE

30 stories | 369 feet

83 condos

Credit: Cimbra Partners and SK Development/ CBSK Developers

Credit: Cimbra Partners and SK Development/ CBSK Developers

Cimbra Partners and SK Development/ CBSK Developers are rapidly moving forward on a 29-story, 369-foot-tall residential condominium at 401 East 51st Street (930 First Avenue) in Turtle Bay / Beekman-Sutton Place with 83 apartments. The superstructure has recently emerged from its foundation, and the building is expected to open sometime in 2027.

The 174,000-square-foot project, designed by Annabelle Selldorf with SLCE as the executive architects, will include ground-floor retail space and a 15-car parking garage. Renderings show the project will be a lively, loft-like addition to this staid section of Manhattan. The tower replaces a cluster of low-rise prewar buildings at 930 First Avenue, 936 First Avenue, and 409 East 51st Street that were purchased for $46.8 million in June 2023.

The 174,000-square-foot project, designed by Annabelle Selldorf with SLCE as the executive architects, will include ground-floor retail space and a 15-car parking garage. Renderings show the project will be a lively, loft-like addition to this staid section of Manhattan. The tower replaces a cluster of low-rise prewar buildings at 930 First Avenue, 936 First Avenue, and 409 East 51st Street that were purchased for $46.8 million in June 2023.

