Monogram New York, 135 East 47th Street, #PHB | https://www.cityrealty.com/nyc/midtown-east/monogram-new-york-135-east-47th-street/68152/PHB/MVhpQbUjakeN

Monogram New York, 135 East 47th Street, #PHB | https://www.cityrealty.com/nyc/midtown-east/monogram-new-york-135-east-47th-street/68152/PHB/MVhpQbUjakeN

Beware if you need a mortgage. Underwriting is notoriously challenging. Since the pandemic, many lenders have raised their qualification requirements. This means that more than ever before, applicant’s finances, job security, and down payment funds will be under scrutiny. Here are a few things potential buyers can do to prepare to go under the underwriting microscope.

In this article:

Start Early

In the case of underwriting, the previous 60 days of your financial life will receive the most scrutiny, followed by the previous quarter. For this reason, if you’re thinking about applying for financing, be sure to start cleaning up your act sooner rather than later. Any suspicious deposits (e.g., a $5,000 gift from a relative overseas), unusual activity (e.g., a series of cash deposits or withdrawals over $2000), or overdrafts in the 60 days before applying for a mortgage will raise red flags that you don’t want going up.

Prepare to Get Prequalified, Preapproved, and Approved

As a rule, you should prequalify for a mortgage before even looking at properties. If you’re confident you can obtain a mortgage, you can technically skip this step, though it is not advised. Either way, prequalifying doesn’t mean you’ve been preapproved or approved.

Prequalification is simply a first step that confirms you are creditworthy. Prequalification also offers an estimate on how much financing your lender might provide.

The next and more important step is preapproval. During this step, you will complete a mortgage application, the lender verifies your information, and carries out an initial credit check. If everything checks out, you’ll receive a preapproval letter—an offer but not a final commitment to finance the purchase.

The final stage is approval or “clear to close.” Only when the lender issues a clear to close has the mortgage been approved and can the close proceed.

Understand that a Good Credit Score Is Just a Start

When it comes to credit ratings, start early. If you pay down all your debt, the impact will likely not become visible on your credit rating for 30 to 45 days. Also, a good credit rating may not be good enough in the current market. If possible, aim to bring your credit rating up well over 740 into the very good or excellent zone before approaching any lenders. But don’t stop there—even an excellent credit score may not be enough to get you through the underwriting process.

First, lenders don’t just look at one credit score but all three—Equifax, Experian, and TransUnion. Since these scores take different things into account, one score may be significantly higher or lower than another. In fact, you may find that your scores vary as much as 50 points. To prepare for underwriting, log into all three sites and check your scores.

Second, download your reports. Again, lenders aren’t just looking at your overall score, which is primarily based on the age of your accounts and history of paying bills on time. Lenders also look at other factors, including how many credit and retail cards are under your name, how often you open new accounts, and even how often you change addresses.

Finally, address any errors. If you have a lot of rotating debt, you’ll only be able to fix the problem by paying it off. If, however, your report says you failed to pay a ConEdison bill three years ago, which you did pay, you may be able to dispute this information and have it erased from your credit history. Disputing false information on a credit report isn’t easy, but in some cases, it is necessary and may make or break your ability to get through the underwriting process.

Get Ready to Explain Your Down Payment

Your down-payment or “earnest money” is the money you bring to the deal. In New York City, this is usually 20% or more. In rare cases, you may be able to put down just 10%, but this will generally limit your options for finding a mortgage, especially in the current lending market. However much you are putting down, be prepared to explain where and how you acquired the money in question.

If you’ve been diligently building up your savings for years, you’re in luck. Lenders prefer this approach. If your earnest money comes from a one-time payment (e.g., gifts, a signing bonus, or an advance on a book), you’ll have some explaining to do. If the money arrived recently (in the past quarter), expect additional scrutiny. Here, it is helpful to consider the following scenarios.

Scenario 1: You’re a writer, and you were just lucky enough to get a $70,000 advance on a novel from your publisher. The first half of this advance—$35,000—appeared in your account 30 days before applying for a mortgage. In this case, sourcing the deposit should be easy since you’ll simply need to provide evidence that this sudden windfall was a book advance from a publisher rather than a loan from a friend or relative or money you acquired doing something illegal.

