412 Classon Avenue, TH | https://www.cityrealty.com/nyc/clinton-hill/412-classon-avenue/apartment-/ayHYDpioMT

412 Classon Avenue, TH | https://www.cityrealty.com/nyc/clinton-hill/412-classon-avenue/apartment-/ayHYDpioMT

In 2023, Public Advocate Jumaane Williams and Council Member Pierina Sánchez introduced legislation aimed at increasing transparency in New York City co‑op boards. While co‑ops can't reject applicants for protected characteristics like race or gender, they don’t currently need to explain their decisions. The proposed law would require boards with ten or more units to provide a written explanation within five business days of rejecting an applicant, detailing all specific deficiencies, or face fines up to $25,000.

As it stands, the bill has gained 29 City Council sponsors but remains stalled, with no scheduled hearing and resistance from co‑op board advocates who fear litigation and increased insurance costs. While this would be a meaningful step toward fairness, it doesn’t address deeper inequities in the real estate process—from appraisers and brokers to lending sources. In the next section, we'll explore where bias still lingers and how individuals can challenge it when it arises.

In this article:

Financing Discrimination

Types of financing discrimination

Even before many buyers start looking for a home, they face hurdles in their negotiations with lenders. One 2022 study carried out by the mortgage company Lending Tree found that Black borrowers were twice as likely to be denied financing as the overall population of borrowers in the nation’s 50 largest metropolitan areas.While some studies have suggested that the lower rates of pre-qualification and pre-approval are based on quantifiable measures (e.g., credit scores), there is compelling evidence that credit scores may themselves be impacted by legacies of racism and that mortgage denials aren't always based on purely objective factors. This recently led the NAACP to pass a resolution opposing discriminatory lending practices. Among other practices, the resolution calls attention to "ongoing, modern-day ‘redlining’ or refusal to insure mortgages in and near Black neighborhoods.” The resolution also calls out "the denial to refinance loans at lower interest rates for Black homeowners, and the high rate of rejection of credit applications from qualified Black Americans through automated algorithms and machine learning systems.”

Although financing discrimination has had a particularly devastating effect on Black Americans, there is evidence that it also impacts other communities. A 2017 Pew Research Study found that next to Black Americans, Hispanic Americans were most likely to be denied financing (compared to White Americans, they were over 8% more likely to face rejection).

Moreover, race and ethnicity aren’t the only factors that appear to impact one’s likelihood of acquiring financing or acquiring financing at the best rate. In New York City and nationwide, LGBTQ+ neighborhoods are home to some of the most expensive urban real estate (e.g., in New York City, the West Village, Chelsea, and Park Slope all reflect this trend). Still, the LGBTQ+ community has also historically faced discrimination from lenders. One 2019 study found that same-sex applicants were 73.12% more likely to be denied financing than their different-sex counterparts and are generally charged 0.2% higher fees and interest rates. Even more surprising, the study found that different-sex borrowers seeking financing for properties in LGBTQ+ neighborhoods also appeared to be negatively impacted.

In addition to financing discrimination stemming from race, ethnicity, and sexual orientation, gender and gender expression, age, and marital status have been found to negatively impact one's financing prospects.

Moreover, race and ethnicity aren’t the only factors that appear to impact one’s likelihood of acquiring financing or acquiring financing at the best rate. In New York City and nationwide, LGBTQ+ neighborhoods are home to some of the most expensive urban real estate (e.g., in New York City, the West Village, Chelsea, and Park Slope all reflect this trend). Still, the LGBTQ+ community has also historically faced discrimination from lenders. One 2019 study found that same-sex applicants were 73.12% more likely to be denied financing than their different-sex counterparts and are generally charged 0.2% higher fees and interest rates. Even more surprising, the study found that different-sex borrowers seeking financing for properties in LGBTQ+ neighborhoods also appeared to be negatively impacted.

In addition to financing discrimination stemming from race, ethnicity, and sexual orientation, gender and gender expression, age, and marital status have been found to negatively impact one's financing prospects.

