366 Bainbridge Street (Halstead Property)

366 Bainbridge Street (Halstead Property)

Friends went off the air in 2004, but one would never know it to look at statistics. Not only has it been one of the most popular shows on streaming services (first Netflix, now Max), but it shot to the top of streaming charts in the wake of sitcom star Matthew Perry’s death at the end of October 2023. The show about a group of male and female friends sharing New York City apartments, splitting the rent (even on the ludicrously low-priced apartments seen here), and embarking on adventures together has turned into a comfort watch for many and even inspired some to share an apartment with their real-life friends.

In this article:

The “roommate law” notwithstanding, it is fairly common practice for two or more friends to rent a New York apartment together. However, buying with friends is often approached with more trepidation than purchasing with a family member. And yet, with peer-to-peer funding showing no sign of slowing down, buying real estate with friends is not being completely ruled out. This article details when and how to do it, what to keep in mind, and listings where a real-life Friends reboot could possibly play out.

Turning to Friends for a Down Payment

If you want to establish a start-up, make a film, or engage in many other costly endeavors nowadays, you are just as likely to turn to your peers as you are to a bank. Although raising capital was once primarily carried out through formal lenders, it is now increasingly executed via peer-to-peer lending platforms. Whether one needs just a few thousand dollars or several million, the idea of turning to one’s peers for start-up funding has become the norm—especially for many Millennials—and the trend is increasingly impacting real estate deals too.

Compass agent Jake Velazquez has seen clients turning to friends for a range of reasons. “There’s a rising trend in the use of crowdfunding for real estate investments,” says Velazquez. “Groups of friends are also taking the same idea and pooling together their money and skills for investments. In some cases it works very well, since different people can take on different roles, and this can be more efficient.” Whether the deal involves a buyer turning to friends for help with a down payment or friends pooling resources to invest in a residential or commercial property, as peer-to-peer lending continues to move from a peripheral to a central funding strategy, it is also restructuring how buyers approach real estate investments. But is it wise to purchase with friends?

'Pre-nuptial Contracts' for Friend Co-owners

Most friends buying together don’t want to think about worst-case scenarios, but it is one of the most important things to consider when it comes to co-ownership. Indeed, like newlyweds who walk down the aisle with a pre-nuptial contract already inked, friends who buy together—even if they are driven by a desire for community rather than profit—are advised to prepare for the worst and hope for the best.

Compass agent Marina Schindler points out that while friends co-purchasing is on the rise today, there is a long history of friends buying properties together in New York City. “Many artist buildings in Soho and the East Village were purchased by friends, and these are now among some of the city’s most coveted spaces,” she points out. However, friends are coming together to buy apartments as well as buildings. Condos may be perceived as friendlier to this type of arrangement, but the consensus at Cooperator News is that a co-op board cannot discriminate against buyers based on marital status. Indeed, co-op attorney Andrew Freedland says, "This arrangement happened a lot before marriage equality, when gay couples wanted to purchase an apartment together. I don't see any reason two friends couldn't do it."

While Schindler is very optimistic about friends buying together and enjoys the community-building aspect of bringing friends together as owners, she notes that both of her current clients are working with attorneys to ensure their agreement is as tight as possible. “You really need to nail down all the possible worst-case scenarios,” she says, “What if the roof needs to be replaced? What if the basement floods? Who is responsible? The most important thing is having an internal agreement.” Freedland concurs, recommending a tenancy-in-common agreement outlining the distribution of tax benefits, inheritance rights, and what would happen to the apartment if one owner dies or wants to sell.

While Schindler is very optimistic about friends buying together and enjoys the community-building aspect of bringing friends together as owners, she notes that both of her current clients are working with attorneys to ensure their agreement is as tight as possible. “You really need to nail down all the possible worst-case scenarios,” she says, “What if the roof needs to be replaced? What if the basement floods? Who is responsible? The most important thing is having an internal agreement.” Freedland concurs, recommending a tenancy-in-common agreement outlining the distribution of tax benefits, inheritance rights, and what would happen to the apartment if one owner dies or wants to sell.

The New York Times recently ran a profile of three friends who purchased a multi-family Brooklyn townhouse where they would each have their own apartment, but would allow for communal living and group dinners. In doing so, they created an LLC with a 25-page operating agreement. This outlines three pools of money – one for a jointly held mortgage, one for repairs and improvements, and one for operations – and addresses how to manage disagreements and future developments (e.g., if someone gets married or wants to sell).

