Various images from new development condos currently selling in NYC

Various images from new development condos currently selling in NYC

From pristine interiors and state-of-the-art appliances to eco-friendly environments and top-level services, there are many reasons to purchase in a newly constructed building. By and large, newly constructed buildings are cleaner, greener, and more convenient as they have been built to serve the needs of contemporary New Yorkers. Still, buying in a newly constructed building can present unexpected challenges. This article examines six potential risks and challenges associated with buying in a newly constructed building.

In this article:

Financing

While one might assume that lenders would prefer newly constructed buildings to aging buildings, it is usually more difficult to secure financing for a purchase in a new building, and the reason may come as a surprise. Lenders typically only agree to lend to buyers after a certain percentage of a building's units have already gone into contract. Depending on the building, the percentage will differ but is usually between 15 to 50 percent. Fortunately, in most developments, “preferred lenders” are brought on board to bridge the gap, but this also isn’t ideal. It ultimately means that buyers have fewer choices when shopping for a mortgage and, as a result, may end up with a much higher mortgage rate than they would if they could freely shop for financing.Another common catch-22 when attempting to finance a unit in a newly constructed building is that most lenders will only issue a mortgage after the building has obtained a Certificate of Occupancy or Temporary Certificate of Occupancy. In order to obtain even a Temporary Certificate of Occupancy, however, the building must be close to completion.

Closing costs

Closing costs on condos are nearly always much higher than closing costs on coops because coop buyers don’t pay a mortgage recording tax. However, closing costs on newly constructed condos are also higher than closing costs on resale condos. In most cases, this is due to an expectation that the buyer rather than the seller (in this case, the developer or sponsor) is expected to cover all or most of the closing costs. Notably, closing costs include attorney fees, and for a variety of reasons, attorney fees are also nearly always higher when closing on a new condo versus a resale coop or condo.Move-in dates

As many New Yorkers discovered during the pandemic, anticipated move-in dates on newly constructed buildings can be postponed for months and, in extreme cases, much longer. From permits and inspections to labor shortages and supply-chain troubles, a lot of things can delay the completion of a residential building project. For buyers, these delays not only add to the anxiety of moving but can prove costly. If, for example, a buyer has purchased a new condo and is selling an existing unit to finance the purchase, a long delay may result in both deals falling through. More often than not, however, move-in delays result in buyers being forced to rent while they wait for their newly constructed condo to be completed. Given the cost of moving, storage, and renting in New York City, move-in delays can add tens of thousands of dollars to one’s closing.Construction errors

Even in luxury developments, a lot of things can go wrong during the construction process, and some problems won’t become visible until after the building has become occupied. These problems include drainage and plumbing problems, faulty electrical work, foundation cracks, HVAC system problems, and aesthetic defects (e.g., peeling paint and floors that can’t hold up to the wear-and-tear experienced in large residential buildings). In extreme cases, construction errors can result in certain parts of newly constructed buildings being rendered unusable. In most cases, construction errors are minor and simply result in new residents being forced to live around the buzz of ongoing maintenance work for longer than expected.Community and culture

Many New York City buildings have a unique community or culture that has developed over many decades of habitation. It can be difficult to move into a building with an established community or culture, but when it comes to New York City housing, the timeless adage “better the devil you know than the devil you don’t” also seems to hold true. When you move into an existing building, it is usually possible to gain at least some sense of what to expect once you arrive. For example, if you’re looking for a child-friendly building or a building that welcomes musicians who practice at home, you’ll likely be able to assess the tolerance for crying children or trombone playing prior to moving in. In newly constructed buildings, it is virtually impossible to anticipate whether the community and culture of the building will ultimately be a good fit for you and your family over time.Long-term return on investment

Buying in New York City is nearly always a strategic long-term investment. Still, buying in a newly constructed building does pose a slightly higher risk. In addition to the possibility that the newly constructed building may suffer from chronic problems (e.g., ongoing leaks), there is also a risk that the building may end up being largely unoccupied or end up being home to more renters than owner-occupants. While unoccupied units and units inhabited by renters don’t necessarily impact the value of one’s property, when the situation is extreme (i.e., the building is mostly unoccupied or home to a third or more renters), the value of one’s property may be negatively impacted. Here, it is also important to bear in mind that the Federal Housing Authority (FHA) even restricts mortgages on condo communities that aren’t at least 35 percent owner-occupied (until 2019, the FHA required at least 50 percent of units to be occupied by owners).The bottom line is that buying a newly constructed unit has many advantages, but it also tends to come with increased uncertainty and higher closing costs. If you know and accept the risks and higher price tag, however, it is nearly always a great investment.

The new development market in New York is still going strong, though still off from its highs in the mid-2010s and down from the transaction volume of 2000s when prices were more approachable. Spencer Levine, president at RAL Companies who developed Quay Tower on the Brooklyn Heights waterfront says, “Construction costs, financing uncertainty, and global tariffs have created real hesitancy in New York’s new development market. But as interest rates come down and the mayoral race settles, we expect clarity to return, and with it, renewed confidence in getting new projects off the ground.”