Scenario 2: You recently got married, and you and your spouse received over $40,000 in gifts from generous friends and relatives. You’ve decided to use these gifts to top up a fund you had already started for your down payment. While most lenders are happy to overlook small deposits (e.g., a $50 check from your great aunt), larger gifts and certainly any gifts exceeding $2000 will need to be sourced. This will likely require getting a “gift letter” from everyone who helped you out. The letter must clearly state where the money came from, that it wasn’t a loan that you’ll need to pay back now or in the future. Some lenders may take sourcing a step further and even ask you to provide additional evidence (e.g., a copy of your relative’s bank statements to prove that their gift wasn’t coming from a borrowed source). This practice is invasive, and if a relative or friend doesn’t comply, it could complicate your underwriting process. For this reason, it is generally easier to wait a quarter or two before approaching lenders. After all, the longer the money is sitting in your personal account, the fewer questions asked.

Start Compiling Your 1040s, Paystubs, Bank Statements, and More

In addition to having a good to excellent credit score and a reasonable explanation for how you acquired your down payment, to get through the underwriting process, you’ll need to provide evidence that you have a steady source of income.

As a starting point, be prepared to provide 1040s for the past two years. Also, be prepared to provide W-2s for the past two years. In addition, you’ll likely be asked to provide two months of paystubs. If you’re applying with a spouse, they will also need to provide the lender with all these documents. If you have just started a new position, work on a contract basis, or don’t have a long employment history, you or your spouse may be asked for additional 1040s, W-2s, or paystubs.

Beyond providing evidence that you have money coming in, lenders will want to see how you’re handling this money. As a result, be prepared to provide checking account statements for the past two months and savings statements for the past quarter. Once again, limiting unusual activity during this timeframe is advised since anything that looks suspicious may raise a red flag and slow down your preapproval or final approval.

Beware If You’re a Freelancer or Contract Worker

Millions of Americans now derive all or some of their income from freelance or contract work. In the world of underwriting, however, freelance and contract work are still treated differently than other types of work, making the underwriting process especially challenging for anyone who relies entirely or partially on this type of income.

To prepare, anyone who is a freelancer or contract worker should be prepared to provide the following additional documents:

• Additional 1040s: As a freelancer or contract worker, be prepared to provide 1040s going back beyond the prerequisite two-year period.

• Profit-and-loss statement: You’ll also likely be asked for a profit-and-loss statement—a document, prepared by a chartered accountant, that clearly outlines your year-to-date net income.

• Additional evidence of active freelance or contract work: Lenders may also ask you to provide invoices (e.g., issued to clients) or other evidence (e.g., bank statements that show deposited checks from clients) to verify any claims made in your profit and loss statement.

In addition to having all the right documents on hand, there is one more consideration freelancers and contractors should consider—how to present their net versus gross income. Freelancers and other contract workers often write down their income by claiming as many expenses as possible. While it is generally advantageous to lower one’s tax liability, this can backfire when seeking financing for a home. After all, if you’ve been consistently writing down your income from $100,000 to $65,000, underwriters will evaluate your creditworthiness based on the lower amount. For this reason, if you’re thinking of applying for a mortgage, it may be advantageous to write off fewer business-related expenses in the two to three years prior to approaching a lender.

Brace Yourself for Delays and Additional Paperwork

Preapprovals last for 90 days. In the past, this timeframe was generally enough time to close a deal. Unfortunately, the pandemic has added considerable time to the underwriting process and made closing deals more time-consuming (e.g., since most closings no longer occur in person, sellers and buyers may need two to three days to sign all the required documents). Given these challenges, a growing number of deals are now stretching beyond 90 days. If this happens, you won’t be asked to restart the mortgage application process, but you will be asked to resubmit key documents. For example, if you submitted paystubs on February 1, but your deal hasn’t closed by May 2, you’ll likely need to ask to provide additional paystubs. The same rule applies to any other documents you submitted during the process, including bank statements and if you’re a freelancer, profit-and-loss statements. While resubmitting documents you’ve already submitted is frustrating, failure to comply may jeopardize your mortgage application.

