East Hill, #2AB (OFFICIAL)

East Hill, #2AB (OFFICIAL)

With less than four weeks until Election Day, some buyers are apprehensive about whether they should close the deal now or wait until they know who the next president is going to be. However, an analysis of S&P’s Case-Shiller Home Price Index shows that the elections themselves do not affect home values or the housing market; rather, several other factors were at work in past election years.

For example, when home prices plummeted in 2008, that had more to do with the broader financial crisis than the presidential election. Conversely, when home values dramatically improved in 2021, low mortgage rates played the largest role in the bustling market. Moreover, Bankrate observes that for the majority of Americans, the election results will have little impact on their income and shouldn't impact their decision to buy or sell.

For example, when home prices plummeted in 2008, that had more to do with the broader financial crisis than the presidential election. Conversely, when home values dramatically improved in 2021, low mortgage rates played the largest role in the bustling market. Moreover, Bankrate observes that for the majority of Americans, the election results will have little impact on their income and shouldn't impact their decision to buy or sell.

That being said, there is little question that certain times of the week, month, and year are more conducive to a smooth closing than others, and can carry greater tax benefits. This article offers insight into when those are.

In this article:

The best time of the week to close on a property

While any day is a good day to close on a desired property, real estate agents and attorneys typically prefer closes between Tuesday and Thursday for a practical reason. Closing real estate transactions requires both the buyer and seller—and their representative attorneys—to sign off on hundreds of pages of documents. If a document is missing or incorrect and needs to be drafted or modified, a midweek close is preferable since it offers the highest chance that all implicated parties will be available to keep the transaction moving forward.The best time of the month to close on a property

Mortgage payments are always due on the first of the month with one notable exception—the first payment isn't due until the first full month after closing. As a result, if a buyer closes on October 10, technically, their first mortgage payment won't be due until December 1. In the short term, some buyers welcome this situation since it can offer temporary financial relief when also faced with the high cost of moving. But this doesn't mean buyers who close earlier in the month ultimately gain. In fact, the truth is quite the opposite.What buyers gain upfront when they close earlier in the month actually comes at a cost. After all, if a buyer closes early in the month and doesn’t start paying their mortgage off for nearly two months, they are accumulating interest without making payments. Due to the delayed repayment start, they ultimately end up paying more rather than less overall on their home purchase. However, if a seller has agreed to pay all the buyer’s closing costs, including any additional interest accrued from an early closing, then the buyer likely has nothing to lose and everything to gain by closing earlier rather than later in the month.

The best time of the year to close on a property

On a financial level, the most important consideration for buyers when it comes to closing is the time of the year the close takes place because there are several different types of tax deductions one can take when they close on a home. The most common tax deductions connected to home purchases include:- Points: Purchased upfront to help lower one's mortgage rate, points are considered non-recurring closing costs and are deductible in the year paid.

- Interest: Anyone who has a mortgage pays at least some interest. The sooner one starts paying interest, the sooner it can be treated as a deductible. As such, if a buyer wants to lower their tax liability in the current year, it may be preferable to close and begin paying down the mortgage before the end of the year. That said, since the first mortgage payment isn’t due until the first full month after closing, it's imperative to close before the end of October if this is part of one's current-year taxation plan.

- Property taxes: Buyers can claim any property taxes they have paid during the fiscal year, and the same rule holds true for sellers. However, in this case, much depends on the language that ends up in the buyer's contract of sale (also known as a purchase agreement). In most cases, taxes are prorated. In other words, if a buyer closes on a home on December 15 and the yearly property taxes are $12,000, they will only pay $500 and only be able to claim this amount on their tax filing. If the seller agrees to cover all the year's taxes as a buyer's incentive, or conversely, the buyer agrees to cover the taxes for the entire month of December, the amount of tax paid and the amount that can be deducted changes.

Since each buyer's situation is unique, it is impossible to determine the best time of year to close on a property, but one thing is clear. If a buyer is interested in lowering their tax liability, the sooner they close, the more deductions they will be able to claim. On the flip side, if a buyer purchases in a year when their income is low but anticipates having a higher income the following year, it may be more advantageous for them to move the close to January to ensure they can take full advantage of all the tax benefits of buying, including one-time deductions, when they need the deductions most.

The best time for sellers to close deals

Like buyers, depending on their anticipated tax liability, sellers may or may not benefit from closing in the current fiscal year since they can also lower their tax liability by leveraging several one-time costs related to the sale of their home. These costs include any repairs required to ensure the home is habitable as well as any improvements carried out in conjunction with the sale.If a seller hopes to take advantage of these tax deductions, however, it is important that they understand how the IRS defines "home repairs" versus "home improvements." A repair is anything one does to ensure a home is habitable (e.g., fixing a leaky roof or removing mold from a basement). An improvement is anything one does to add value to a home (e.g., installing solar panels or a back deck). Home repairs, which are necessary to sell the home, can be deducted in the year the home sells, but only if they are claimed within 90 days of closing. Home improvements can also be deducted, but in this case, the deduction is distributed over several years.