The new development market in New York is still going strong, though still off from its highs in the mid-2010s and down from the transaction volume of 2000s when prices were more approachable. Spencer Levine, president at RAL Companies who developed Quay Tower on the Brooklyn Heights waterfront says, “Construction costs, financing uncertainty, and global tariffs have created real hesitancy in New York’s new development market. But as interest rates come down and the mayoral race settles, we expect clarity to return, and with it, renewed confidence in getting new projects off the ground.”

30 highly anticipated fall 2025 sales launches

Downtown

14 White Street, Tribeca

Developed by Nava Companies | Design by Kurv Architecture

7 stories | 9 units

Estimated 2026 occupancy

Rendering of 14 White Street (DXA Studio)

Rendering of 14 White Street (DXA Studio)

Boutique condominium 14 White Street rose on a triangular lot reported to be a legacy of the southern extension of Sixth Avenue. This makes for a Flatiron-esque design, and the building is aiming for Passive House standards between high-performance windows and a continuously insulated rain screen envelope beneath the exteriors.

The condos inside will range from 1,200-square-foot two-bedrooms to approximately 4,000-square-foot full-floor four-bedrooms, and some units will have private terraces. Information is not available on amenities, but the greatest perk may be its address in the heart of Tribeca.

The condos inside will range from 1,200-square-foot two-bedrooms to approximately 4,000-square-foot full-floor four-bedrooms, and some units will have private terraces. Information is not available on amenities, but the greatest perk may be its address in the heart of Tribeca.

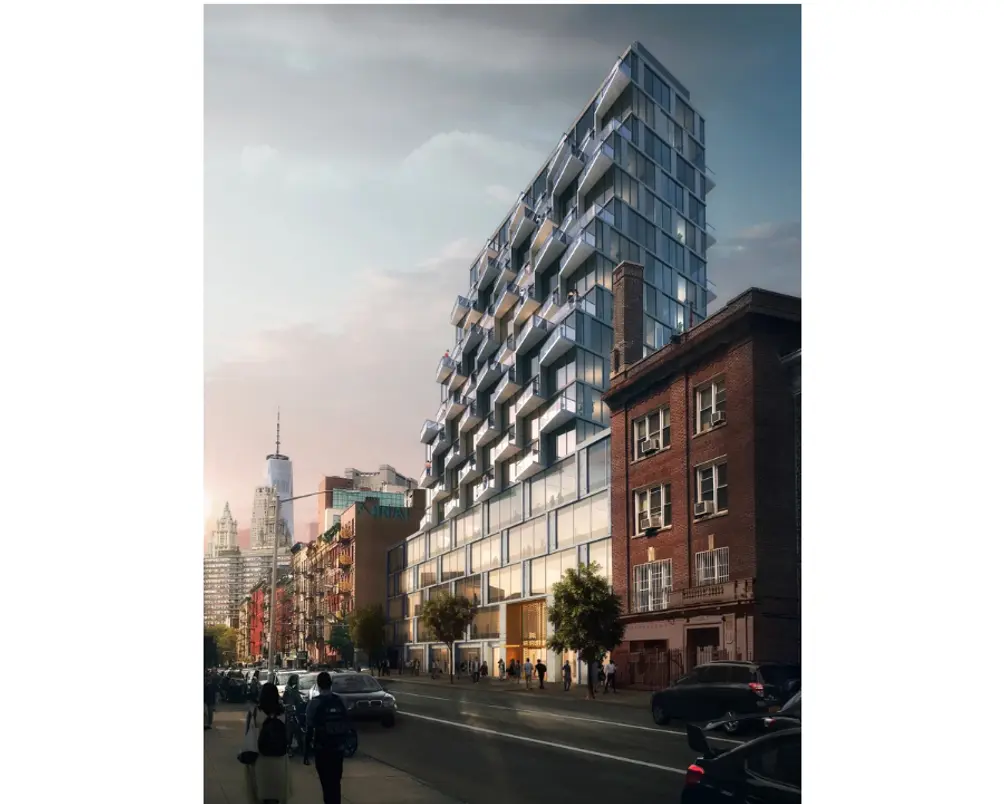

59 Henry Street, Lower East Side

Developed by W&L Group with NYC Henry Street Group | Design by S9 Architecture

19 stories | 80 units

Estimated Late 2026 occupancy

On a Two Bridges block of low-rise tenement buildings, 59 Henry Street makes a bold statement with its towering height, glassy facade, and angled balconies on the uppermost levels. It will feature five levels of community space, commercial units, and condos on top to make the most of Lower Manhattan views. The building is surrounded by popular Chinatown restaurants and in close proximity to the East Broadway F train.

Freeman Residences

4 Freeman Alley, Lower East Side

Developed by Omni Properties | Design by GF55 Architects

17 stories | 18 condo units

Fall 2025 occupancy

Studios from $1.2 million | One-beds from $1.46 million

When this building at the nexus of Nolita and the Lower East Side was still on the drawing board, plans initially called for a nine-story, 26-unit boutique building. But in June 2023, new permits were filed for a building nearly double the planned size. As per an accepted offering plan, it will offer ground-floor retail, 40 rental units (11 of which will be affordable), and 18 condo units on the uppermost floors.