Buddying Up for a Vacation Home

While some friends team up to invest and others team up with the intention of purchasing a primary dwelling, for others, the goal is a shared second home. After all, even for some of the city’s more affluent buyers, a second house in the Hamptons may otherwise be out of reach.

Compass agent Cindy Scholz has worked with multiple sets of friends buying homes in the Hamptons and, by and large, she considers these co-purchasing arrangements to be a great option for people looking to buy a second home. “Co-purchasing is a great way to build equity while minimizing the upfront and ongoing costs of purchasing a home,” explains Scholz. But building equity is usually not the only or primary goal for these buyers: “My clients know the Hamptons is their destination of choice for the summer and are tired of someone else’s mortgage. Co-owning allows my clients to divide up the costs and responsibilities of a home while experiencing all the benefits. They are not overextended financially, allowing them to still take ski vacations and travel to other destinations in the off-season.”

Scholz also emphasizes that for many her clients, co-purchasing even represents a way to immediately increase their cash flow. “My clients often rent their homes for a portion of the summer and use the profits to take a trip elsewhere,” says Scholz, adding, “The Hamptons is prime for appreciation and ability to rent for ultra-prime prices. These conditions allow purchasers to choose between a long- and short-term hold—for co-purchasing, this flexibility is very appealing.”

“Keep things simple, be realistic, and don’t get discouraged. It’s easy for a group to persuade you to have unrealistic expectations—just stick to the numbers and make sure the team stays focused.”

To Buy with Friends or Not—That is the Question

While there are no guarantees, there are at least a few factors that appear to contribute to the success of friend co-investments. Scholz has observed that while the length of friendship prior to buying varies and doesn’t appear to be a major factor, her clients nearly always have “aligned interests, mutual friends and similar financials.” Velazquez has seen both good and bad deals among the friend groups with whom he has worked. His advice? “Keep things simple, be realistic, and don’t get discouraged. It’s easy for a group to persuade you to have unrealistic expectations—just stick to the numbers and make sure the team stays focused.” Schindler agrees that co-purchasing can be a great way to buy into the city’s real estate market but adds, “it is also crucial to have completely honest communication between both parties.”

Would you like to tour any of these properties?

Just complete the info below.

Or call us at (212) 755-5544

Two beds in Lower Manhattan waiting for you to create your own NYC sitcom

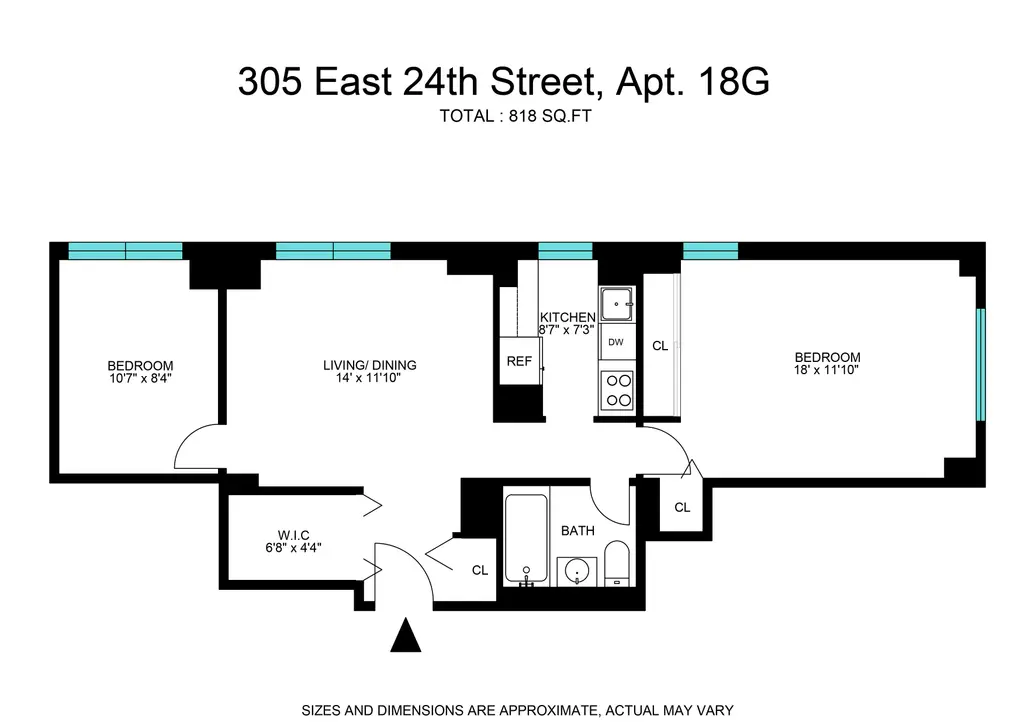

The New York Towers, #18G

$775,000 (-6.1%)

