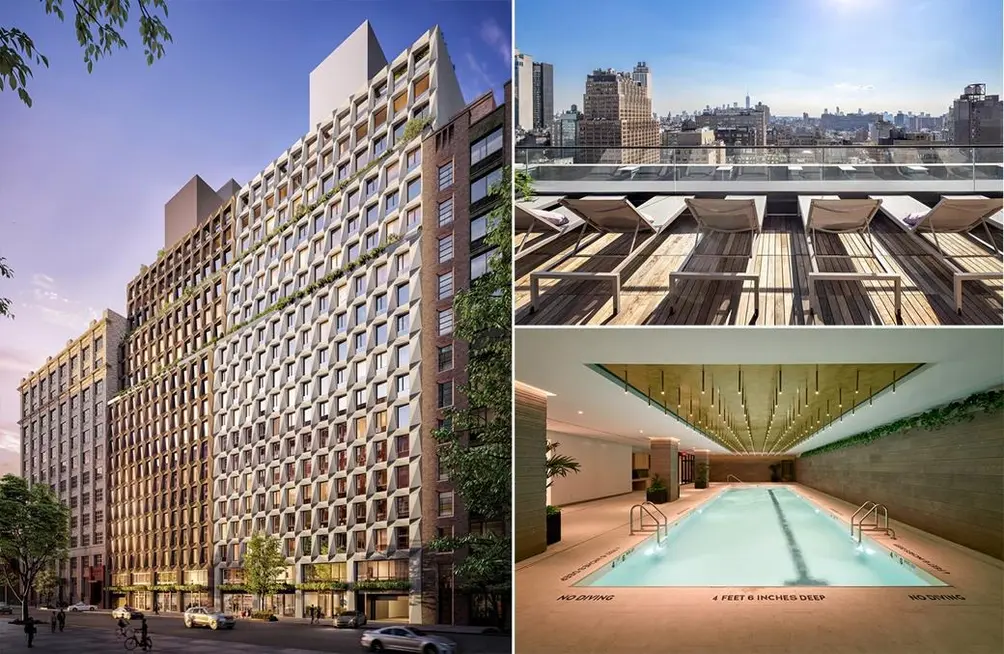

One United Nations Park

One United Nations Park

Saving up for a New York City apartment is a lofty goal, but the down payment is just the beginning. Even if a person is lucky enough to buy their new condo outright and avoid some surprise charges, they must still pay common charges and real estate taxes, the combined total of which can rival some mortgage payments, the entire time they're living in the apartment. This article takes a look at how the price of common charges is determined, what they cover, and how to avoid making excessively high monthly payments.

In this article:

What Common Charges Cover

In condos, tenants pay common charges, which cover many of these same things as maintenance fees in co-ops (e.g., maintenance of common areas such as the lobby and hallways, pest control, trash, and snow removal, etc.). But there is one notable difference: Common charges don’t cover property taxes. As a result, common charges are often lower than co-op maintenance fees.However, this doesn’t necessarily mean that one ends up paying lower fees in a condo. Once the taxes are taken into account, one’s combined taxes and common charges can be much higher than one’s co-op fees. Of course, it depends on the building and the building’s range of amenities — a boutique condominium in Brooklyn is likelier to have significantly lower common charges than an amenity-rich supertall.

How Common Charges Are Set

Common charges are set based on the size (and in some cases, also the location) of one’s unit. In essence, the condo unit’s “percentage of common interest” (a variable usually based solely on square footage) is multiplied by the cost of the included operating costs. Therefore, the bigger the unit, the higher the fees.Common charges are also subject to change over time. Higher fuel costs, major repairs to common areas in the building, and new services will all impact one’s fees. Like co-op boards, condo boards may also levy assessments to cover the cost of major projects, including façade repairs.

Negotiating Common Charges

If your common charges spike, there is not much you can do. In fact, even if you purchased in a new building and were led to believe the common charges would be considerably lower than they are, you may have little or no way to take action. What’s clear is that failure to pay your common charges is never a good idea. Condo boards are empowered to take legal action to ensure they can collect any common charges in arrears. Again, if a condo owner who believes their building’s common charges are too high, the best line of defense is to get involved in the building by running for the condo board.Finding Low Common Charges

While there is rarely much one can do to lower their common charges, condo owners have long had one recourse that co-ops don't: From time to time, tax abatements can help lower monthly fees. The most common abatement is the 421-a tax abatement. The program, which dates back to the early 1970s, was created as an incentive to motivate developers to use underused land. In return, developers were given tax cuts, which were, in turn, passed along to owners in the form of dramatically low costs.Most 421-a tax abatements lasted for ten years, but a 2006 initiative offered some developers a 20-year abatement if they also agreed to add affordable units to their development. For this reason, although the 421-a tax abatement program expired in June 2022, there are still a small handful of buildings in New York City where the abatements remain in effect into the 2030s.