The tower beginning to rise as of late November 2025 (CityRealty

The tower beginning to rise as of late November 2025 (CityRealty

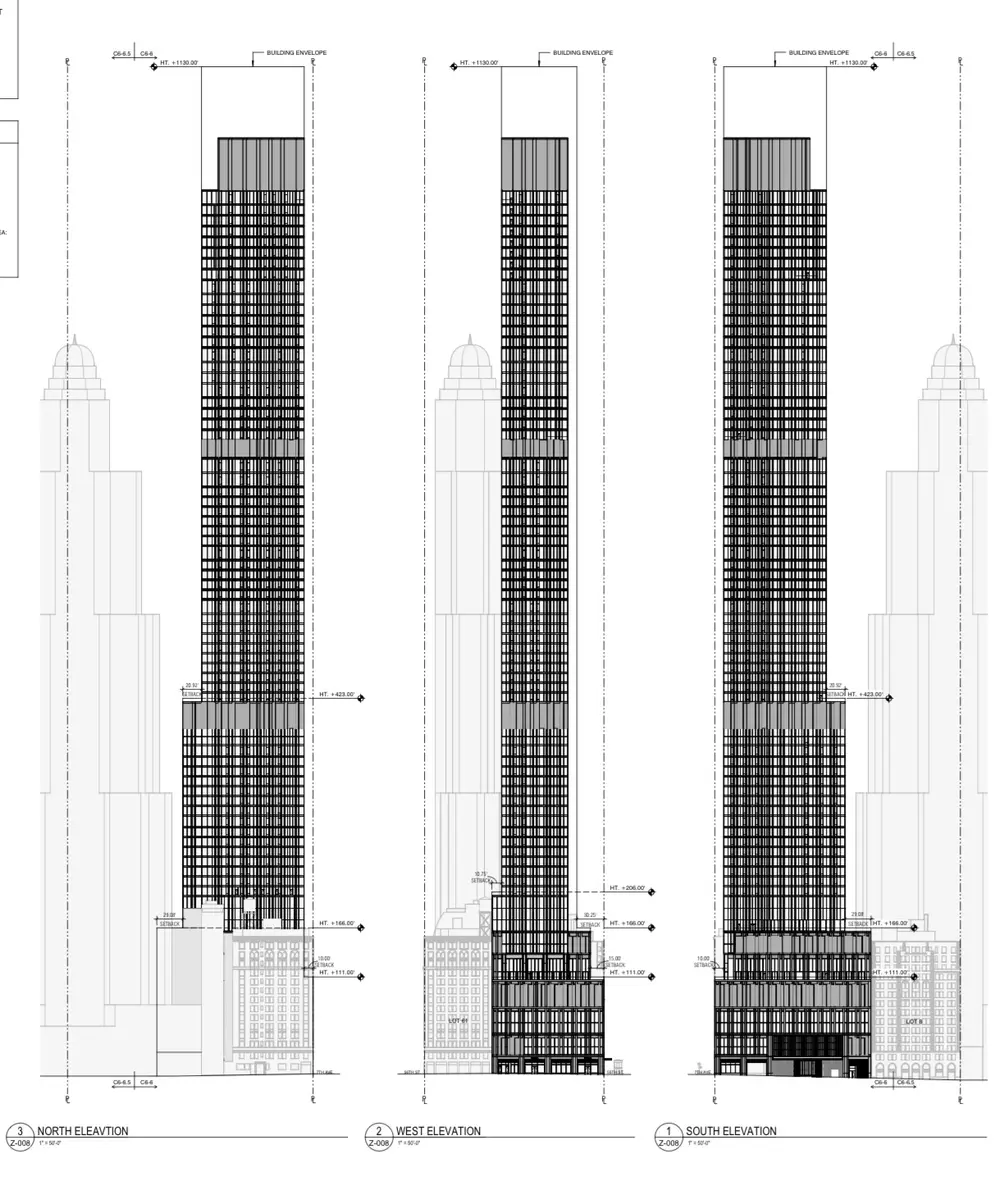

Wellington Hotel Redevelopment, Billionaires' Row/Midtown West

871 Seventh Avenue

Developed by Extell Development Company

Design by Beyer Blinder Belle

71 stories | 1,050 feet

130 residential units / 156 hotel rooms

871 Seventh Avenue

Developed by Extell Development Company

Design by Beyer Blinder Belle

71 stories | 1,050 feet

130 residential units / 156 hotel rooms

Schematic elevations by Beyer Blender Belle for Extell Development

Schematic elevations by Beyer Blender Belle for Extell Development

Gary Barnett's Extell Development has begun demolishing the former Wellington Hotel at 871 Seventh Avenue with plans to replace its previously approved 27-story hotel with a much larger 71 story, 1,050-foot mixed use tower spanning about 484,000 square feet. The revised proposal being reviewed by the NYC Department of City Planning includes 130 residential units, 156 hotel rooms, ground floor retail, parking for 55 cars, and major accessibility upgrades to the nearby 50th Street 1 train station in exchange for the added height and density. The new tower is proposed to rise slightly higher than Extell's nearby supertall One57 and many residences and suites will have Central Park views.

Late November 2025

Late November 2025

Demolition underway as of late November 2025 (CityRealty

Demolition underway as of late November 2025 (CityRealty

Would you like to tour any of these properties?

Just complete the info below.

Or call us at (212) 755-5544

Parc Beaufort, Billionaires' Row/Midtown West

140 West 57th Street

Developed by The Feil Organization

Design by MDeaS Architects

14 stories | 150 feet

47 condos

140 West 57th Street

Developed by The Feil Organization

Design by MDeaS Architects

14 stories | 150 feet

47 condos

Rendering of Parc Beaufort (Corcoran Sunshine)

Rendering of Parc Beaufort (Corcoran Sunshine)

The building at 140 West 57th Street was constructed as a studio apartment building for artists in 1907. In the decades that followed, it changed to commercial use and was designated a New York City landmark. Most recently, owner Feil Organization filed permits to convert it to a luxury boutique condominium in April 2025. Sales are expected to launch in the second quarter of 2026.

Upper West and Upper East Side

Design of 215 West 76th Street - 2160 Broadway (Credit: Z Architecture)

Design of 215 West 76th Street - 2160 Broadway (Credit: Z Architecture)

At the northeast corner of West 76th Street and Broadway on the Upper West Side, a more than century-old, albeit greatly altered, four-story building at 2160 Broadway is being demolished to make way for a 12-story mixed-use condo development following permits filed in May 2025. The proposed 149-foot-tall building would include 10 large residential units (likely condos), along with roughly 1,000 square feet of ground-floor commercial space. The project utilizes unused air rights tied to the site and will block some south-facing windows from the adjacent co-op, The Opera.