Gramercy Park | Cooperative | 2 Bedrooms, 1 Bath | 700 ft2

The New York Towers, #18G (Nardoni Realty Inc)

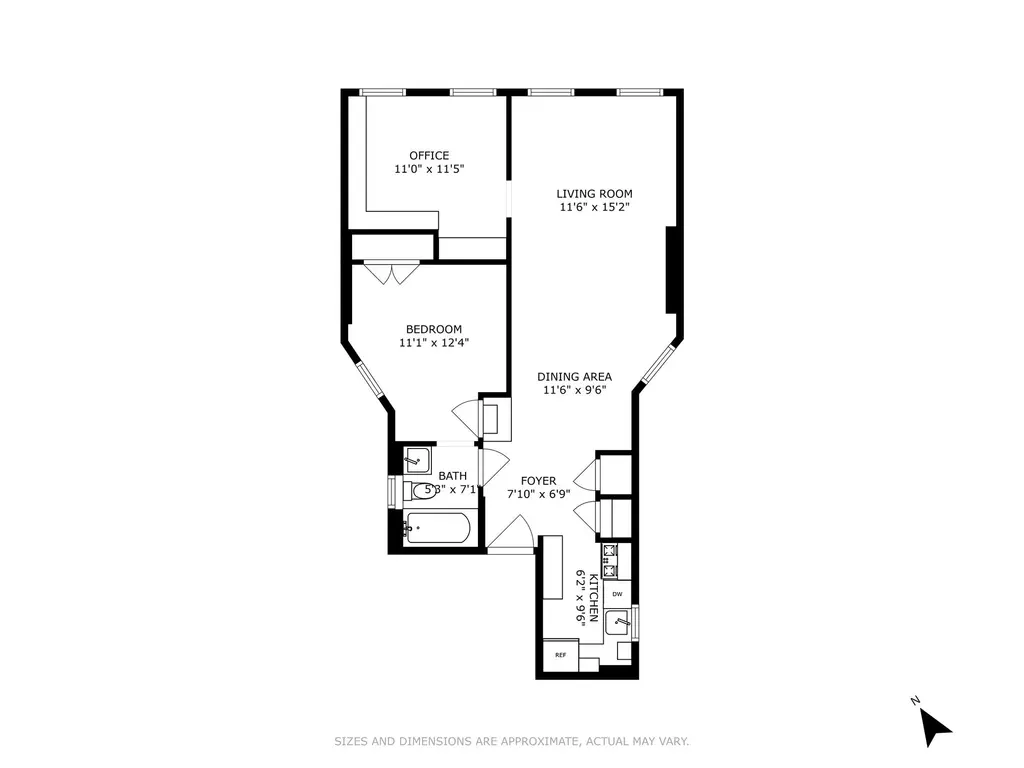

East River Coop, #H2001

$899,000 (-12.3%)

Lower East Side | Cooperative | 2 Bedrooms, 1 Bath | 1,100 ft2

East River Coop, #H2001 (Weichert Properties)