Select residences will have private balconies, and all interiors will feature engineered wood floors, Miele appliances in the kitchens, high-end bath fixtures, and in-unit laundry. Amenities will include a fitness center, bike storage, a rear courtyard, and a roof terrace with grilling, dining, and lounging areas. Another perk is a prime Downtown address near popular retail and dining, Sara D. Roosevelt Park, a Whole Foods supermarket, and the Second Avenue F and Bowery J/Z trains.

Select residences will have private balconies, and all interiors will feature engineered wood floors, Miele appliances in the kitchens, high-end bath fixtures, and in-unit laundry. Amenities will include a fitness center, bike storage, a rear courtyard, and a roof terrace with grilling, dining, and lounging areas. Another perk is a prime Downtown address near popular retail and dining, Sara D. Roosevelt Park, a Whole Foods supermarket, and the Second Avenue F and Bowery J/Z trains.

Village Garden Condominium

183 Avenue B, Lower East Side

Developed by Richard Pino | Design by Plan Architecture

8 stories | 12 units

Estimated 2026 occupancy

Village Garden Condominium is taking shape two blocks north of Tompkins Square Park, and the building plays up its connection to nature. Not only will the majority of units have private outdoor space (including two penthouses with massive private terraces), but six garden spaces will be available to six apartment buyers.

Interiors will feature floor-to-ceiling windows, elegant wood flooring, kitchens with natural materials and Miele appliances, and bathrooms with heated floors and Porcelanosa fixtures. Amenities will include virtual doorman service, basement-level bike storage with e-bike charging stations, and a rooftop fitness center with state-of-the-art equipment and incredible light and views.

Interiors will feature floor-to-ceiling windows, elegant wood flooring, kitchens with natural materials and Miele appliances, and bathrooms with heated floors and Porcelanosa fixtures. Amenities will include virtual doorman service, basement-level bike storage with e-bike charging stations, and a rooftop fitness center with state-of-the-art equipment and incredible light and views.

220E9

220 East 9th Street, East Village

Developed by Arcus | Design by Colberg Architecture

6 stories | 18 units

Estimated 2026 occupancy

Rendering of 220E9 (Arcus)

Rendering of 220E9 (Arcus)

On an East Village block near Astor Place, a former parking garage is being converted to a boutique condominium. Renderings show a building with a red brick facade and factory-style windows that makes a respectful addition to its neighborhood. Interiors will feature board-formed concrete ceilings, hand-crafted details, and custom oak-finished kitchens.

Seven units (including three penthouses) will have large private terraces, and all residents will have access to amenities like a fitness center with Pilates studio, a sauna, a pet grooming station, and a Japanese-style viewing garden. Sales are expected to launch later this fall.

Seven units (including three penthouses) will have large private terraces, and all residents will have access to amenities like a fitness center with Pilates studio, a sauna, a pet grooming station, and a Japanese-style viewing garden. Sales are expected to launch later this fall.

550 West 21st Street, Chelsea

Developed by Legion Investment Group | Designer TBD

23 stories | 83 units

Estimated 2027 occupancy

In a statement about his forthcoming project, Legion Group Founder and CEO Victor Sigoura described 550 West 21st Street as "the last major waterfront development site in West Chelsea of this scale and quality." Its address on the corner of Eleventh Avenue and West 21st Street puts it in close proximity to the High Line and Hudson River Park, and luxurious interiors with Hudson River views are all but assured. A recent site visit saw foundations taking shape; and the developer recently secured a construction loan for the project (h/t The Real Deal).

550 West 21st Street, fall 2025 (CityRealty)

550 West 21st Street, fall 2025 (CityRealty)

The Flatiron Building

175 Fifth Avenue, Flatiron District

Developed by Brodsky Organization and GFP Real Estate | Design by Daniel Burnham (original)/SLCE Architects (renovation)

22 stories | 38 units

Estimated 2026 occupancy

Three-beds from $10.95 million | Four-beds from $15.5 million

The Flatiron Building

The Flatiron Building

Ever since the Flatiron Building sold at auction in spring 2023, it has been one of the most widely watched and anticipated office-to-residence conversions in New York City. The Beaux-Arts facade was meticulously restored to its original glory, and the building will be illuminated at night when it reopens.

The interiors were converted to apartments with two units per floor starting on the third floor, three units on the 22nd floor, and the top floor will be dedicated to a penthouse with a private terrace. Early speculation imagined breakfast nooks in the narrow end facing 23rd Street, but that is not showing up on early floor plans. Interiors are to feature hardwood floors, in-unit Whirlpool washers and heat pump dryers, kitchens with high-end appliances by Gaggenau, Thermador, and Miele, and primary suites with dressing rooms and en suite baths boasting Waterworks fixtures and Toto toilets.

Building amenities will include a swimming pool with hot tub and cold plunge, fitness center, bike room, package room, lounge, game room, and dining room with kitchenette. Private storage is available for purchase, as are six wine storage units.

The interiors were converted to apartments with two units per floor starting on the third floor, three units on the 22nd floor, and the top floor will be dedicated to a penthouse with a private terrace. Early speculation imagined breakfast nooks in the narrow end facing 23rd Street, but that is not showing up on early floor plans. Interiors are to feature hardwood floors, in-unit Whirlpool washers and heat pump dryers, kitchens with high-end appliances by Gaggenau, Thermador, and Miele, and primary suites with dressing rooms and en suite baths boasting Waterworks fixtures and Toto toilets.

