(Bushwick Avenue Lofts, #5B - The Bracha Group) | https://www.cityrealty.com/nyc/bushwick/bushwick-avenue-lofts-1411-bushwick-avenue/90252/5B/IzAINueIrgV

(Bushwick Avenue Lofts, #5B - The Bracha Group) | https://www.cityrealty.com/nyc/bushwick/bushwick-avenue-lofts-1411-bushwick-avenue/90252/5B/IzAINueIrgV

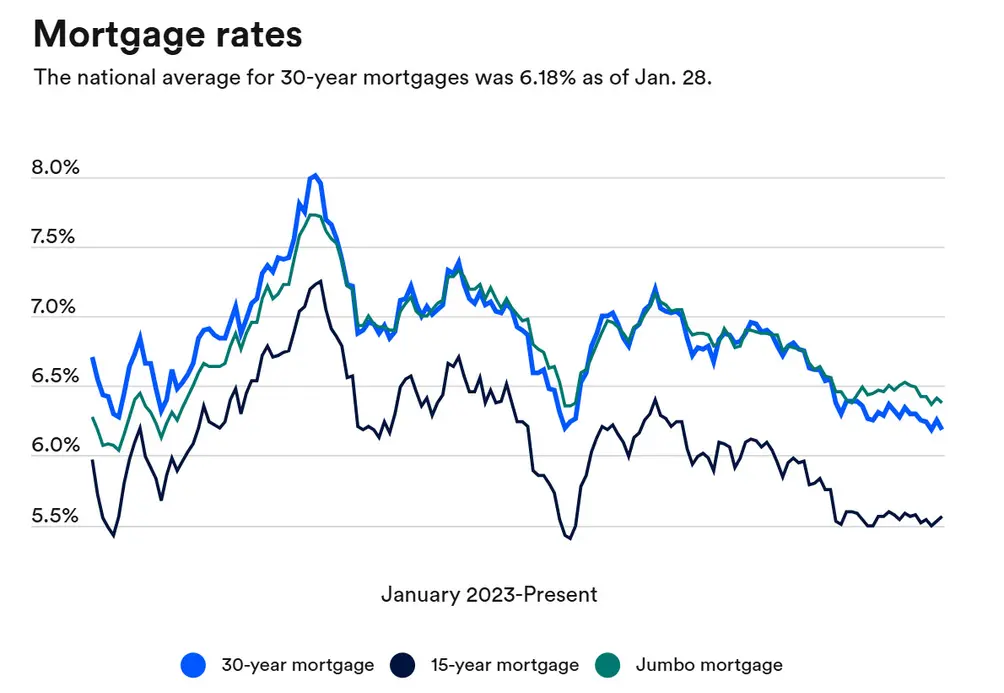

Nevertheless, U.S. consumers have been fretting about rising mortgage rates since early 2023. It has reportedly reached a point where many current homeowners have paused plans to move and many prospective buyers have opted to continue to rent. But are our current mortgage rates technically high, or just higher than the historically low rates consumers encountered during the pandemic?

In this article:

Mortgage rates, January 2023-present (Bankrate | https://www.bankrate.com/mortgages/analysis/mortgage-rates-january-28-2026/)

Mortgage rates, January 2023-present (Bankrate | https://www.bankrate.com/mortgages/analysis/mortgage-rates-january-28-2026/)

The average U.S. mortgage rate is higher than you think

Since the 1970s, mortgage rates in the United States have fluctuated widely. According to historical data from the Federal Reserve Bank of St. Louis, in the early 1980s, the average 30-year mortgage rate was double and, at one point, nearly triple the current mortgage rate. In October 1981, for example, the 30-year mortgage rate even edged above 18.5 percent. Although mortgage rates did decline after this peak, in the 1980s, they rarely dipped below 10 percent.

In the 1990s, mortgage rates started to decline, generally hovering between 7 and 9 percent. While this may have been a relief to homeowners who had grappled with the inflation-driven rates of the early 1980s, these slashed rates would pale in comparison to the rates we have grown accustomed to since 2000.

30-year fixed rate mortgage average chart (Federal Reserve Bank of St. Louis)

30-year fixed rate mortgage average chart (Federal Reserve Bank of St. Louis)

In the early 2000s, mortgage rates started to move below the 6 percent threshold, creating new expectations for borrowers. By the 2010s, rates plunged even further, dipping into the 3.3 percent range in late 2012. But all-time lows would not appear until the end of the first year of the pandemic. In January 2021, the 30-year mortgage rate plunged to 2.65 precent.

With mortgage rates ranging from well under 3 percent to over 18 percent, the historical average mortgage rate in the United States—based on data from 1971 to 2025—is several points higher than our current mortgage rate of roughly 7.7 percent.

Extreme conditions and outlier mortgage rates

While many would-be borrowers continue to sit on the sidelines of the housing market, hoping for mortgage rates to drop back down to the 3 percent range, it seems unlikely that mortgage rates will reach these historical lows again any time soon. On the flipside, it also seems unlikely they will ever spike back to 18 percent. This reflects the fact that these outlier percentages both appeared under exceptional conditions.