518 East 11th Street, #4A (Douglas Elliman Real Estate)

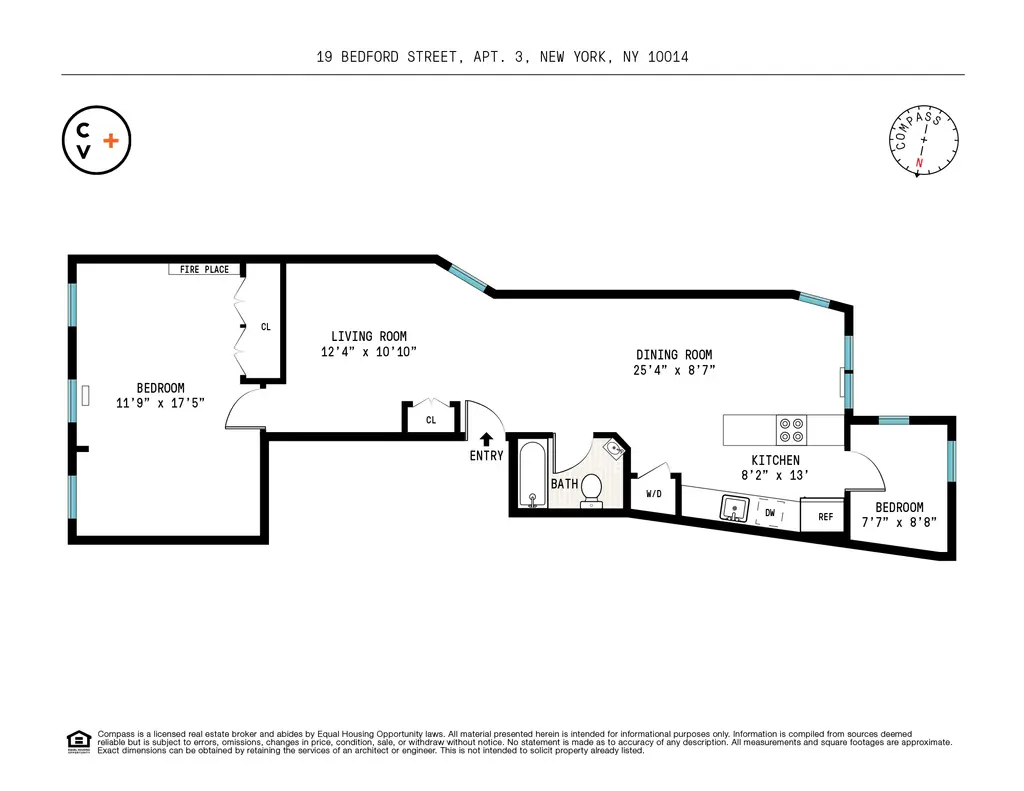

19 Bedford Street, #3F (Compass)

205 East 10th Street, #1B (Brown Harris Stevens Residential Sales LLC)

425 West 24th Street, #1E (Compass)

The Albert, #2A (Yoreevo LLC)