Building amenities will include a swimming pool with hot tub and cold plunge, fitness center, bike room, package room, lounge, game room, and dining room with kitchenette. Private storage is available for purchase, as are six wine storage units.

Armorie

114 East 25th Street, Flatiron District

Developed by Adellco | Design by Andre Kikoski Architecture (renovation)

14 stories | 20 units

Estimated 2026 occupancy

Armorie (Adellco via Corcoran Sunshine)

Armorie (Adellco via Corcoran Sunshine)

In April 2025, publisher-turned-condominium Armorie experienced one of the fastest sellouts in years when one buyer bought all 20 units plus the commercial space for $71 million. Matthew Adell of Adellco, the building's original developer, told CityRealty that the buyer initially eyed a group of apartments, but he convinced them that controlling the entire building would be consistent with their vision and would let them sell at their own pace. The building features newly created interiors by Andre Kikoski Architecture as well as amenities like an attended lobby with cold storage, a fitness center, and a roof terrace with dining and lounging areas.

262 Fifth Avenue, NoMad/Flatiron District

Developed by Five Points Development | Design by SLCE Architects

56 stories | 26 units

Estimated 2026 occupancy

Two-beds from $9.15 million | Three-beds from $14.6 million

Long before it even topped out, 262 Fifth Avenue garnered strong criticism from New Yorkers as far south as the Lower East Side whose views of the Empire State Building were blocked by the new tower. However, its towering height and column-free layouts promise panoramic views for the very few residents.

The apartments will comprise a mix of simplexes, duplexes, and one quadruplex unit with hardwood floors, Miele and Sub-Zero appliances in the kitchens, and spa-like primary baths. Amenities are set to include a fitness center, a swimming pool, and a common terrace with views almost equivalent to those seen from the nearby Empire State Building's observatory. The building also offers parking for purchase, though it is in a central location near several transportation options.

The apartments will comprise a mix of simplexes, duplexes, and one quadruplex unit with hardwood floors, Miele and Sub-Zero appliances in the kitchens, and spa-like primary baths. Amenities are set to include a fitness center, a swimming pool, and a common terrace with views almost equivalent to those seen from the nearby Empire State Building's observatory. The building also offers parking for purchase, though it is in a central location near several transportation options.

The Residences at West 9th Street

26 West 9th Street, Greenwich Village

Developed by Lionheart Capital | Design by Schwartz & Gross (original)/Stonehill Taylor (renovation)

10 stories | 45 units

4 public availabilities from $1.975 million

Developed by Lionheart Capital | Design by Schwartz & Gross (original)/Stonehill Taylor (renovation)

10 stories | 45 units

4 public availabilities from $1.975 million

The Residences at West 9th Street (Reuveni LLC)

The Residences at West 9th Street (Reuveni LLC)

Owing to the protections of the Greenwich Village Historic District, new construction in one of New York City's most coveted neighborhoods is few and far between. However, The Residences at West 9th Street gets around that by restoring an over 100-year-old building near Washington Square Park to its original glory amidst a condo conversion.

Original features like patinated metal entry doors, beamed ceilings, and decorative fireplaces were preserved and restored, while perks like high-end kitchen appliances, VRF climate control, and in-unit washer and dryer bring the new homes into the 21st century. An attended, beautifully restored lobby sets the tone, and the building offers a package room with cold storage.

Original features like patinated metal entry doors, beamed ceilings, and decorative fireplaces were preserved and restored, while perks like high-end kitchen appliances, VRF climate control, and in-unit washer and dryer bring the new homes into the 21st century. An attended, beautifully restored lobby sets the tone, and the building offers a package room with cold storage.

The Residences at West 9th Street, #6C

$2,200,000

Greenwich Village | Condominium | 1 Bedroom, 1 Bath | 720 ft2

The Residences at West 9th Street, #6C (Reuveni LLC)

The Village West

525 Sixth Avenue, Greenwich Village

Developed by Izaki Group | Design by BKSK Architects

14 stories | 68 units

Estimated Q2 2026 occupancy

12 public availabilities from $1.4 million

Developed by Izaki Group | Design by BKSK Architects

14 stories | 68 units

Estimated Q2 2026 occupancy

12 public availabilities from $1.4 million

The Village West (CORE Group Marketing LLC)

The Village West (CORE Group Marketing LLC)

Shortly after The Village West launched sales, a flurry of contracts has already been signed in the building. As it is located outside the Greenwich Village Historic District, it could rise to its soaring height without Landmarks' approval; however, the red brick facade and massing by BKSK Architects pays respectful tribute to the surrounding architecture, not to mention the masonry-style building it replaced.

Select units have private balconies or terraces, and all interiors feature open-plan layouts, kitchens with custom Poliform cabinetry and Gaggenau appliances, and luxurious primary baths with radiant heated flooring. Over 10,000 square feet of amenities include a two-level fitness center, a recovery studio with hydrotherapy and cryotherapy, a lounge with bar and prep kitchen, a two-story courtyard, and a roof terrace with outdoor kitchen.

