Manhattan’s apartment market showed surprising strength this summer. In Q3 2025, more than 3,300 condo and co-op sales are projected to close, marking a 9 percent increase from last year and one of the highest totals of the past decade. Condo activity rose 10 percent year over year, while co-op sales climbed 9 percent.

Even with this solid pace, median prices have held relatively steady as unsold inventory, higher interest rates, and global uncertainty continue to influence the market. The median Manhattan apartment price (condos, condops, and co-ops) reached $1.2 million in the third quarter, up 2 percent from a year ago. The median condo price increased 2 percent to $1.68 million, while the median co-op price rose 4 percent to $875,000.

In this article:

Below, we look at the Manhattan neighborhoods where median sale prices declined. In most cases, the shift reflects the mix of properties sold rather than falling values. We also highlight one standout listing for each neighborhood under $1.2 million that appears to offer exceptional value.

Ten Manhattan neighborhoods with year-over-year declines in condo median sale price

#12. Roosevelt Island

#12. Roosevelt Island

Median Q3 2025 condo price: $875,000 (-1% Y-O-Y)

Number of Q3 2025 condo sales: 4 (-40% Y-O-Y)

Roosevelt Island

Roosevelt Island

With only three condo buildings on Roosevelt Island, just four sales were reported last quarter: three one-bedrooms and one two-bedroom. There were seven condo sales on the island in Q3 2024, including two three-bedroom units, which explains the slip in the median sale price.

Riverwalk Place, #4K

$799,000 (-9.2%)

Roosevelt Island | Condominium | 1 Bedroom, 1.5 Baths | 879 ft2

Riverwalk Place, #4K (Douglas Elliman Real Estate)

#11. Lower East Side

#11. Lower East Side

Median Q3 2025 condo price: $1,571,327 (-1%)

Number of Q3 2025 condo sales: 25 (-15%)

Lower East Side

Lower East Side

The median price paid for a condo on the Lower East Side was essentially unchanged year over year. Much of the neighborhood's condo sales come from one building, One Manhattan Square. As that massive 800-plus-unit development inches closer to sellout, there will naturally be a decline in sales activity until another large-scale project comes to market. No new development of this scale is planned for the LES, though smaller boutique properties may help meet ongoing demand.

55 Hester Street, #8C (City Sphere)

#10. Lincoln Center

#10. Lincoln Center

Median Q3 2025 condo price: $1,422,730 (-4%)

Number of Q3 2025 condo sales: 53 (-2%)

The refreshed condos at 155 West 68th Street have been the standout best-selling development in the Lincoln Square area over the past two years. Its approachable pricing and large number of units have made this prime neighborhood feel relatively attainable for condo buyers. The area has also seen little new supply, with massive developments such as Waterline Square and 200 Amsterdam nearly sold out of inventory, which has contributed to a drop in condo sales.

155W68, #324 (Brown Harris Stevens Development Marketing LLC)

#9. Midtown West

#9. Midtown West

Median Q3 2025 condo price: $1,390,000 (-6%)

Number of Q3 2025 condo sales: 150 (+28%)

Best known for its super-luxury towers of Hudson Yards and Billionaires’ Row, sales in those sky-high buildings (some now nearing a decade since launch) are taking a back seat to smaller boutique properties, especially in Hell’s Kitchen. Conversions like One11 Residences, which saw eleven sales last quarter, are also driving activity. The West Residence Club and the remaining price-reduced sponsor units at 15 and 35 Hudson Yards have further boosted the area’s sales momentum but have kept prices grounded.