Downtown

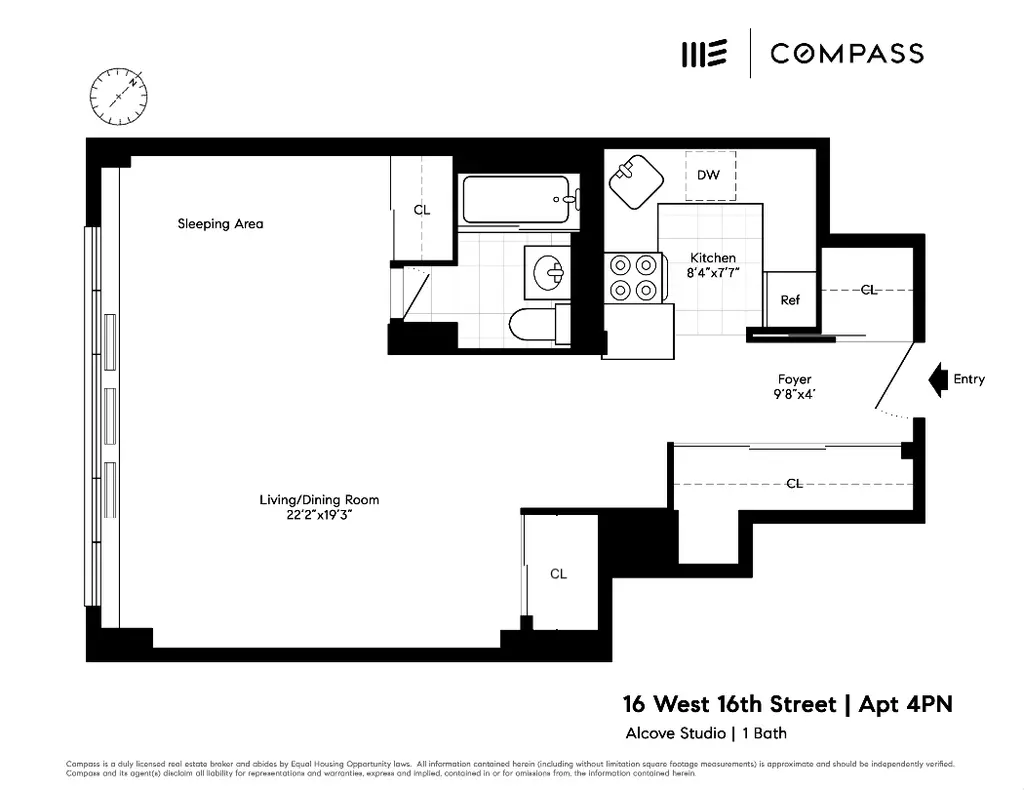

Chelsea Lane, #4PN

$775,000

Flatiron/Union Square | Cooperative | Studio, 1 Bath

Open House: Sunday, October 13, 2024

Chelsea Lane, #4PN (Compass)

175 East 2nd Street, #4B

$1,195,000

East Village | Condominium | 1 Bedroom, 1 Bath | 740 ft2

Open House: Sunday, October 13, 2024

175 East 2nd Street, #4B (Compass)

One Manhattan Square, #12N

$1,262,500

Lower East Side | Condominium | 1 Bedroom, 1 Bath | 695 ft2

Open House: Sunday, October 13, 2024

One Manhattan Square, #12N (Compass)

305 West 16th Street, #4H

$1,750,000

Chelsea | Condop | 2 Bedrooms, 2 Baths

Open Houses: Saturday, October 12 | Sunday, October 13, 2024

305 West 16th Street, #4H (Compass)

The Chelsea Mercantile, #10O

$2,645,000

Chelsea | Condominium | 2 Bedrooms, 2 Baths | 1,562 ft2Open Houses: Sunday, October 13 | Tuesday, October 15, 2024

The Chelsea Mercantile, #10O (Douglas Elliman Real Estate)

21W20, #9

$2,995,000

Chelsea | Condominium | 2 Bedrooms, 2 Baths | 1,302 ft2

Open House: Thursday, October 10, 2024

21W20, #9 (Douglas Elliman Real Estate)

The American Thread Building, #4G

$3,295,000

Tribeca | Condominium | 3 Bedrooms, 2 Baths | 1,450 ft2

Open House: Sunday, October 13, 2024

The American Thread Building, #4G (Corcoran Group)

15 Hubert Street, #2C

$3,750,000

Tribeca | Condominium | 3 Bedrooms, 2.5 Baths | 2,269 ft2

Open House: Sunday, October 13, 2024

15 Hubert Street, #2C (Compass)

Would you like to tour any of these properties?

Just complete the info below.