Select units have private balconies or terraces, and all interiors feature open-plan layouts, kitchens with custom Poliform cabinetry and Gaggenau appliances, and luxurious primary baths with radiant heated flooring. Over 10,000 square feet of amenities include a two-level fitness center, a recovery studio with hydrotherapy and cryotherapy, a lounge with bar and prep kitchen, a two-story courtyard, and a roof terrace with outdoor kitchen.

The Village West, #4D (CORE Group Marketing LLC)

The Florian

350 East 18th Street, Gramercy

Developed by Minrav Group | Design by ARC Architecture + Design Studio

10 stories | 50 units

Estimated Q1 2026 occupancy

6 public availabilities from $1.225 million

Developed by Minrav Group | Design by ARC Architecture + Design Studio

10 stories | 50 units

Estimated Q1 2026 occupancy

6 public availabilities from $1.225 million

The Florian (Douglas Elliman)

The Florian (Douglas Elliman)

On the corner of First Avenue and East 18th Street, The Florian combines Art Deco, Moderne, and traditional Japanese design influences to create a look entirely its own. The gentle curve of the corner allows for distinctive curved windows in select units, and all interiors feature ceilings up to 10 feet high, chevron-patterned white oak floors, custom kitchens with premium appliances, Nest thermostats, and in-unit Bosch washers and dryers. Select units have private balconies or terraces.

The Florian's amenity package is distinguished by wellness offerings that include a fitness center and spa with sauna, Jacuzzi, cold plunge, and treatment room. Additional amenity offerings include 24-hour doorman and concierge service, a lounge with adjacent courtyard, a pet spa, and a roof terrace with outdoor kitchen, dining and lounge areas, and beautiful city views. Sales launched in September 2025, and closings are estimated to begin in early 2026.

The Florian's amenity package is distinguished by wellness offerings that include a fitness center and spa with sauna, Jacuzzi, cold plunge, and treatment room. Additional amenity offerings include 24-hour doorman and concierge service, a lounge with adjacent courtyard, a pet spa, and a roof terrace with outdoor kitchen, dining and lounge areas, and beautiful city views. Sales launched in September 2025, and closings are estimated to begin in early 2026.

The Florian, #12C (Douglas Elliman Real Estate)

Midtown

Would you like to tour any of these properties?

Just complete the info below.

Or call us at (212) 755-5544

Casoni

989 Sixth Avenue, Midtown West

Developed by Sioni Group | Design by C3D Architecture

70 stories | 311 units

Estimated Late 2026 occupancy

C3D Architecture

C3D Architecture

Around the same time the Midtown South Mixed Use Plan was approved, construction topped out on Casoni, a mixed-use tower located just outside the plan's boundaries on the corner of Sixth Avenue and West 37th Street. The podium was designed to complement the nearby Haier Building, and the curving glass facade wraps around the upper levels to allow for expansive views.

The residential units will comprise a mix of rentals and condos on the uppermost levels. Amenities will include an attended lobby, a gym, a pool, a spa lounge, a children's playroom, a coworking lounge, a speakeasy-inspired recreation lounge, and open terraces on the 23rd, 58th, and 70th floors.

The residential units will comprise a mix of rentals and condos on the uppermost levels. Amenities will include an attended lobby, a gym, a pool, a spa lounge, a children's playroom, a coworking lounge, a speakeasy-inspired recreation lounge, and open terraces on the 23rd, 58th, and 70th floors.

435 West 48th Street, Hell's Kitchen/Midtown West

Developed by Dharshyni Peries | Design by Kimberly Brown Architecture

6 stories | 6 units

Estimated 2026 occupancy

Rendering of 435 West 48th Street (Kimberly Brown Architecture)

Rendering of 435 West 48th Street (Kimberly Brown Architecture)

Boutique condominium 435 West 48th Street is taking shape across the street from the Clinton Community Garden, allowing for beautiful views of greenery in every unit. The design by Kimberly Brown Architecture features a pale limestone facade and French windows with custom-patterned guardrails. Interior renderings of the full-floor units feature private elevator entry, gracious layouts, and private outdoor space.

Linden Lane

349 West 51st Street, Midtown West

Developed by Cadence Property Group | Design by Architecture Outfit

7 stories | 21 units

Estimated 2026 occupancy

Linden Lane is located in a bustling section of New York near Central Park, Hudson River Park, the Theater District, and popular Hell's Kitchen dining and nightlife. However, a series of private green spaces serves as a sanctuary, and indoor and outdoor amenities will focus on health and wellness. Many of the one- through three-bedroom apartments will have private outdoor space, and designer Humanscale has collaborated on dedicated workspaces in the residences, which sound reminiscent of the ones at Hendrix House.

Linden Lane, fall 2025 (CityRealty)

Linden Lane, fall 2025 (CityRealty)

The Gild

441 West 54th Street, Hell's Kitchen/Midtown West

Developed by Yaus Special Clinton District LLC | Design by ODA New York

7 stories | 28 units

Occupancy TBD

One-beds from $1.395 million | Two-beds from $2.15 million | Three-beds from $3.695 million

Rendering of The Gild (ODA Architecture)

Rendering of The Gild (ODA Architecture)

The Gild's height is congruent with its prewar neighbors on its Hell's Kitchen block, but the project stands out for its brass-colored louvers and intriguingly patterned floor-to-ceiling windows. Approximately half the units will have private outdoor space, and all residents will have access to a lobby with green wall, an outdoor terrace with meditation room and children's play area, and a common roof terrace; additional amenities include a fitness center and bike storage. Exterior construction looks to be complete, but the listings have not yet come on the market.

