Although it may be easy to brush aside campaign promises as hollow words to just get elected, a study by Institute for Policy Research at Northwestern University reviewed 18 quantitative studies and found that on average, political parties keep about 67% of their campaign promises. With that in mind, if elected, what would a Zohran Mamdani victory mean for New York City’s condo market? His campaign promises present a study in contrasts: potent upside for sales demand if quality-of-life improvements hit home but real risks if luxury-owner taxes or regulatory burdens take center stage.

The Upside: Demand anchored by livability

Mamdani’s platform emphasizes affordability and public-realm enhancements, both of which could buoy condo sales in the city. He has pledged to freeze rent for rent-stabilized units, build 200,000 units of affordable housing, and make city buses fare-free, among other quality-of-life initiatives.

The New York Times reported that the rent freeze would enormously benefit the two million people who live in rent-stabilized apartments in New York City. But what about the three million renters who rent at market rate? “For them, Mr. Mamdani’s rent freeze would, at best, have no broad effect. And some housing experts say that holding rents on stabilized units steady could drive market-rate rents up. Freezing stabilized rents would likely encourage their tenants to stay put longer, these experts say, leaving the rest of the rental market to absorb the huge demand to live in New York City.”

But in terms of sales, Mamdani’s promises present opportunities:

- Improved transit service and amenity access raise the appeal of well-located condos, especially those near major nodes or strong neighborhoods.

- A healthy rental market (via affordable housing) would help retain the workforce that supports urban vibrancy and, indirectly, the attractiveness of residential real estate.

- If the city successfully projects a “livable, high-quality” image, buyers from outside the region, who often drive luxury condo demand, may be lured in.

- Mamdani supported the pro-housing referendum, signaling a genuine commitment to expanding housing supply. Some of the expedited projects will likely include condos, a crucial boost given the limited pipeline in Lower Manhattan and the Upper West Side. Allowing more development could help moderate condo prices and prevent the market from becoming accessible only to the ultra-wealthy, as seen in Greenwich Village and the West Village.

In this scenario, the condo market’s mid-to-upper segment could benefit. For an investor or owner seeking long-term value (rather than short-term flip), emphasis on craftsmanship, location, and access may pay off.

The Risk: Tax & Regulatory Headwinds

However, Mamdani’s ambitions for major tax shifts raise red flags for the top end of the condo market. He supports increasing corporate taxes and raising taxes on the wealthiest city residents to fund his agenda. He proposes shifting more of the property-tax burden onto “more expensive homes in richer and whiter neighborhoods.”

Mamdani’s plan would raise New York City’s income tax by two percentage points for earners making over $1 million a year, which is roughly 1% of taxpayers. The increase amounts to a 52% proportional hike, pushing the combined city and state top rate to 16.8%, the highest in the nation by 3.5 points.

He also proposes higher corporate taxes affecting about 1,000 of the city’s 250,000 businesses. Together, the measures are projected to generate roughly $9 billion annually, an 11% boost in overall tax revenue.

While he has not explicitly detailed a pied-à-terre tax or expanded mansion tax in all of his public documents, the tax-hike orientation signals that luxury owners could face increased costs of ownership or ownership risk. Business leaders have expressed concern that sharp tax increases could encourage relocation of high-income individuals or companies, reducing the pool of affluent buyers.

In essence, if the policies tilt toward “tax the luxury segment,” the condo sales market (especially at the ultra-high end) may see slowed demand, longer holding periods, pricing pressure. The city and state likely know better than to jeopardize New York’s real estate “golden goose.” High earners, both full- and part-time residents, contribute a large share of tax revenue.

According to the Citizens Budget Commission, New York’s share of U.S. millionaires fell from 12.7% in 2010 to 8.7% in 2022, costing the state and city an estimated $10.7 billion and $2.5 billion, respectively, in annual income tax revenue. The Empire Center notes that the top 1% of city filers already pay about 40% of city income taxes, potentially rising to over 60% under Mamdani’s plan. Even a small outflow of these taxpayers could erase any projected revenue gains, weakening both the tax base and the high-end real estate market that sustains it.