Whatever happens during the underwriting process, being patient, organized, and compliant is always the best way to keep the process moving toward your goal—the purchase of your first home.

Select listings with open houses this weekend

Financial District / BPC

Hudson Tower, #8A

$899,000 (-5.4%)

Battery Park City | Condominium | 1 Bedroom, 1.5 Baths | 840 ft2

Open House: Sunday, February 15, 2026

Hudson Tower, #8A (Serhant)

272 Water Street, #5R/6R

$1,995,000 (-4.8%)

Financial District | Condominium | 1 Bedroom, 2 Baths | 1,519 ft2

Open House: Sunday, February 15, 2026

272 Water Street, #5R/6R (Christies International Real Estate Group LLC)

Downtown

633 East 11th Street, #12A

$525,000

East Village | Cooperative | 1 Bedroom, 1 Bath

Open House: Sunday, February 15, 2026

633 East 11th Street, #12A (Compass)

93 Worth Street, #405

$915,000 (-3.7%)

Tribeca | Condominium | Studio, 1 Bath | 485 ft2

Open House: Saturday, February 14, 2026

93 Worth Street, #405 (Compass)

Blue, #8B

$1,850,000

Lower East Side | Condominium | 2 Bedrooms, 2 Baths | 1,129 ft2

Open House: Sunday, February 15, 2026

Blue, #8B (Compass)

Would you like to tour any of these properties?

Just complete the info below.

Or call us at (212) 755-5544

Stewart House, #11L

$1,995,000

Greenwich Village | Cooperative | 2 Bedrooms, 2 Baths | 1,500 ft2

Open House: Sunday, February 15, 2026

Stewart House, #11L (Douglas Elliman Real Estate)

Gramercy Park Habitat, #2B

$2,699,000

Gramercy Park | Condominium | 3 Bedrooms, 2 Baths | 1,890 ft2

Open House: Sunday, February 15, 2026

Gramercy Park Habitat, #2B (Douglas Elliman Real Estate)

108 Leonard, #11E

$2,895,000 (-3.3%)

Tribeca | Condominium | 2 Bedrooms, 2.5 Baths | 1,308 ft2

Open House: Sunday, February 15, 2026

108 Leonard, #11E (Compass)

The Chelsea Quarter, #4B

$3,850,000

Chelsea | Condominium | 3 Bedrooms, 2.5 Baths | 2,140 ft2

Open House: Sunday, February 15, 2026

The Chelsea Quarter, #4B (Compass)

Midtown

Executive Plaza, #1918

$815,000

Midtown West | Condominium | 1 Bedroom, 1 Bath | 715 ft2

Open House: Sunday, February 15, 2026

Executive Plaza, #1918 (Corcoran Group)

Morgan Court, #7A

$1,195,000

Murray Hill | Condominium | 1 Bedroom, 1.5 Baths | 1,095 ft2

Open House: Sunday, February 15, 2026

Morgan Court, #7A (Brown Harris Stevens Residential Sales LLC)

The Charleston, #14J

$1,325,000

Murray Hill | Condominium | 1 Bedroom, 1 Bath | 870 ft2

Open House: Sunday, February 15, 2026

The Charleston, #14J (Compass)

The Orion, #20L

$1,435,000 (-4%)

Midtown West | Condominium | 2 Bedrooms, 2 Baths | 957 ft2

Open House: Sunday, February 15, 2026

The Orion, #20L (Compass)

The West Residence Club, #1114

$1,888,000

Midtown West | Condominium | 2 Bedrooms, 2 Baths | 1,019 ft2

Open House: Saturday and Sunday, February 14-15, 2026

The West Residence Club, #1114 (Corcoran Sunshine Marketing Group)

325 Fifth Avenue, #20C

$2,050,000 (-10.9%)