133 East 55th Street, Midtown East

Developed by Rybak Development | Design by Zproekt

21 stories | 31 units

Early 2026 occupancy

One-beds from $1.89 million | Two-beds from $3 million | Three-beds from $6.3

million

Rendering of 133 East 55th Street

Rendering of 133 East 55th Street

Also known as 660 Lexington Avenue, 133 East 55th Street is rising a short distance from Malabar Residences (see below). A September 2023 Instagram post dubbed it "the jewel of Midtown" and depicted a building with a light stone facade and setback terraces. Inside, there will be no more than three units per floor, and the twelfth floor up will be devoted to full-floor penthouses, including a duplex with private roof terrace. Select units will have private balconies.

There will be full-time doormen on staff, and amenities are expected to include a fitness center, a spa complex, bike storage, and an outdoor terrace. Another perk is its address near Central Park, flagship department stores, and fine dining.

There will be full-time doormen on staff, and amenities are expected to include a fitness center, a spa complex, bike storage, and an outdoor terrace. Another perk is its address near Central Park, flagship department stores, and fine dining.

The Lucia

120 East 37th Street, Murray Hill

Developed by Peak Capital Advisors | Design by Romeyn & Stevens (original)/James Chai Architect (renovation)

5 stories | 8 units

Estimated Q2 2026 occupancy

6 public availabilities from $400K

Developed by Peak Capital Advisors | Design by Romeyn & Stevens (original)/James Chai Architect (renovation)

5 stories | 8 units

Estimated Q2 2026 occupancy

6 public availabilities from $400K

The Lucia (Nest Seekers LLC)

The Lucia (Nest Seekers LLC)

Over 100 years after the Renaissance Revival-style mansion at 120 East 37th Street was built for James C. Fargo, president of American Express and brother of Wells Fargo co-founder William Fargo, the building has been converted to The Lucia, an eight-unit boutique condominium. All studio through three-bedroom units feature tall sash windows, wide plank hardwood floors, kitchens with two-toned cabinetry and integrated high-end appliances, three-piece bathrooms, and in-unit laundry. It is located in close proximity to the Morgan Library and Museum, the United Nations headquarters, popular Murray Hill dining, and Grand Central Terminal.

The Lucia, #PH (Nest Seekers LLC)

Malabar Residences

125 East 57th Street, Billionaires' Row/Midtown East

Developed by MRR Development | Design by ODA Architecture

28 stories | 147 units

Estimated Q2 2026 occupancy

6 public availabilities from $1.48 million

Developed by MRR Development | Design by ODA Architecture

28 stories | 147 units

Estimated Q2 2026 occupancy

6 public availabilities from $1.48 million

Malabar Residences (Douglas Elliman)

Malabar Residences (Douglas Elliman)

At the eastern end of Billionaires' Row, and a short distance from 432 Park Avenue, Malabar Residences stands out for its "pixelated" facade by ODA Architecture. This creative massing allows for private outdoor space in the majority of units, and all interiors feature high ceilings, oversized windows, kitchens with Jenn-Air appliances, and tranquil primary baths with natural materials and glass-enclosed rain showers.

The amenities span five floors of wellness and social offerings. A fitness center overlooks a double-height lap pool with hot tub, steam room, and sauna, not to mention an indoor sports half-court. The fourth floor houses a game room with catering kitchens, a children's playroom, and access to an outdoor terrace. CLUB13 on the thirteenth floor offers an indoor-outdoor lounge and access to a covered terrace. The crowning glory is a roof terrace with dining areas and views of the Manhattan skyline and Central Park.

The amenities span five floors of wellness and social offerings. A fitness center overlooks a double-height lap pool with hot tub, steam room, and sauna, not to mention an indoor sports half-court. The fourth floor houses a game room with catering kitchens, a children's playroom, and access to an outdoor terrace. CLUB13 on the thirteenth floor offers an indoor-outdoor lounge and access to a covered terrace. The crowning glory is a roof terrace with dining areas and views of the Manhattan skyline and Central Park.

Malabar Residences, #1401 (Douglas Elliman Real Estate)

Upper East Side

500 East 81st Street, Yorkville

Developed by Rybak Development | Design by Zproekt

10 stories | 10 units

Estimated 2026 occupancy

Rendering of 500 East 81st Street (Douglas Elliman)

Rendering of 500 East 81st Street (Douglas Elliman)

Following their success at 126 East 86th Street (where only one unit remains on the market), Rybak Development and Zproekt Architecture reunite on another Upper East Side project. The ten-story building on the corner of York Avenue and East 81st Street will offer only 10 floor-through, four-bedroom apartments with private elevator access, oversized windows, high-end finishes, and private outdoor space. The building will also offer private parking, but it is in close proximity to the East 86th Street Q train.

