After years of soaring prices earlier in the decade, Manhattan residential real estate continued to cool off with transaction volume greatly down. Condo prices showed slight declines while co-ops showed marginal gains in 2018. The median sales price of all apartments in 2018 was $1.2 million, down from $1.25 million in 2017.

See a few highlights from the report below and download the full 2018 Year-End Manhattan Market Report here.

See a few highlights from the report below and download the full 2018 Year-End Manhattan Market Report here.

Total Residential Sales

CityRealty projects that total co-op and condo sales volume will be approximately $21.3 billion for the full calendar year of 2018, based on the $18.9 billion recorded through November 30 and accounting for seasonality and properties in-contract.

The $21.2 billion projection would be substantially down from the total sales volume recorded in 2017 which was $25.7 billion.

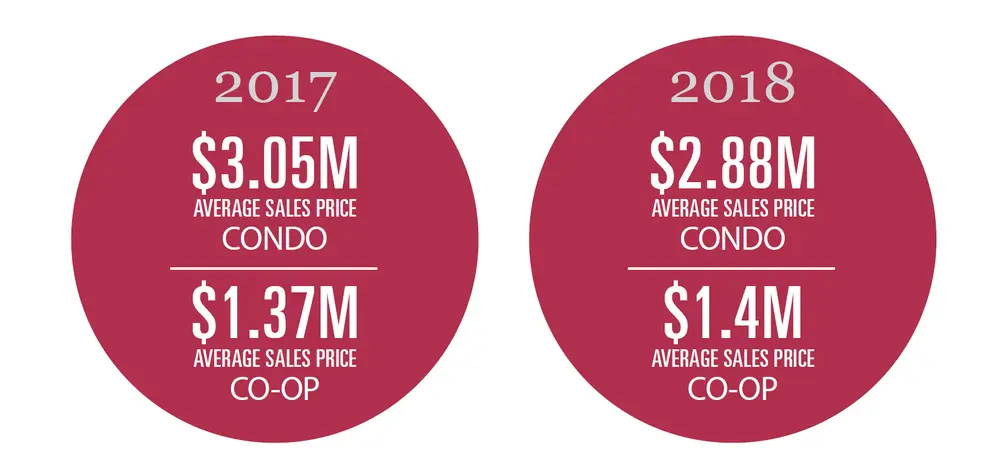

Average Sales Prices of Condos and Co-ops

The median sales price of all apartments in 2018 was $1.2 million, down from $1.25 million in 2017. The average price of a condo in 2018, $2.88 million, was down from $3.05 million the year prior. The average price per square foot dipped slightly to $1,802, down from $1,861 in 2017. Prices rose slightly in the Manhattan co-op market. The average price paid for a co-op was $1.4 million, up from $1.37 million in 2017.

While down this year, average and median sales prices for all residential units in Manhattan—both condos and co-ops—have increased significantly since 2008. This year's average condo/co-op apartment price of $2.06 million is 30% higher than in 2008. This year's median price of $1.97 million is 25.3% higher than it was in 2008.

Transaction Volume

There were 9,157 co-op and condo closings recorded through the first 11 months of 2018. CityRealty projects that there will be approximately 10,354 sales through the end of 2018, a substantial decrease from the 11,881 sales recorded in 2017.