Z Architecture is leading the design where they provide a neo-traditional aesthetic that somewhat mirrors The Laureate condo across 76th Street.

Pre-existing building at 2160 Broadway

Pre-existing building at 2160 Broadway

Credit: Z Architecture

Credit: Z Architecture

1122 Madison Avenue, Carnegie Hill

Developed by

Legion Investment / Nahla

Design by Hill West Architects

22 stories | 283 feet

26 three- to six-bedroom condos

Developed by Legion Investment / Nahla

Design by Hill West Architects

22 stories | 283 feet

26 three- to six-bedroom condos

While 1122 Madison Avenue is set to tower over its nearest neighbors, its design by Studio Sofield draws inspiration from prewar Upper East Side architecture. The 26 apartments will include several floor-through units, and many will have private terraces. Information is not yet available on amenities, but one certain perk is its Upper East Side address in close proximity to Central Park, Museum Mile, and some of Madison Avenue's most rarefied shopping.

1122 Madison under construction on the right

1122 Madison under construction on the right

200 West 88th Street, Upper West Side

Developed by

Nortco Development

Design by Robert A.M. Stern Architects

18 stories | 215 feet

37 three- to five-bedroom condos

Developed by Nortco Development

Design by Robert A.M. Stern Architects

18 stories | 215 feet

37 three- to five-bedroom condos

Rendering of 200 West 88th Street (Robert A.M. Stern Architects)

Rendering of 200 West 88th Street (Robert A.M. Stern Architects)

A short distance from The Henry, where closings are expected to begin soon, another luxury condo designed by Robert A.M. Stern Architects is in the works. Renderings of 200 West 88th Street, which is rising on a site that once included the Mermaid Inn, reveal a warm brick façade with elaborate limestone detailing and elegant fenestration along the lower two floors. Residents of the 37 forthcoming "ultra-luxury" condos will have access to amenities like a rooftop deck, motor court, automated parking, fitness center with yoga studio, music room, maker space, game room, card room, kids’ playroom, and multiple lounges and dining areas.

200 West 88th Street as of October 2025

200 West 88th Street as of October 2025

214 West 80th Street, Upper West Side

Developed by ZHL Group Inc.

Design by Z Architecture

7 stories | 68 feet

Six condos

Developed by ZHL Group Inc.

Design by Z Architecture

7 stories | 68 feet

Six condos

Rendering of 214 West 80th Street (Z Architecture)

Rendering of 214 West 80th Street (Z Architecture)

In February 2025, a real estate developer bought the Upper West Side parking garage at 214 West 80th Street for $10.5 million. Months later, they filed permits to convert it to a boutique condominium with amenities like a gym, a children's playroom, and private storage.

Brooklyn

205 Montague Street, Brooklyn Heights

Developed by Landau Properties

Design by Hill West Architects

47 stories | 792 feet

46 condos

Developed by Landau Properties

Design by Hill West Architects

47 stories | 792 feet

46 condos

205 Montague Street

205 Montague Street

In December 2025, developer Landau Properties, in partnership with Third Millennium Group and Midtown Equities, closed on the purchase of the development site at 205 Montague Street. The project is set to comprise 40,000 square feet of retail space, 90 rental residences, and 46 condo residences. Demolition and construction are expected to begin in 2026.

One Wharf Way, Williamsburg

80 Wharf Way

Developed by Naftali Group

Design by COOKFOX Architects

20 stories | 460 feet

218 condos

80 Wharf Way

Developed by Naftali Group

Design by COOKFOX Architects

20 stories | 460 feet

218 condos

Rendering of One Wharf Way (COOKFOX)

Rendering of One Wharf Way (COOKFOX)

As of mid-December 2025, One Williamsburg Wharf is nearly 65% sold and construction is underway on One Wharf Way, a two-towered condominium in the second phase of the Williamsburg Wharf complex. It will offer over 285 feet of East River frontage and unobstructed eastern and western views of the Manhattan and Downtown Brooklyn skylines. Renderings by COOKFOX show a light-colored facade, oversized windows, and numerous balconies and terraces consistent with the architect's biophilic design principles.