What to do if you face financing discrimination

As per Federal Trade Commission guidelines, if a creditor denies your mortgage application, they must:- Explain why you were denied (n.b., you may have to ask in writing for specific reasons, but if you ask within 60 days of a rejection, the creditor must offer an explanation)

- Offer you the name and address of the agency to which you can report your concerns

Notably, the FTC also offers additional advice on how to respond to financing discrimination, encouraging anyone who believes they have been discriminated against while applying for a mortgage to pursue one or more of the following courses of action:

- File an Equal Credit Opportunity Act (ECOA) violation complaint with the Consumer Financial Protection Bureau

- File an FHA violation complaint on the U.S. Department of Housing and Urban Development’s (HUD) website or call 1-800-669-9777 or 1-800-877-8339 (TTY) to speak to a specialist

- Report your concerns to the lender, who may reconsider the loan application

- If they don't reconsider and you feel that you have a strong case, sue the creditor.

Buyer Discrimination

Types of buyer discrimination

In addition to the discrimination buyers sometimes face when seeking approval from coop and condo boards, there are a host of other points in the buying process when race, ethnicity, sexual orientation, gender expression, gender marital status, age, ability, and religion create barriers to buying. Among other challenges, buyers may experience discrimination as they attempt to find an agent to represent them, gain access to listings in specific neighborhoods or price points, or when putting in offers.Since proving discrimination at any of these stages is difficult, buyers need to understand what constitutes discrimination and which laws protect their rights, including the following federal laws:

- The Civil Rights Act of 1866 prohibits all racial discrimination in the sale and rental of property

- The Fair Housing Act makes it illegal to discriminate in the sale, lease, or rental of housing based on race, color, religion, sex, ability, familial status, or national origin

- Title III of the Americans with Disabilities Act prohibits discrimination against persons with disabilities in places of "public accommodations and commercial facilities"

Additionally, New York State residents are protected by even more comprehensive legislation, which includes robust legislation protecting people based on gender identity or expression.

What to do if you face buyer discrimination

Depending on the type of discrimination and why it occurred, there are many potential ways to report and challenge discrimination experienced while buying a home.- File a complaint with the New York State Division of Human Rights (DHR) using their complaint form or by reaching out to the Fair Housing hotline at (844)-862-8703

- If you suspect you've experienced discrimination from a licensed real estate professional, the National Association of Realtors further advises that you contact your local Boards of REALTORS® or file a complaint at your nearest Housing and Urban Development (HUD) offices on HUD’s online site

- In New York State, you can also file a complaint against a licensed agent or broker through New York State’s Division of Licensing Services

Seller Discrimination

Types of seller discrimination

While most discrimination takes place on the lending and buying side of the process, sellers also face bias. The most common form of seller discrimination takes place during the appraisal process. A 2020 report in The New York Times found that for some Black homeowners, appraisals jumped as much as 40 percent when they removed any sign of their racial background from their homes during the appraisal process. Some Black homeowners even go one step further, asking white friends to stand in for them during the appraisal.Notably, as reported in a 2022 follow-up investigation on appraisal discrimination, the subjectivity of appraisers isn't the only factor that seems to end up undervaluing Black-owned properties. In some cases, Black-owned properties have ended up being undervalued by being falsely compared to properties with which they share little or nothing in common (e.g., a newly renovated home might be compared to one in distressed condition or to a home in a different neighborhood known to have lower property values).

What to do if you face appraisal discrimination

If you experience appraisal discrimination, there are two primary ways to respond:- File a complaint with the Housing and Urban Development Department (HUD); to get started, visit the Interagency Taskforce on Property Appraisal and Evaluation Equity site

- Take legal action against the appraiser or appraisal company

To learn more about financing, buyer, and seller discrimination and how to challenge it as a consumer or agent, visit the National Association of Realtors Fair Housing Compiled Resources site.