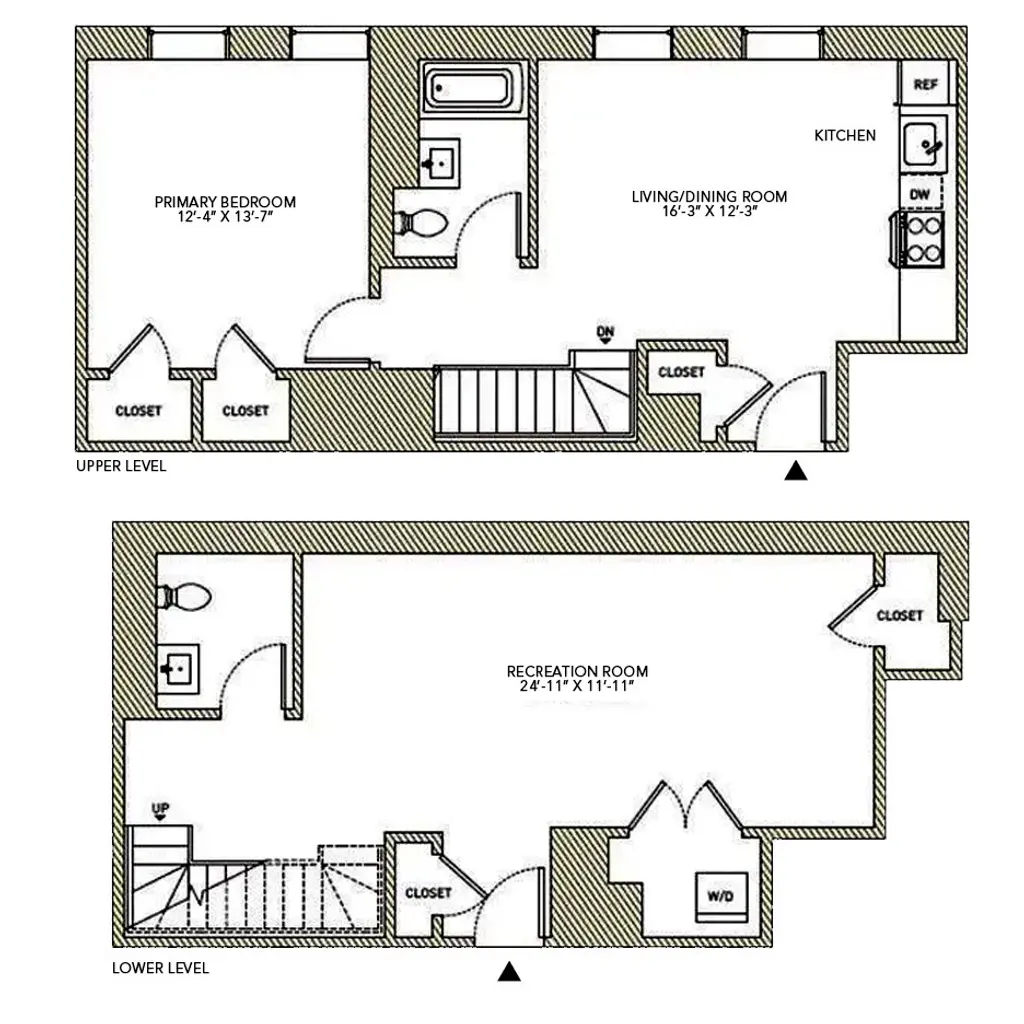

NINE52, #TH221 (Corcoran Group)

East Harlem

East Harlem

The East Harlem market has waned over the past decade, largely due to quality-of-life challenges. That said, its edge has helped it remain one of Manhattan’s few affordable enclaves for low- and middle-income New Yorkers. While a median apartment price of nearly $700K is far from cheap by national standards, it’s considered a bargain in New York City, especially with the neighborhood’s 15-minute commute to Midtown. The ongoing extension of the Second Avenue Subway promises to add new vibrancy and convenience to the eastern reaches of the area. Almost no new condo development is planned.

Magnolia Mansion Lofts, #2D (Compass)

Yorkville has seen a steady wave of new condo developments over the past decade, spurred by the opening of the Second Avenue Subway. Much of the new inventory has sold out, with little fresh supply since the completion of Beckford House & Tower, 200 East 83rd Street, and The Harper. Several new condo projects are in the works, however. Resale listings in these newer buildings remain scarce, while sales in the neighborhood’s large stock of condos from the 1980s through the 2000s have helped keep median prices steady.

The Salem House, #5A (Brown Harris Stevens Residential Sales LLC)

One United Nations Park has been the standout new development condo in the Murray Hill area in recent years. As that suave First Avenue tower is now essentially sold out, resale units have driven much of the neighborhood’s condo activity. Large buildings from the 1980s, such as The Corinthian, The Future, and Manhattan Place, have taken on a greater share of sales. Very few new condo developments are in the pipeline aside from Bruce Eichner’s planned 35th Street project and a few others in early stages along Madison and Third Avenues. Rather, the focus has been on converting several large, dated, and supposedly underperforming office buildings into rental apartments.

Murray Hill Terrace, #14C (Douglas Elliman Real Estate)

#5. Battery Park City

#5. Battery Park City

Median Q3 2025 condo price: $875,000 (-9%)

Number of Q3 2025 condo sales: 20 (-46%)

With the Battery Park City master plan now fully built out, no new ground-up condo developments are expected anytime soon. However, the rental-to-condo and condop conversion trend may likely continue. River & Warren has been the standout condo conversion of recent years, though limited inventory there has contributed to a drop in median prices. Many of Battery Park City’s older condos from the 1980s and 1990s now feel too dated to attract high-end buyers, keeping the area a haven for the upper-middle class. Fewer sales have also been recorded at Tribeca Green and Solaire, both rental-to-condops that once commanded premium prices.