The extremely high mortgage rates homeowners faced in the early 1980s were linked to excessive inflation, largely a by-product of a sudden surge in oil prices in the late 1970s. At the time, the Federal Reserve decided to raise borrowing rates to manage inflation. While the intervention worked, eventually bringing inflation under control, it also had a negative impact on homeowners and prospective homeowners. Since the Federal Reserve’s set interest rate also influences mortgage rates, it left prospective U.S. homeowners with staggeringly high mortgage rates.

The extremely low mortgage rates homeowners encountered in late 2020 and into 2022 were also linked to exceptional conditions. In this case, the Federal Reserve lowered its interest rate to 0 percent to encourage borrowing and stimulate the economy during the COVID-19 pandemic shutdown. This translated into mortgage rates as low as 2.65 percent, leading millions of Americans to move, enter the housing market for the first time, and refinance existing mortgages.

Would you like to tour any of these properties?

Just complete the info below.

Or call us at (212) 755-5544

(Pexels - Photo by Mikhail Nilov) | https://www.pexels.com/photo/woman-in-polo-long-sleeves-computing-using-a-calculator-8297044/

(Pexels - Photo by Mikhail Nilov) | https://www.pexels.com/photo/woman-in-polo-long-sleeves-computing-using-a-calculator-8297044/

Resetting expectations

Barring the extreme conditions that have historically resulted in outlier mortgage rates, it seems likely that mortgage rates will remain close, though still under, the historical average (roughly 7 percent) moving forward. Given this, there are several reasons why 2026 could be a strategic year for consumers who have been holding back from moving or purchasing a first home to finally enter the market.

Current rates are still below historical average

Over the past five decades, mortgage rates have fluctuated widely, with the average 30-year mortgage rate hovering between 7 and 8 percent. Moving into 2026, average mortgage rates are about 6 percent, putting them slightly below the historic average.

Over the past five decades, mortgage rates have fluctuated widely, with the average 30-year mortgage rate hovering between 7 and 8 percent. Moving into 2026, average mortgage rates are about 6 percent, putting them slightly below the historic average.

Different mortgage products offer different rates

The lending market offers consumers many choices. As a result, while the 30-year mortgage rates may be roughly 6 percent, there are more competitive options available. Entering 2026, many U.S. lenders were offering 15-year mortgage rate in the low 5 percent range. Some lenders have also started to roll out special rates for return borrowers.

The lending market offers consumers many choices. As a result, while the 30-year mortgage rates may be roughly 6 percent, there are more competitive options available. Entering 2026, many U.S. lenders were offering 15-year mortgage rate in the low 5 percent range. Some lenders have also started to roll out special rates for return borrowers.

Affordability is about more than mortgage rates

Mortgage rates are just one factor that impacts housing affordability. For consumers who have been waiting for rates to drop for the past three years, it is worth noting that while they have been waiting, housing prices in most New York City neighborhood have continued to rise. If this trend continues, waiting for interest rates to drop may ultimately work against, not for, consumers looking to upgrade or purchase a first home.

Mortgage rates are just one factor that impacts housing affordability. For consumers who have been waiting for rates to drop for the past three years, it is worth noting that while they have been waiting, housing prices in most New York City neighborhood have continued to rise. If this trend continues, waiting for interest rates to drop may ultimately work against, not for, consumers looking to upgrade or purchase a first home.

The bottom line is that while mortgage rates may feel high compared to the extraordinary lows of the early 2020s, current rates are still average to below average. As we enter 2026, New York City homebuyers may want to reset their expectations about mortgage rates and focus on other reasons to enter the local market, including the established fact that buying real estate in New York City has virtually always proven to be a great long-term investment (see the regularly large percentage of Manhattan apartments that sell at a profit) that holds strong potential to build generational wealth, whether one originally buys during a period of historically low or average to high lending rates.

NYC listings with mortgage incentives

Bushwick Avenue Lofts, #3C (THE BRACHA GROUP)

Calvert House, #3D (Corcoran Group)

The Rennie, #614 (Brown Harris Stevens Residential Sales LLC)

The Bennett, #PH1 (Compass)

Calvert House, #4J

$1,215,000

Prospect Lefferts Gardens | Condominium | 2 Bedrooms, 2 Baths | 1,055 ft2

Calvert House, #4J (Corcoran Group)

Would you like to tour any of these properties?

Just complete the info below.

Or call us at (212) 755-5544

Would you like to tour any of these properties?

Contributing Writer

Cait Etherington

Cait Etherington has over twenty years of experience working as a journalist and communications consultant. Her articles and reviews have been published in newspapers and magazines across the United States and internationally. An experienced financial writer, Cait is committed to exposing the human side of stories about contemporary business, banking and workplace relations. She also enjoys writing about trends, lifestyles and real estate in New York City where she lives with her family in a cozy apartment on the twentieth floor of a Manhattan high rise.

6sqft delivers the latest on real estate, architecture, and design, straight from New York City.

6sqft delivers the latest on real estate, architecture, and design, straight from New York City.