613 East 6th Street, #5A (Bond New York Properties LLC)

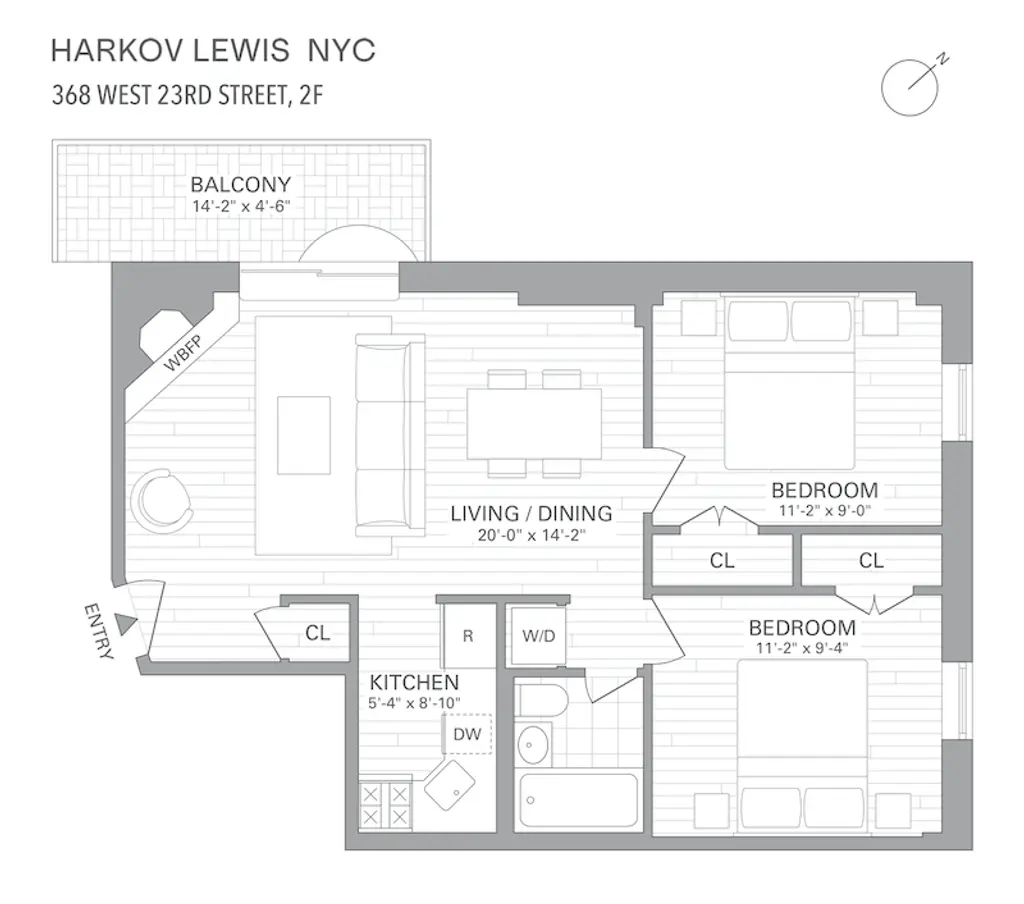

368 West 23rd Street, #2F (Brown Harris Stevens Residential Sales LLC)

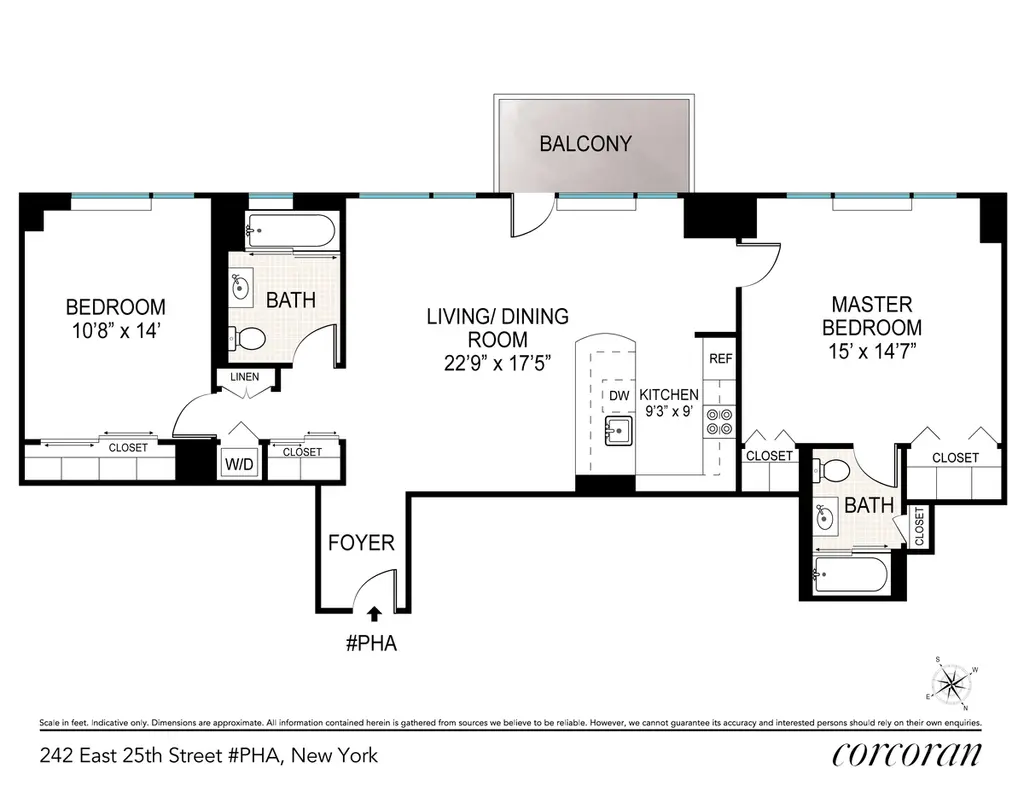

242 East 25th Street, #PHA

$1,100,000 (-4.3%)