Riverhouse - One Rockefeller Park, #3B

$1,199,000 (-4.1%)

Battery Park City | Condominium | 1 Bedroom, 1 Bath | 865 ft2

Riverhouse - One Rockefeller Park, #3B (Sothebys International Realty)

In Q3 2024, sponsor closings at The Cortland, One High Line, Flatiron House, and The Elisa sent the median condo price in Chelsea soaring. Much of that inventory has now sold, and resale units from the 2000s and 2010s have captured the market. Over the next year, more sales will come in for boutique developments such as Linea and 435 West 19th Street. Looking ahead, large new projects include Legion’s condo at 540 West 21st Street and Toll Brothers’ upcoming development near Tenth Avenue and 18th Street. As prices in Chelsea remain among the city’s highest, that may have fueled a storm of displacement and retail vacancies, leaving parts of the neighborhood unusually quiet despite its prime location.

420 West 23rd Street, #9B (Corcoran Group)

Harlem has endured one of the steepest downturns in Manhattan from the pandemic. As the neighborhood regains its footing and storefronts fill with new businesses, it now offers some of the best bargains for first-time buyers. The last sizable ground-up condo, 300 West 122nd Street, quickly sold out much of its sub-$1M inventory. Much of Harlem’s condo inventory consists of conversions such as the now-selling Smithsonian Place. These and other mid-size buildings from the Bloomberg era have maintained a steady flow of opportunities for buyers, while keeping prices approachable. Tonier condo developments along Central Park North are essentially sold out.

Ellington on the Park, #1201 (Wohlfarth & Associates Inc)

#2. Gramercy Park

#2. Gramercy Park

Median Q3 2025 condo price: $1,410,277 (-16%)

Number of Q3 2025 condo sales: 61 (-20%)

While it appears that Gramercy condo prices have fallen sharply, the shift is largely due to the wave of closings in Q3 2024 at two new developments: 200 East 20th Street and VU New York. The newly completed Hendrix House was the top seller last quarter, while sales continue to be driven by older properties such as Gramercy Mews, Gramercy Starck, Kips Bay Towers, and Coda.

The Sycamore, #14B (Compass)

#1. Riverside Dr./West End Ave.

#1. Riverside Dr./West End Ave.

Median Q3 2025 condo price: $1,500,000 (-32%)

Number of Q3 2025 condo sales: 96 (+51%)

As with Gramercy, the drastic change in the median condo price along Riverside Drive and West End Avenue is tied to a few new developments. Chief among them is 720 West End Avenue, which began closings earlier this year and saw 28 units close last quarter, mostly on lower floors at lower price points. This single building, in an area dominated by co-ops, makes it appear that activity is surging even as average prices trend lower.

Ten Manhattan neighborhoods with year-over-year declines in co-op median sale price

333 East 53rd Street, #2DE (Corcoran Group)

#9. Washington Heights

#9. Washington Heights

Median Q3 2025 co-op price: $516,750 (-2%)

Number of Q3 2025 co-op sales: 38 (-28%)

250 Cabrini Boulevard, #1H (Compass)

Lindley House, #14C (Brown Harris Stevens Residential Sales LLC)

253 West 16th Street, #5C (Compass)

#6. Lincoln Center

#6. Lincoln Center

Median Q3 2025 co-op price: $710,000 (-8%)

Number of Q3 2025 co-op sales: 55 (-28%)

Lincoln Towers, #14G (SHARP BROKERAGE LLC)

#5. Lower East Side

#5. Lower East Side

Median Q3 2025 co-op price: $700,000 (-15%)

Number of Q3 2025 co-op sales: 46 (+75%)

The Norfolk Arms, #6 (Sothebys International Realty)

The Osborne, #11DB (Compass)

#3. Hamilton Heights

#3. Hamilton Heights

Median Q3 2025 co-op price: $406,500 (-32%)

Number of Q3 2025 co-op sales: 4 (+323%)

345 West 145th Street, #11C2A (Compass)

Garden Court, #5K (Brown Harris Stevens Residential Sales LLC)

#1. Roosevelt Island

#1. Roosevelt Island

Median Q3 2025 co-op price: $565,000 (-53%)

Number of Q3 2025 co-op sales: 4 (-29%)

Westview, #LL34 (POWERED BY DMT LLC)

Would you like to tour any of these properties?

6sqft delivers the latest on real estate, architecture, and design, straight from New York City.

6sqft delivers the latest on real estate, architecture, and design, straight from New York City.