Or call us at (212) 755-5544

The Spring, #6D

$4,195,000

NoLiTa/Little Italy | Condominium | 2 Bedrooms, 2.5 Baths | 2,047 ft2

Open House: Sunday, October 13, 2024

The Spring, #6D (Serhant LLC)

Midtown

Tudor Tower, #623

$325,000

Turtle Bay/United Nations | Cooperative | Studio, 1 Bath

Open House: Sunday, October 13, 2024

Tudor Tower, #623 (Compass)

The Ashfield, #2B

$595,000

Midtown West | Cooperative | 1 Bedroom, 1 Bath

Open House: Sunday, October 13, 2024

The Ashfield, #2B (Compass)

16 Sutton Place, #12C

$1,290,000

Beekman/Sutton Place | Cooperative | 2 Bedrooms, 2 Baths

Contact CityRealty to schedule a tour

16 Sutton Place, #12C (Compass)

Upper East Side

The Kimberly, #4A

$499,000

Yorkville | Cooperative | 1 Bedroom, 1 Bath

Open House: Sunday, October 13, 2024

The Kimberly, #4A (Compass)

166 East 61st Street, #18E

$645,000

Lenox Hill | Cooperative | 1 Bedroom, 1 Bath | 840 ft2

Contact CityRealty to schedule a tour

166 East 61st Street, #18E (Compass)

205 East 78th Street, #7T

$790,000

Lenox Hill | Cooperative | 2 Bedrooms, 1 Bath

Open House: Sunday, October 13, 2024

205 East 78th Street, #7T (Serhant LLC)

68 East 86th Street, #2B

$799,000

Carnegie Hill | Cooperative | 1 Bedroom, 1 Bath | 1,000 ft2

Open House: Sunday, October 13, 2024

68 East 86th Street, #2B (Compass)

205 East 78th Street, #12J

$925,000

Lenox Hill | Cooperative | 1 Bedroom, 1 Bath

Open House: Sunday, October 13, 2024

205 East 78th Street, #12J (Compass)

The Bryn Mawr, #1BC

$969,000

Lenox Hill | Cooperative | 2 Bedrooms, 2 Baths | 1,100 ft2

Open House: Thursday, October 10, 2024

The Bryn Mawr, #1BC (Douglas Elliman Real Estate)

The Waterford, #28AF

$1,995,000

Yorkville | Condominium | 3 Bedrooms, 2 Baths

Open House: Sunday, October 13, 2024

The Waterford, #28AF (Brown Harris Stevens Residential Sales LLC)

75 East End Avenue, #15B

$2,200,000

Yorkville | Cooperative | 2 Bedrooms, 2.5 Baths

Contact CityRealty to arrange a tour

75 East End Avenue, #15B (Simple Real Estate)

60 East End Avenue, #4C

$2,275,000

Yorkville | Cooperative | 3 Bedrooms, 3.5 Baths

Open House: Sunday, October 13, 2024

60 East End Avenue, #4C (Brown Harris Stevens Residential Sales LLC)

East Hill, #2AB

$3,495,000

Yorkville | Condominium | 4 Bedrooms, 4 Baths | 2,592 ft2

Open House: Sunday, October 13, 2024

East Hill, #2AB (OFFICIAL)

30 East 76th Street, #15AB

$3,500,000

Park/Fifth Ave. to 79th St. | Condominium | 3 Bedrooms, 4 Baths | 2,240 ft2

Contact CityRealty to arrange a tour

30 East 76th Street, #15AB (Sothebys International Realty)

Upper West Side

2322 Adam Clayton Powell Jr Boulevard, #1B

$849,000

Harlem | Condominium | 3 Bedrooms, 2 Baths | 1,460 ft2

Open House: Sunday, October 13, 2024

2322 Adam Clayton Powell Jr Boulevard, #1B (Douglas Elliman Real Estate)

222 Riverside Drive, #2A

$2,099,000

Riverside Dr./West End Ave. | Condominium | 3 Bedrooms, 3 Baths | 1,715 ft2

Open Houses: Thursday, October 10, 2024 | Sunday, October 13, 2024

222 Riverside Drive, #2A (Serhant LLC)

The Park Belvedere, #16CD

$3,750,000

Broadway Corridor | Condominium | 3 Bedrooms, 2 Baths

Open House: Sunday, October 13, 2024

The Park Belvedere, #16CD (Brown Harris Stevens Residential Sales LLC)

One Central Park, #72B

$17,995,000

Central Park West | Condominium | 3 Bedrooms, 5.5 Baths | 3,491 ft2

Open House: Thursday, October 17, 2024

One Central Park, #72B (Brown Harris Stevens Residential Sales LLC)

Would you like to tour any of these properties?

Just complete the info below.

Or call us at (212) 755-5544

Would you like to tour any of these properties?

6sqft delivers the latest on real estate, architecture, and design, straight from New York City.

6sqft delivers the latest on real estate, architecture, and design, straight from New York City.