Murray Hill | Condominium | 2 Bedrooms, 2 Baths | 1,282 ft2

Open House: Sunday, February 15, 2026

325 Fifth Avenue, #20C (Douglas Elliman Real Estate)

Monogram New York, #PHB

$5,499,000

Midtown East | Condominium | 2 Bedrooms, 2 Baths | 1,674 ft2

Open House: Saturday, February 14, 2026

Monogram New York, #PHB (Douglas Elliman Real Estate)

Upper East Side

Belmont 79, #18E

$557,000

Lenox Hill | Cooperative | 1 Bedroom, 1 Bath

Open House: Sunday, February 15, 2026

Belmont 79, #18E (Corcoran Group)

410 East 73rd Street, #1A

$650,000 (-16.1%)

Lenox Hill | Cooperative | 1 Bedroom, 2 Baths | 938 ft2

Open House: Sunday, February 15, 2026

410 East 73rd Street, #1A (Corcoran Group)

175 East 74th Street, #15A

$1,299,000

Lenox Hill | Cooperative | 2 Bedrooms, 2 Baths | 1,200 ft2

Open House: Sunday, February 15, 2026

175 East 74th Street, #15A (Douglas Elliman Real Estate)

300 East 64th Street, #9A

$1,600,000

Lenox Hill | Condominium | 2 Bedrooms, 2 Baths | 1,044 ft2

Open House: Sunday, February 15, 2026

300 East 64th Street, #9A (Howard Hanna NYC)

311 East 83rd Street, #B

$1,870,000 (-3.9%)

Yorkville | Cooperative | 3 Bedrooms, 3.5 Baths | 1,824 ft2

Open House: Sunday, February 15, 2026

311 East 83rd Street, #B (Garg Real Estate)

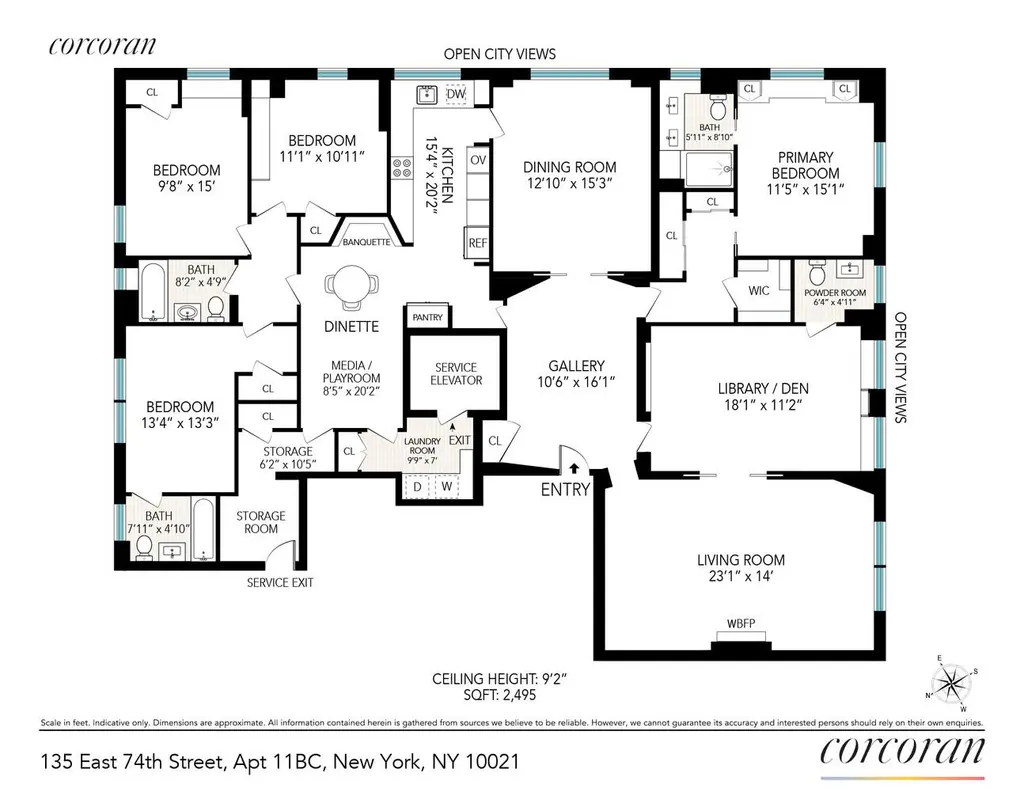

135 East 74th Street, #11BC

$3,500,000 (-4.1%)