Gramercy Park | Condop | 2 Bedrooms, 2 Baths | 1,150 ft2

242 East 25th Street, #PHA (Corcoran Group)

Yes, the shower is in the kitchen and the toilet is across the way

140 West 10th Street, #5F

$1,190,000

Greenwich Village | Cooperative | 2 Bedrooms, 2 Baths

140 West 10th Street, #5F (Serhant LLC)

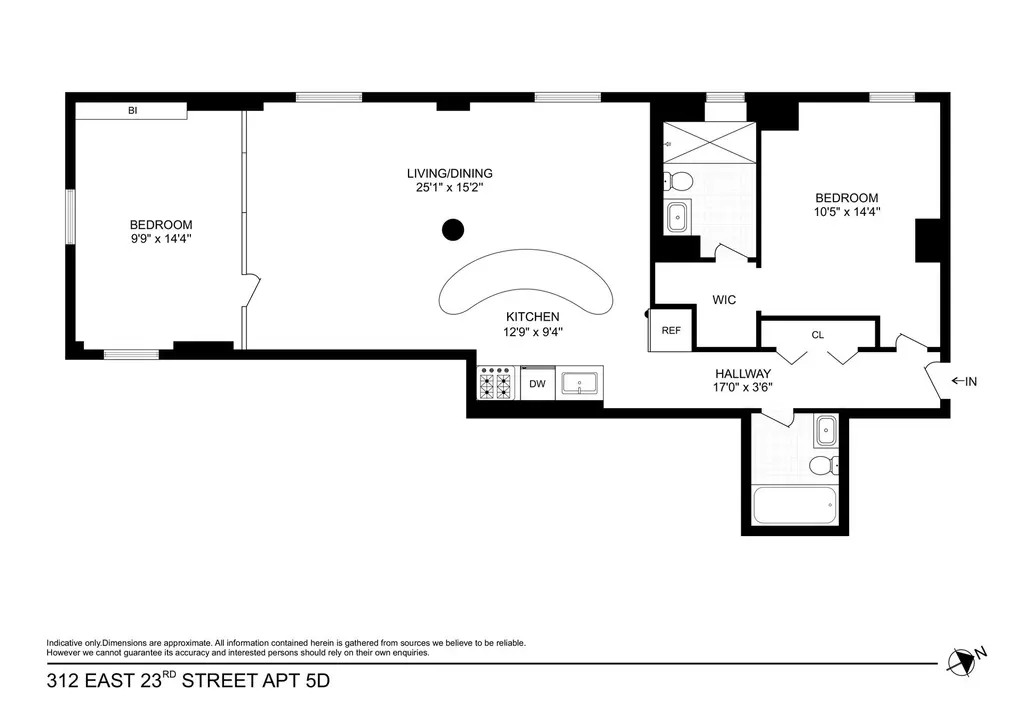

The Foundry, #5D (Douglas Elliman Real Estate)

536 East 13th Street, #2F

$1,230,000 (-10.9%)

East Village | Condominium | 2 Bedrooms, 1 Bath | 830 ft2

536 East 13th Street, #2F (Sothebys International Realty)

Park Towers, #3B (Corcoran Group)