The Strathmore

400 East 84th Street, Yorkville

Developed by Related Companies | Design by Costas Kondylis (original)

48 stories | 144 units

Fall 2025 Occupancy

One-beds from $945K | Two-beds from $1.555 million | Three-beds from $2.795 million | Four-beds from $4.75 million

Renderings of The Strathmore (Related Companies)

Renderings of The Strathmore (Related Companies)

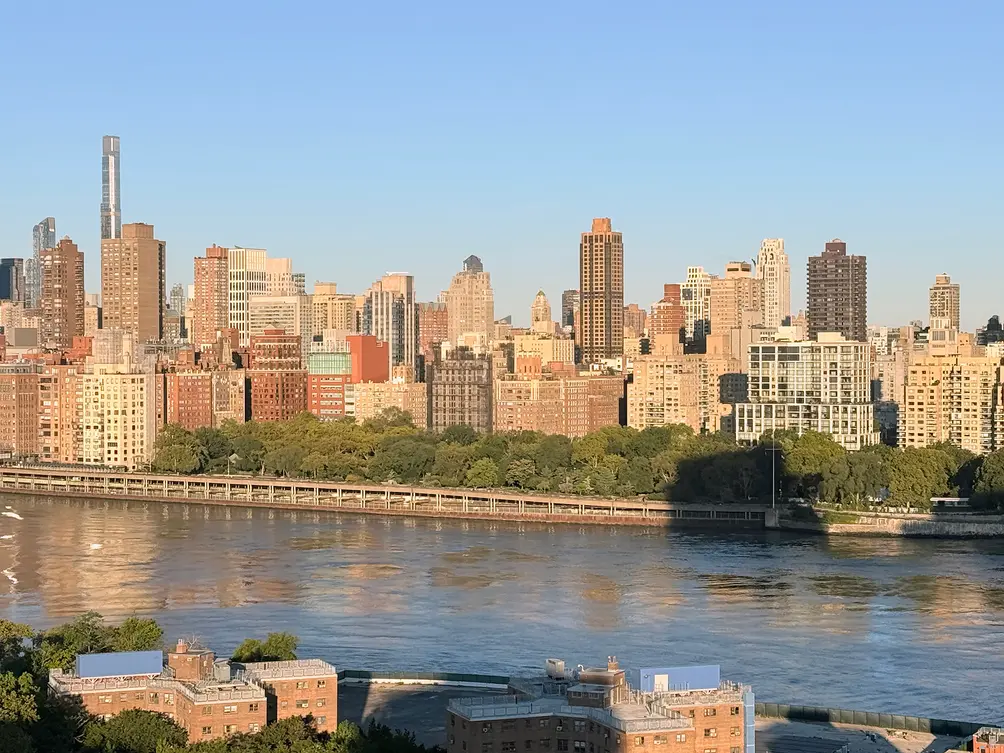

When The Strathmore was under construction as a rental, the city passed restrictive zoning laws to prohibit such tall, slender buildings from rising between York and Third Avenues from East 57th to 96th Streets. Nearly 30 years later, amidst its conversion to sales units, it is one of the taller buildings in its neighborhood, which allows for unobstructed East River and skyline views. Reimagined interiors by Ingrao Inc. feature open layouts, oversized windows, whitewashed oak floors, kitchens with marble countertops and integrated Miele appliances, serene primary baths, and smart thermostats.

A resort-style amenity package offers a 24-hour attended lobby, a landscaped entry garden, a fitness center with training studio, a 50' lap pool with sauna, a squash/sports court, a children's playroom, a lounge with coworking space, and a private dining room with catering kitchen. Parking is available for purchase, but The Strathmore is located near the Second Avenue subway and the 90th Street ferry landing, two transportation options that didn't exist when it was first constructed.

A resort-style amenity package offers a 24-hour attended lobby, a landscaped entry garden, a fitness center with training studio, a 50' lap pool with sauna, a squash/sports court, a children's playroom, a lounge with coworking space, and a private dining room with catering kitchen. Parking is available for purchase, but The Strathmore is located near the Second Avenue subway and the 90th Street ferry landing, two transportation options that didn't exist when it was first constructed.

The Upper East Side with The Strathmore (center-right), from Astoria waterfront

The Upper East Side with The Strathmore (center-right), from Astoria waterfront

1122 Madison Avenue, Carnegie Hill

Developed by Legion Group | Design by Studio Sofield

22 stories | 26 units

Estimated 2027 occupancy

Rendering of 1122 Madison Avenue (Legion Group)

Rendering of 1122 Madison Avenue (Legion Group)

One block from Central Park, 1122 Madison Avenue will be designed inside and out by Studio Sofield. Renderings show an homage to the surrounding prewar architecture with a limestone facade, sculpted reliefs, and custom decorative railings.

Inside, there will be many full-floor units with private terraces. While information is not yet available on amenities, one undeniable perk is its Upper East Side address near the Metropolitan Museum of Art and prime Madison Avenue shopping.

Inside, there will be many full-floor units with private terraces. While information is not yet available on amenities, one undeniable perk is its Upper East Side address near the Metropolitan Museum of Art and prime Madison Avenue shopping.