Meanwhile, condo developers have cottoned on to the high costs of common charges and how this might be a deterrent for potential buyers. As such, some have sought to sweeten the deals by offering reduced common charges or a certain period of free common charges. As appealing as this may sound, it is important to note that it will not last forever, and the eventual common charges should be included in one's budget.

Common Charge Sponsor Incentives

100 Claremont Avenue

11 availabilities from $1.34M - $5.15M

2 years of sponsor-paid common charges

11 availabilities from $1.34M - $5.15M

2 years of sponsor-paid common charges

Claremont Hall, #24A (Corcoran Sunshine Marketing Group)

250 West 96th Street

17 availabilities from $1.85M - $9.5M

12 Months of Free Common Charges on Contracts Signed through 12/31/25

17 availabilities from $1.85M - $9.5M

12 Months of Free Common Charges on Contracts Signed through 12/31/25

96+Broadway (Compass)

96+Broadway (Compass)

96+Broadway, #19B (Compass)

100 East 53rd Street

9 availabilities from $1.72M - $29M

2 months of common charges paid by sponsor on contracts signed by 12/31/25

9 availabilities from $1.72M - $29M

2 months of common charges paid by sponsor on contracts signed by 12/31/25

Selene, #58A (Corcoran Sunshine Marketing Group)

547 West 47th Street

15 availabilities from $700K - $1.89M

10% deposit at contract signing

The West Residence Club, #1114

$1,888,000

Midtown West | Condominium | 2 Bedrooms, 2 Baths | 1,019 ft2

The West Residence Club, #1114 (Corcoran Sunshine Marketing Group)

350 West 44th Street

5 availabilities from $1.99M - $2.53M

3 years common charges and real estate tax credit on contracts signed by 11/27/25

LightSquare, #603 (Corcoran Group)

695 First Avenue

5 availabilities from $1.43M - $7M

Parking included with the purchase of a 4-bedroom

*Parking incentive is effective for signed contracts from October 15th through December 31st, 2025, and applies to standard SUV parking. The dollar amount will be applied as a credit at closing.

One United Nations Park, #PHD

$6,995,000 (-9.7%)

Murray Hill | Condominium | 4 Bedrooms, 4.5 Baths | 3,831 ft2

One United Nations Park, #PHD (Corcoran Sunshine Marketing Group)

Would you like to tour any of these properties?

Just complete the info below.

Or call us at (212) 755-5544

501 Third Avenue

9 availabilities from $1.03M - $2.83M

Two years of common charges and complimentary storage with purchase of one-bedroom

9 availabilities from $1.03M - $2.83M

Two years of common charges and complimentary storage with purchase of one-bedroom

Eastlight, #20A (CORE Group Marketing LLC)

215 West 28th Street

6 availabilities from $2.3M - $4.8M

2 years paid common charges for a limited time

6 availabilities from $2.3M - $4.8M

2 years paid common charges for a limited time

Maverick, #20B (Douglas Elliman Real Estate)

222 East Broadway

10 availabilities from $975K - $3.25M

Sponsor offering 5 years paid common charges for a limited time

10 availabilities from $975K - $3.25M

Sponsor offering 5 years paid common charges for a limited time

222 LES Tower + Lofts, #19A

$2,150,000

Lower East Side | Condominium | 2 Bedrooms, 2.5 Baths | 1,229 ft2

222 LES Tower + Lofts, #19A (Corcoran Sunshine Marketing Group)

19 availabilities from $910K - $9M

Sponsor paid transfer taxes and free common charges for 12 months

Sponsor paid transfer taxes and free common charges for 12 months

One Wall Street, #2308

$2,995,000

Financial District | Condominium | 3 Bedrooms, 2.5 Baths | 1,510 ft2

One Wall Street, #2308 (One Wall Street Sales LLC)