Select price-reduced listings with upcoming open houses

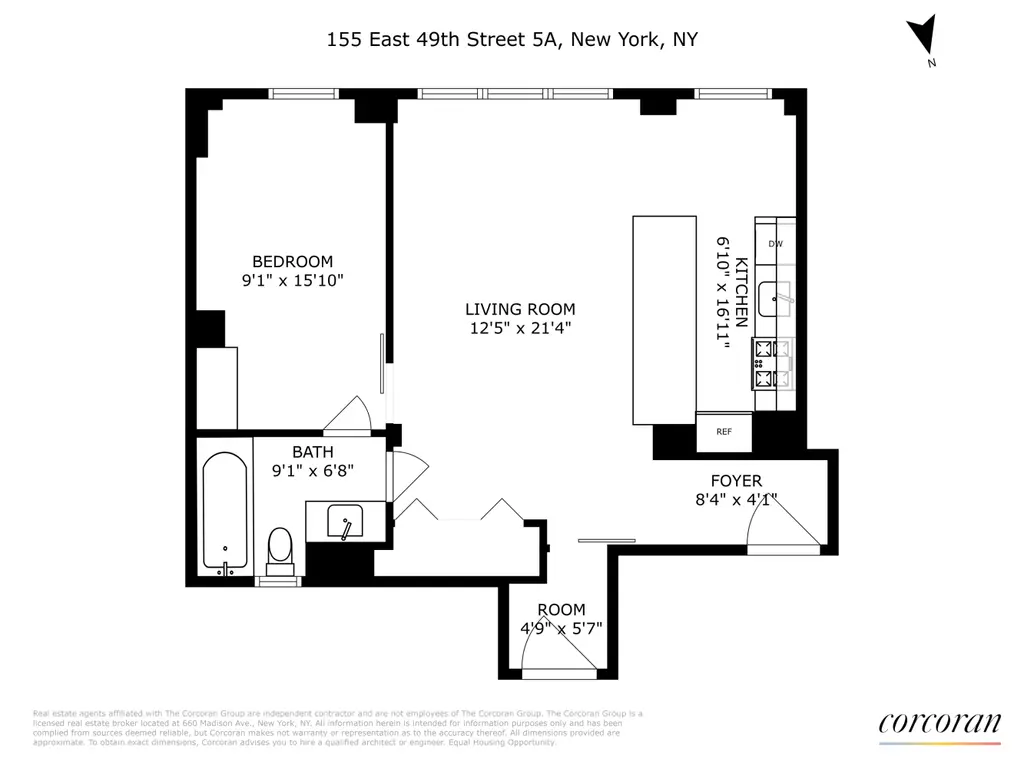

155 East 49th Street, #5A

$500,000 (-4.8%)

Midtown East | Cooperative | 1 Bedroom, 1 Bath

Open House: Sunday July 20, 2025

155 East 49th Street, #5A (Corcoran Group)

Would you like to tour any of these properties?

Just complete the info below.

Or call us at (212) 755-5544

The Cherokee, #6O

$523,000 (-2.2%)

Lenox Hill | Cooperative | 1 Bedroom, 1 Bath

Open House: Sunday July 20, 2025

The Cherokee, #6O (Compass)

261 West 22nd Street, #4

$599,000 (-7.7%)

Chelsea | Cooperative | 1 Bedroom, 1 Bath

Open House: Sunday July 20, 2025

261 West 22nd Street, #4 (Compass)

185 Prospect Park Southwest, #609

$629,000 (-7.4%)

Windsor Terrace | Cooperative | 1 Bedroom, 1 Bath

Open House: Sunday July 20, 2025

185 Prospect Park Southwest, #609 (Compass)

The Sutton East, #5C

$650,000 (-7%)

Midtown East | Cooperative | 2 Bedrooms, 1 Bath

Open House: Sunday July 20, 2025

The Sutton East, #5C (Compass)

The Platinum, #401

$750,000 (-18.9%)

Midtown West | Condominium | 1 Bedroom, 1 Bath | 837 ft2

Open House: Sunday July 20, 2025

The Platinum, #401 (Blu Realty Group)

Northern Lights Condominium, #1J

$750,000 (-3.2%)

Flushing | Condominium | 2 Bedrooms, 2 Baths | 1,143 ft2

Open House: Sunday July 20, 2025

Northern Lights Condominium, #1J (Corcoran Group)

Murray Hill Terrace, #15D

$875,000 (-10.3%)

Murray Hill | Condominium | 1 Bedroom, 1 Bath | 900 ft2

Open House: Sunday July 20, 2025

Murray Hill Terrace, #15D (Living New York)

Turtle Bay Towers, #19M

$999,000 (-8.8%)

Turtle Bay/United Nations | Condop | 2 Bedrooms, 1 Bath

Open House: Sunday July 20, 2025

Turtle Bay Towers, #19M (Sothebys International Realty)

The Bancroft, #17B

$1,100,000 (-15.1%)