New York City’s economy remains solid but increasingly fragile, heavily reliant on two sectors often targeted by progressive lawmakers: commercial real estate and Wall Street. According to the Real Estate Board of New York, real estate-related taxes reached a record $37 billion in 2024, accounting for nearly half of all city tax revenue. Commercial properties alone generate about 82% of that total, underscoring how deeply the city’s fiscal health is tied to office towers, retail space, and multifamily buildings. Meanwhile, the financial industry continues to deliver an outsized share of income and business taxes, buoyed by strong profits and bonuses that ripple through the broader economy.

Yet the city’s job market shows signs of strain. The New York City Comptroller’s October report noted that private-sector employment gains have slowed, adding just a few thousand jobs in recent months, most in health and social services. Finance and professional services employment has been flat, and the city’s unemployment rate remains around 4.7%. The mixed data point to an economy that is stable but vulnerable, supported by a narrow base of high-value industries and taxpayers.

If either commercial real estate or Wall Street falters, the city could feel the effects quickly. The tax base depends disproportionately on a small group of firms, properties, and high-income earners whose spending and investment sustain everything from schools to transit. Policymakers pushing for higher taxes on the wealthy or tougher regulations on the financial sector may find that New York’s economic resilience (and the revenues that fund its ambitions) rest on shakier ground than it appears.

What It Means for the Market: A Two-Scenario View

Scenario A: Livability Boost Prevails

If Mamdani’s team succeeds in enhancing transit, expanding affordable housing, and improving public infrastructure without major friction from business or real-estate interests, then:

- Condos near transit and amenity hubs should hold value or even appreciate.

- Ownership costs remain predictable; tax/regulation stability supports buyer confidence.

- The high-end segment benefits from strong city branding, attracting buyers seeking lifestyle, not just property.

Scenario B: Tax/Regulation Overhang Presses Down

If luxury tax measures (e.g., pied-à-terre or mansion-style levies) and regulatory burdens dominate, then:

- Ultra-luxury condo sales may slow, speculative purchases may recede.

- Developers may hesitate to launch new high-end projects, which could eventually constrain supply but also reduce momentum.

- Ownership costs may rise (taxes, association fees, regulatory compliance), shifting the “cost-of-ownership” calculus downward.

Mamdani’s win could provide a meaningful tailwind to the New York City condo market, provided the emphasis stays on improving urban livability (transit, housing supply, amenities) rather than levying heavy costs on the luxury segment. For buyers and investors with a long-term, quality-focused mindset, this could be a favorable moment as they remain cautious about the tax/regulatory horizon.

That being said, Brown Harris Stevens CEO Bess Freedman is skeptical of Mamdani's campaign promises. In July, she told Bloomberg, “I don’t think what he is saying he could do is even possible.”