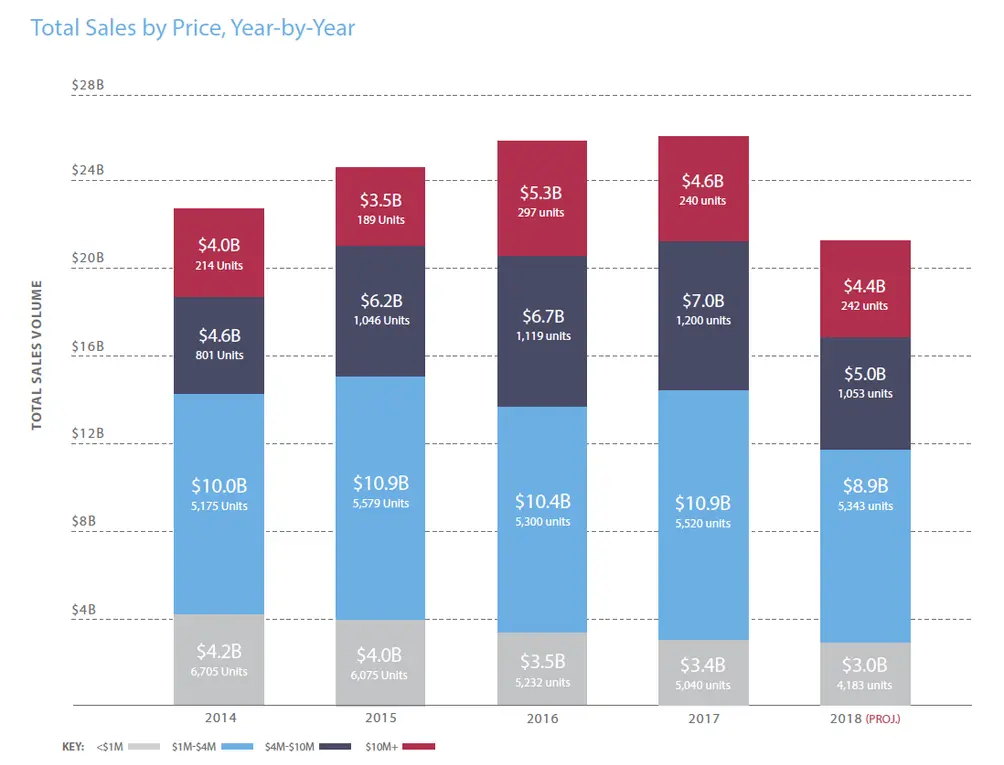

Total Sales by Price

The chart below illustrates the rise in sales of high-priced units over the past five years. With a projected sales volume of $21.3 billion, sales volume by dollar amount is down by 17% when compared to 2017. Total sales of apartments over $10 million are projected to reach $4.4 billion through the end of 2018. The number of apartment sales in this price tier is down from 2017 when it was $4.6 billion, but the aggregate sales total is still on track to account for 20% of all dollars spent on Manhattan residential real estate this year, spread over a scant 242 sales.

Manhattan Condo Market

The average price of a Manhattan condominium was $2.90 million through Nov. 30, a 58% increase from 2008, when it was $1.84 million. The average

price-per-foot for condos, $1,802, was down from last year's average, $1,861. The median sales price for condos, $1.72 million, has increased 42% percent since 2008, when it was $1.21 million.

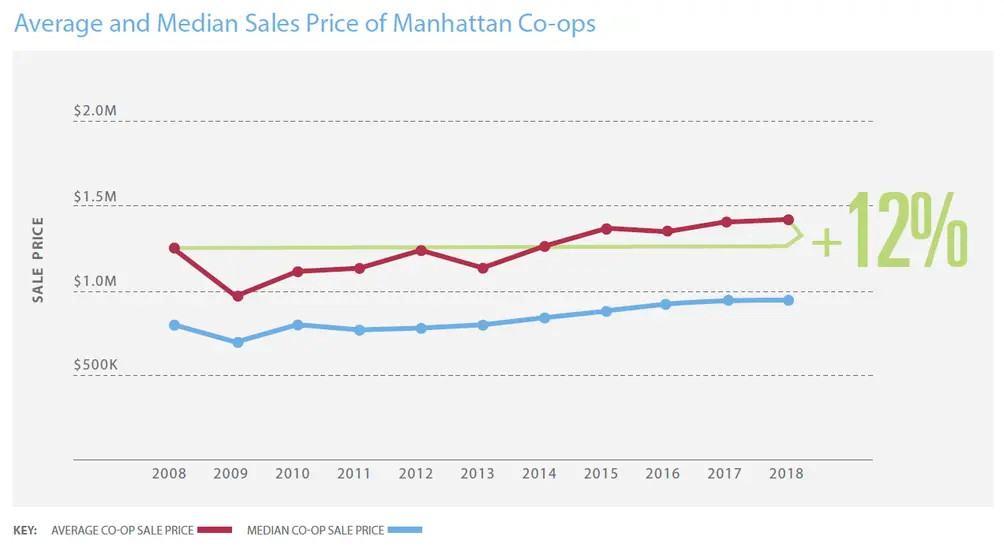

Manhattan Co-op Market

Through Nov. 30, the average sales price for co-ops was $1.40 million, up from $1.37 million last year. The median sales price also rose, to $855,000 from $845,000. CityRealty projects a total of 5,838 co-ops will close through the end of the year, down 15% from 6,267 in 2017.