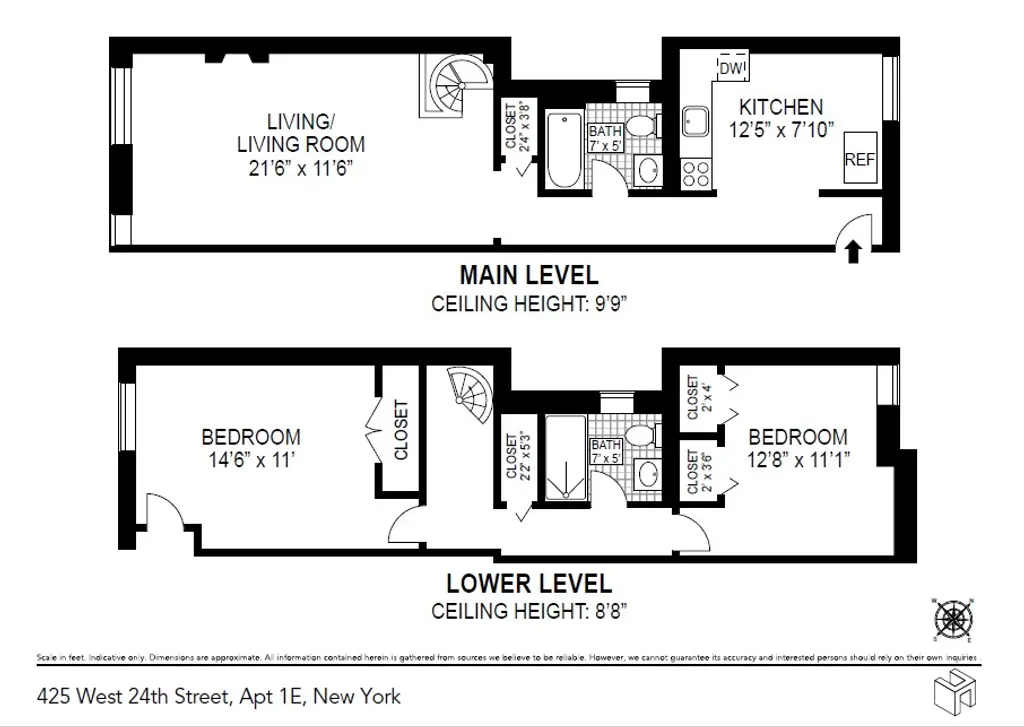

Watch your step!

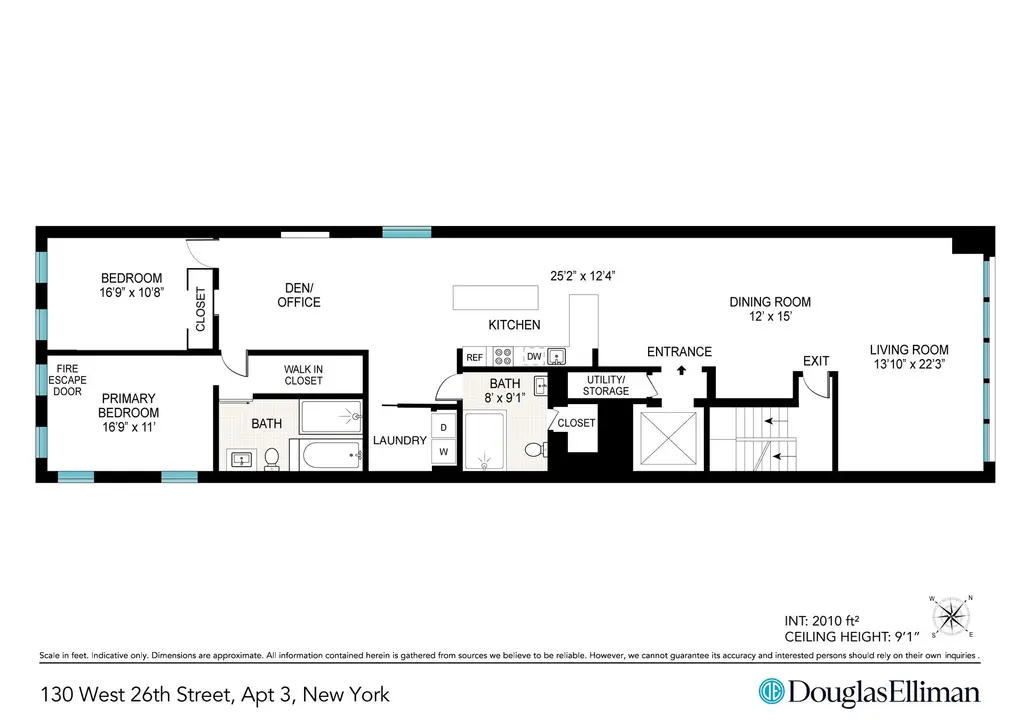

130 West 26th Street, #3

$1,295,000

Chelsea | Cooperative | 2 Bedrooms, 2 Baths | 2,000 ft2

130 West 26th Street, #3 (Douglas Elliman Real Estate)

Would you like to tour any of these properties?

Just complete the info below.

Or call us at (212) 755-5544

Would you like to tour any of these properties?

Contributing Writer

Cait Etherington

Cait Etherington has over twenty years of experience working as a journalist and communications consultant. Her articles and reviews have been published in newspapers and magazines across the United States and internationally. An experienced financial writer, Cait is committed to exposing the human side of stories about contemporary business, banking and workplace relations. She also enjoys writing about trends, lifestyles and real estate in New York City where she lives with her family in a cozy apartment on the twentieth floor of a Manhattan high rise.

6sqft delivers the latest on real estate, architecture, and design, straight from New York City.

6sqft delivers the latest on real estate, architecture, and design, straight from New York City.