Park/Fifth Ave. to 79th St. | Cooperative | 4 Bedrooms, 3.5 Baths | 2,495 ft2

Open House: Saturday, February 14, 2026

135 East 74th Street, #11BC (Corcoran Group)

The Promenade, #8CD

$3,600,000

Lenox Hill | Condominium | 4 Bedrooms, 4.5 Baths | 3,200 ft2

Open House: Sunday, February 15, 2026

The Promenade, #8CD (Compass)

420 East 75th Street, #4

$4,395,000

Lenox Hill | Condominium | 3 Bedrooms, 3.5 Baths | 2,350 ft2

Open House: Sunday, February 15, 2026

420 East 75th Street, #4 (Corcoran Group)

The Laurel, #27A

$4,500,000 (-6.3%)

Lenox Hill | Condominium | 3 Bedrooms, 3 Baths | 2,285 ft2

Open House: Saturday and Sunday, February 14-15, 2026

The Laurel, #27A (Corcoran Group)

Upper West Side

65 West 95th Street, #8C

$800,000 (-19.6%)

Central Park West | Cooperative | 2 Bedrooms, 1.5 Baths

Open House: Sunday, February 15, 2026

65 West 95th Street, #8C (Compass)

334 West 89th Street, #GARDEN

$1,495,000

Riverside Dr./West End Ave. | Condominium | 2 Bedrooms, 2 Baths | 936 ft2

Open House: Sunday, February 15, 2026

334 West 89th Street, #GARDEN (Douglas Elliman Real Estate)

The Ansonia, #1079

$2,450,000 (-7.5%)

Broadway Corridor | Condominium | 2 Bedrooms, 2 Baths | 1,338 ft2

Open House: Sunday, February 15, 2026

The Ansonia, #1079 (Corcoran Group)

Upper Manhattan

31 Nagle Avenue, #3H

$499,000

Washington Heights | Cooperative | 2 Bedrooms, 1 Bath | 875 ft2

Open House: Sunday, February 15, 2026

31 Nagle Avenue, #3H (New Heights Realty)

The Dovecote, #FL2

$1,175,000

Harlem | Condominium | 3 Bedrooms, 2 Baths | 1,402 ft2

Open House: Sunday, February 15, 2026

The Dovecote, #FL2 (Douglas Elliman Real Estate)

Brooklyn

The Elara, #2R

$1,350,000

Williamsburg | Condominium | 2 Bedrooms, 2 Baths | 879 ft2

Open House: Sunday, February 15, 2026

The Elara, #2R (Nest Seekers LLC)

521 Monroe Street, #TH

$2,825,000

Bedford-Stuyvesant | Townhouse | 6+ Bedrooms, 5.5 Baths | 3,931 ft2

Open House: Sunday, February 15, 2026

521 Monroe Street, # (Compass)

The Orson, #PH1

$3,150,000

Williamsburg | Condominium | 3 Bedrooms, 3 Baths | 1,580 ft2

Open House: Sunday, February 15, 2026

The Orson, #PH1 (Serhant)

Would you like to tour any of these properties?

Just complete the info below.

Or call us at (212) 755-5544

Would you like to tour any of these properties?

Contributing Writer

Cait Etherington

Cait Etherington has over twenty years of experience working as a journalist and communications consultant. Her articles and reviews have been published in newspapers and magazines across the United States and internationally. An experienced financial writer, Cait is committed to exposing the human side of stories about contemporary business, banking and workplace relations. She also enjoys writing about trends, lifestyles and real estate in New York City where she lives with her family in a cozy apartment on the twentieth floor of a Manhattan high rise.

6sqft delivers the latest on real estate, architecture, and design, straight from New York City.

6sqft delivers the latest on real estate, architecture, and design, straight from New York City.