185 Skillman Avenue, Williamsburg

Developed by Spruce Consulting Inc.

Design by StudiosC

5 stories | 792 feet

8 condos

Developed by Spruce Consulting Inc.

Design by StudiosC

5 stories | 792 feet

8 condos

185 Skillman Avenue | Credit: StudioSC

185 Skillman Avenue | Credit: StudioSC

Renderings of 185 Skillman Avenue, a forthcoming East Williamsburg boutique condo designed by StudioSC, depict a tasteful building with a hand-crafted brick facade and a carefully composed play of window sizes. Interior renderings show airy apartments with hardwood floors, open kitchens, and natural materials throughout.

Credit: StudiosC

Credit: StudiosC

109 Devoe Street, Williamsburg

Developed by Devoe Condominiums LLC

Design by StudiosC

5 stories | 50 feet

Eight one- to three-bed condos from $1.23 million

Developed by Devoe Condominiums LLC

Design by StudiosC

5 stories | 50 feet

Eight one- to three-bed condos from $1.23 million

Rendering of 109 Devoe Street (StudiosC)

Rendering of 109 Devoe Street (StudiosC)

To launch sales next year, 109 Devoe Street is a ground-up five-story condo designed by StudiosC with eight one- to three-bed residences. The building is defined by a series of setbacks that create large private terraces, and oversized windows promise abundant natural light. Amenities are to include a welcoming lobby and on-site parking.

Credit: StudiosC

Credit: StudiosC

477-479 Washington Avenue, Clinton Hill

Developed by Wisdom Equities LLC

Design by Z Architecture

5 stories | 55 feet

Developed by Wisdom Equities LLC

Design by Z Architecture

5 stories | 55 feet

477 Washington Avenue (Z Architecture)

477 Washington Avenue (Z Architecture)

The increasingly busy firm Z Architecture has designed a five-story condominium development at 477 Washington Avenue in Clinton Hill. The long-vacant site between Gates and Fulton Streets has seen multiple proposals over the years, largely centered on the empty lot, and now also incorporates the adjacent stately but deteriorated red-brick building. While preservation would have been preferable, the new plans call for an asymmetrical brick-and-metal façade with a centered entrance, large full-height windows (some arched), rounded corners, select balconies, and a setback penthouse level featuring a generous terrace.

Noteworthy new development listings

378 8th Street, #PH (Douglas Elliman Real Estate)

144 Vanderbilt Avenue, #2A (Douglas Elliman Real Estate)

The Strathmore, #18B (Corcoran Sunshine Marketing Group)

One Williamsburg Wharf, #9D (Serhant)

Fifty One Domino, #THA (Serhant)

VU New York, #32A (Brown Harris Stevens Development Marketing LLC)

219 Hudson Street, #PHA (Nest Seekers LLC)

Monogram New York, #PHB (Douglas Elliman Real Estate)

77 Greenwich Street, #PH

$9,500,000 (-2.6%)

Financial District | Condominium | 4 Bedrooms, 5.5 Baths | 3,531 ft2

77 Greenwich Street, #PH (Reuveni LLC)

Spring + Thompson, #5 (Corcoran Sunshine Marketing Group)

One High Line, #W28B (Serhant)

The Katharine, #PH (Compass)

133 East 73rd Street, #PH (Modlin Group LLC)

125 Perry Street, #PHE (Compass)

Would you like to tour any of these properties?

Just complete the info below.

Or call us at (212) 755-5544

Would you like to tour any of these properties?

Contributing Writer

Cait Etherington

Cait Etherington has over twenty years of experience working as a journalist and communications consultant. Her articles and reviews have been published in newspapers and magazines across the United States and internationally. An experienced financial writer, Cait is committed to exposing the human side of stories about contemporary business, banking and workplace relations. She also enjoys writing about trends, lifestyles and real estate in New York City where she lives with her family in a cozy apartment on the twentieth floor of a Manhattan high rise.

6sqft delivers the latest on real estate, architecture, and design, straight from New York City.

6sqft delivers the latest on real estate, architecture, and design, straight from New York City.