11 availabilities from $2.25M - $9.75M

6 months of common charges and 6 months of real estate taxes

6 months of common charges and 6 months of real estate taxes

77 Greenwich Street, #36C

$3,095,000

Financial District | Condominium | 3 Bedrooms, 3.5 Baths | 1,889 ft2

77 Greenwich Street, #36C (Reuveni LLC)

30-55 Vernon Boulevard

8 availabilities from $726K - $1.95M

Up to 3 years common charges paid by sponsor

8 availabilities from $726K - $1.95M

Up to 3 years common charges paid by sponsor

NuSun Vernon, #6P (GLOBAL REAL ESTATE VENTURES GROUP LLC)

22-58 46th Street

5 availabilities from $749K - $1.59M

Up to $40K back in closing costs + Parking incentives

5 availabilities from $749K - $1.59M

Up to $40K back in closing costs + Parking incentives

Fabric Astoria, #504 (MNS)

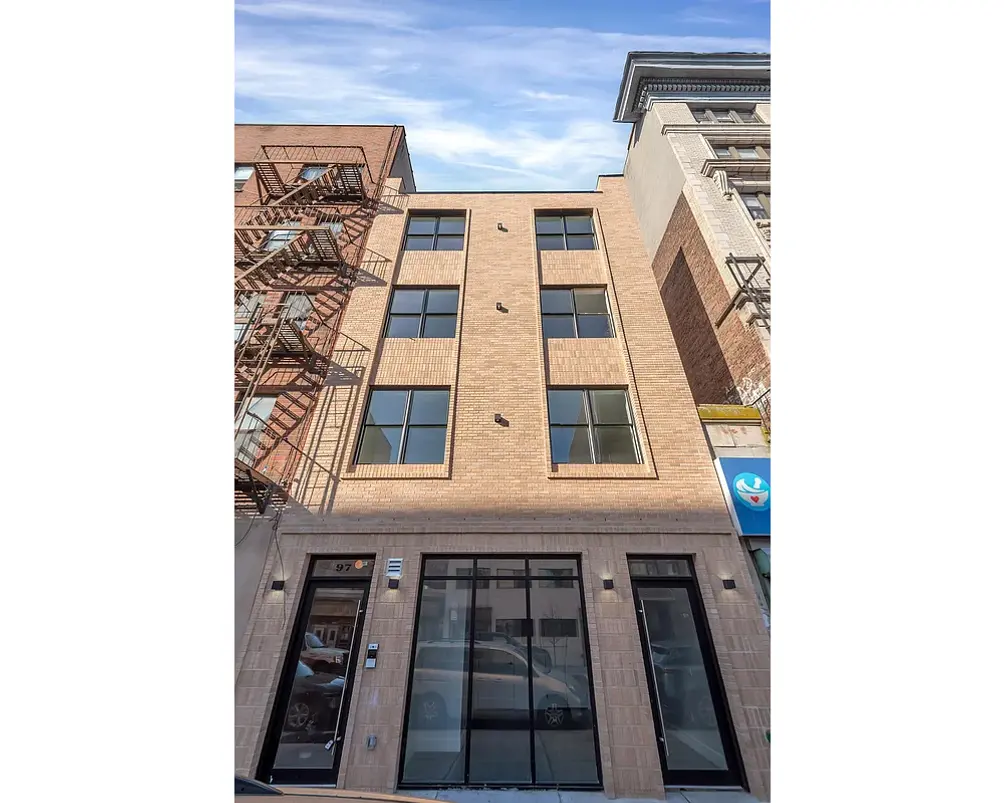

2 availabilities from $628K - $677K

One year of common charges paid by sponsor

One year of common charges paid by sponsor

97 Seigel Street (Compass)

97 Seigel Street (Compass)

97 Seigel Street, #3F (Compass)

428 East 9th Street

10 availabilities from $540K - $1.32M

Approved for first-time homebuyers' program with 5.5% fixed interest rate for 30 years

10 availabilities from $540K - $1.32M

Approved for first-time homebuyers' program with 5.5% fixed interest rate for 30 years

Kensington Manor, #611 (Corcoran Group)

Would you like to tour any of these properties?

Just complete the info below.

Or call us at (212) 755-5544

Would you like to tour any of these properties?

6sqft delivers the latest on real estate, architecture, and design, straight from New York City.

6sqft delivers the latest on real estate, architecture, and design, straight from New York City.