Top Price Gainer : NoLita/Little Italy

For 2018, condo prices in Nolita/Little Italy rose 20% in 2018, more than any other neighborhood. This increase is largely attributable to closings in the new development 152 Elizabeth Street whose five sales include a penthouse which sold for $29.95M ($5,603 ft²).

Trump's Year in Real Estate

In the second full year of Donald Trump’s presidency, the average sales price for the 11 Trump-branded condos in Manhattan climbed above the Manhattan condo average. However, the price per square foot paid in Trump buildings remained below the Manhattan average. The average price paid for a Trump condo rose significantly to $3.12 million (surpassing the $2.89 million Manhattan average), and the average price per square foot in Trump condos fell from $1,749 in 2017 to $1,711 in 2018.

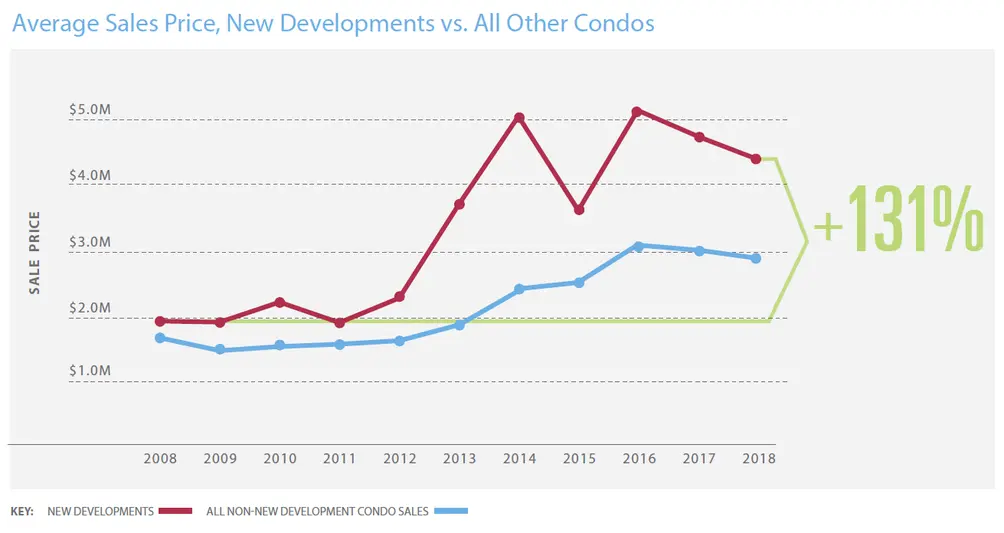

New Development Sales

CityRealty projects that new development sales will reach roughly $4.98 billion through the end of 2018, a decrease from the $8.9 billion in new condo sales recorded in 2017. Approximately 1,050 new condo sales are expected to be recorded through the end of 2018, as compared to 1,848 last year.

Average prices at new developments fell in 2018 to $4.54 million, down from a record high of $5.16 million in 2016. Though the new development market sees high prices, its performance has been volatile year-over-year when compared to the steady growth of non-new development condo sales. Nevertheless, the average price represents a 131% increase from the average price 10 years ago, $1.59 million. A projected 1,050 new development sales will be recorded through the end of 2018, down from the 1,848 recorded in 2017.

New development condo sales in 2018 by region

New development condo sales in 2018 by region

6sqft delivers the latest on real estate, architecture, and design, straight from New York City.

6sqft delivers the latest on real estate, architecture, and design, straight from New York City.