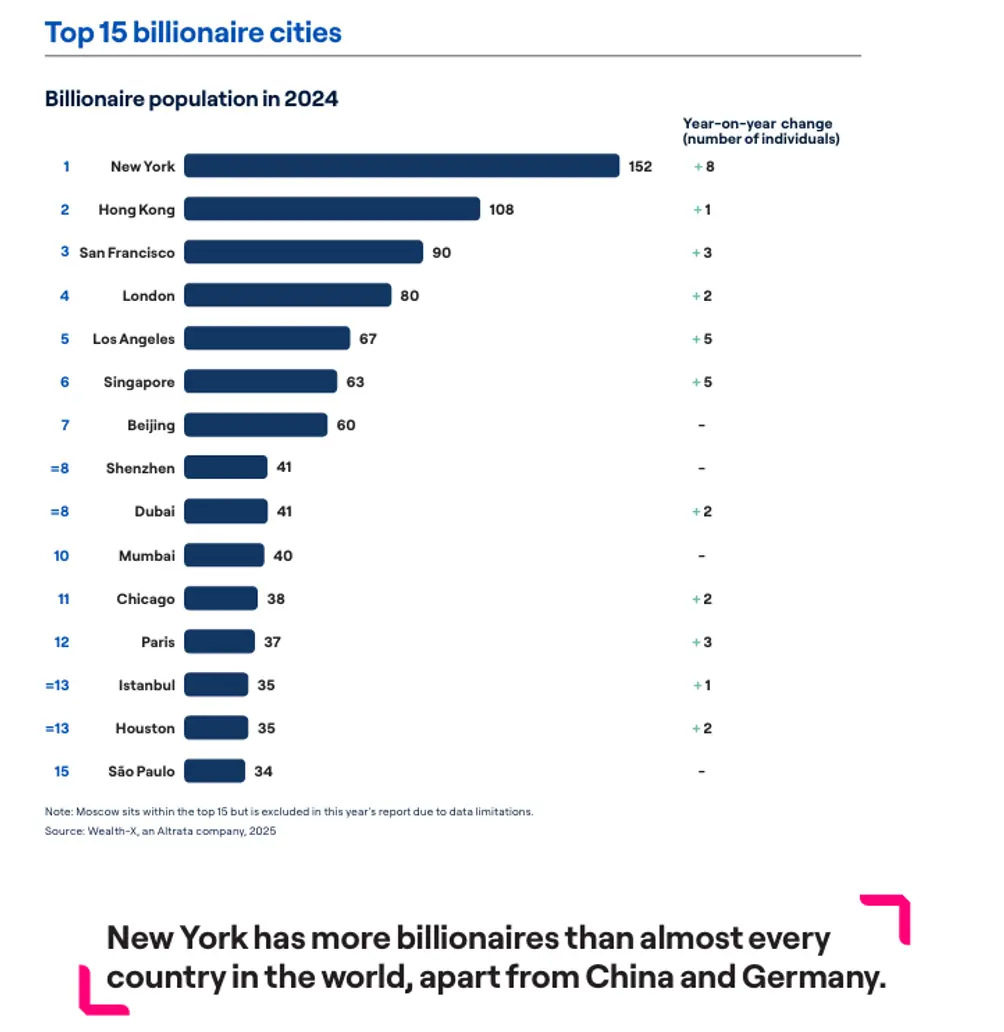

Even if Mamdani’s proposed tax hikes clear Albany, most wealthy residents and corporations are likely to stay. As former mayor Michael Bloomberg once put it, New York is a “luxury product for which many people are willing to pay a luxury price” for the access, culture, and opportunity the city offers. There is, after all, no true U.S. equivalent to New York’s global stature.

Altrata's Billionaire Census 2025 | https://info.altrata.com/l/311771/2025-10-28/27pynf/311771/1761661290vjghPDmV/Altrata_Billionaire_Census_2025.pdf

Altrata's Billionaire Census 2025 | https://info.altrata.com/l/311771/2025-10-28/27pynf/311771/1761661290vjghPDmV/Altrata_Billionaire_Census_2025.pdf

Much also depends on what additional measures Mamdani pursues. His broader policy agenda remains short on detail and would require state approval. Meanwhile, the prospect of an antagonistic Trump administration, already signaling plans to withhold federal funding from New York if Mamdani is elected, could further complicate the city’s fiscal outlook, turning political posturing into real economic risk.

Contributing Writer

Michelle Sinclair Colman

Michelle writes children's books and also writes articles about architecture, design and real estate. Those two passions came together in Michelle's first children's book, "Urban Babies Wear Black." Michelle has a Master's degree in Sociology from the University of Minnesota and a Master's degree in the Cities Program from the London School of Economics.

6sqft delivers the latest on real estate, architecture, and design, straight from New York City.

6sqft delivers the latest on real estate, architecture, and design, straight from New York City.