Central Park West | Cooperative | 1 Bedroom, 1 Bath

Open House: Sunday July 20, 2025

The Bancroft, #17B (Corcoran Group)

Claremont Hall, #10D

$1,125,000 (-10%)

Morningside Heights | Condominium | 1 Bedroom, 1 Bath | 706 ft2

Open House: Sunday July 20, 2025

Claremont Hall, #10D (Compass)

The Horizon, #31D

$1,299,000 (-5.2%)

Murray Hill | Condominium | 1 Bedroom, 2 Baths | 902 ft2

Open House: Saturday July 19, 2025

The Horizon, #31D (Douglas Elliman Real Estate)

Factory Lofts, #4D

$1,399,000 (-3.5%)

Williamsburg | Condominium | 2 Bedrooms, 2 Baths | 940 ft2

Open House: Sunday July 20, 2025

Factory Lofts, #4D (Compass)

2 Beekman Place, #5AG

$1,500,000 (-6.3%)

Beekman/Sutton Place | Cooperative | 3 Bedrooms, 2 Baths | 1,750 ft2

Open House: Sunday July 20, 2025

2 Beekman Place, #5AG (Brown Harris Stevens Residential Sales LLC)

115 East 61st Street, #PH

$1,500,000 (-24.1%)

Lenox Hill | Cooperative | 1 Bedroom, 1 Bath

Open House: Sunday July 20, 2025

115 East 61st Street, #PH (Coldwell Banker Warburg)

Morningside Park, #3

$1,675,000 (-6.7%)

Harlem | Condominium | 3 Bedrooms, 2 Baths | 1,590 ft2

Open House: Sunday July 20, 2025

Morningside Park, #3 (Brown Harris Stevens Residential Sales LLC)

65 Central Park West, #11D

$3,625,000 (-8.2%)

Central Park West | Cooperative | 2 Bedrooms, 2.5 Baths

Open House: Monday July 21, 2025

65 Central Park West, #11D (Corcoran Group)

One Central Park, #56F

$3,775,000 (-1.9%)

Central Park West | Condominium | 2 Bedrooms, 2 Baths | 1,283 ft2

Contact CityRealty to schedule a tour

One Central Park, #56F (Corcoran Group)

Fifteen Hudson Yards, #34A

$4,100,000 (-3.5%)

Midtown West | Condominium | 2 Bedrooms, 2.5 Baths | 1,778 ft2

Open House: Sunday July 20, 2025

Fifteen Hudson Yards, #34A (Corcoran Group)

412 Classon Avenue, #TH

$4,199,000 (-6.7%)

Clinton Hill | Townhouse | 6+ Bedrooms, 3.5 Baths | 3,000 ft2

Open House: Sunday July 20, 2025

412 Classon Avenue, # (Compass)

One High Line, #EAST15E

$4,650,000 (-6.1%)

Chelsea | Condominium | 2 Bedrooms, 2.5 Baths | 1,512 ft2

Open House: Sunday July 20, 2025

One High Line, #EAST15E (Douglas Elliman Real Estate)

350 West 71st Street, #PHA

$4,995,000 (-16.1%)

Riverside Dr./West End Ave. | Condominium | 3 Bedrooms, 3.5 Baths | 2,553 ft2

Open House: Tuesday July 22, 2025

350 West 71st Street, #PHA (R New York)

111 Murray Street, #44W

$7,250,000 (-8.8%)

Tribeca | Condominium | 3 Bedrooms, 3.5 Baths | 2,290 ft2

Open House: Sunday July 20, 2025

111 Murray Street, #44W (Compass)

Would you like to tour any of these properties?

Just complete the info below.

Or call us at (212) 755-5544

Would you like to tour any of these properties?

Contributing Writer

Cait Etherington

Cait Etherington has over twenty years of experience working as a journalist and communications consultant. Her articles and reviews have been published in newspapers and magazines across the United States and internationally. An experienced financial writer, Cait is committed to exposing the human side of stories about contemporary business, banking and workplace relations. She also enjoys writing about trends, lifestyles and real estate in New York City where she lives with her family in a cozy apartment on the twentieth floor of a Manhattan high rise.

6sqft delivers the latest on real estate, architecture, and design, straight from New York City.

6sqft delivers the latest on real estate, architecture, and design, straight from New York City.