Brooklyn and Queens

74 Diamond Street, Greenpoint

Developed by CRE8 Development Group | Design by A&T Engineering

5 stories | 6 units

Estimated 2026 occupancy

74 Diamond Street is taking shape between McCarren Park and Monsignor McGolrick Park in Brooklyn. Renderings depict oversized windows, which promise abundant natural light for the apartments inside, and amenities will reportedly include private storage and a shared roof deck.

Boerum Place

110 Boerum Place, Cobble Hill

Developed by Avdoo & Partners | Design by Brent Buck Architects

6 stories | 21 units

Occupancy estimated for 2026

One-beds from $1.475 million | Two-beds from $2.975 million | Three-beds from $4.85 million | Four-beds from $6.5 million

Rendering of Boerum Place (Avdoo)

Rendering of Boerum Place (Avdoo)

Boerum Place is a new construction building, but renderings depict a respectful addition to the neighborhood: a low-rise building with a red brick facade. All units will offer private outdoor space in the form of a terrace or covered loggia, and interiors will boast meticulous craftsmanship.

Over 11,000 square feet of amenities are set to include a fitness center with movement studio, a spa with treatment rooms, a library, a Great Room lounge, a children's playroom, and a landscaped courtyard. Parking will be available for purchase, but the building is situated between the Bergen Street F/G and the Hoyt-Schermerhorn A/C subway stops.

Over 11,000 square feet of amenities are set to include a fitness center with movement studio, a spa with treatment rooms, a library, a Great Room lounge, a children's playroom, and a landscaped courtyard. Parking will be available for purchase, but the building is situated between the Bergen Street F/G and the Hoyt-Schermerhorn A/C subway stops.

Paragon

45-40 Vernon Boulevard, Long Island City

Developed by ZD Jasper | Design by Archimaera

23 stories | 186 units

Occupancy estimated for 2026

Paragon rendering (ZD Jasper)

Paragon rendering (ZD Jasper)

In the heart of Long Island City, Paragon represents the combination of the historic Paragon Paint Factory with a new 23-story tower. Renderings show a context-sensitive design with oversized casement windows and a brick and metal facade. Information is not yet available on the interiors or amenities, but a spokesperson for the developer said, "This is arguably the best development site in all of Long Island City," likely for its proximity to Gantry Plaza State Park, Vernon Boulevard dining, and the Court Square transportation hub.

Fifty One Domino

51 South 1st Street, Williamsburg

Developed by 51 S 1 LLC | Design by ARC Architecture + Design Studio

6 stories | 8 units

Estimated 2026 occupancy

1 public availability for $3.95 million

Developed by 51 S 1 LLC | Design by ARC Architecture + Design Studio

6 stories | 8 units

Estimated 2026 occupancy

1 public availability for $3.95 million

Rendering of Fifty One Domino (Serhant)

Rendering of Fifty One Domino (Serhant)

A short distance from Domino Park, Fifty One Domino is distinguished by its contemporary design and broad arches. All residences feature 10-foot ceilings, oversized windows, and massive terraces that act as an extension of the living area. Sophisticated kitchens boast full slab Taj Mahal stone walls, custom millwork, and top-of-the-line appliances. Spa-inspired primary baths come outfitted with radiant heated floors, double vanities, sculptural free-standing soaking tubs, and rain showers.

Fifty One Domino, #3 (Serhant)

The Orson

402 Union Avenue, Williamsburg

Developed by 402 Union Associates LLC | Design by Makers Collective

6 stories | 6 units

Estimated late 2025 occupancy

3 public availabilities from $1.799 million

Developed by 402 Union Associates LLC | Design by Makers Collective

6 stories | 6 units

Estimated late 2025 occupancy

3 public availabilities from $1.799 million

The Orson (Serhant)

The Orson (Serhant)

The six apartments at The Orson comprise one two-bedroom duplex, two three-bedroom penthouses, and a trio of floor-through three-bedrooms in between. All interiors feature oversized windows, herringbone wood floors, designer kitchens with eat-in peninsulas and high-end appliances, king-sized primary suites, and in-unit washers and dryers. Many units have private outdoor space, and the building is topped by a furnished, landscaped roof deck with a pergola, an outdoor kitchen, and beautiful Manhattan skyline views.

The Orson, #PH2 (Serhant)

259 Halsey Street, Bedford-Stuyvesant

Developed by 259-261 Halsey St LLC | Design by Infocus Design Planning

4 stories | 8 units

Immediate Occupancy

3 public availabilities from $850K

4 stories | 8 units

Immediate Occupancy

3 public availabilities from $850K

259 Halsey Street (Corcoran Group)

259 Halsey Street (Corcoran Group)

259 Halsey Street is a new construction condominium located in close proximity to neighborhood favorites; Corto Cafe is across the street, and Peaches HotHouse is one block away. Two units per floor allows for excellent privacy, and seven of the eight apartments have private outdoor space. All interiors feature 9-foot ceilings, floor-to-ceiling windows, gracious foyers, designer kitchens, and in-unit laundry. Mounted iPads control the building's video intercom system.

259 Halsey Street, #1F (Corcoran Group)

974 Bergen Street, Crown Heights

3 stories | 3 units

Fall 2025 occupancy

1 public availability for $1.3 million

Fall 2025 occupancy

1 public availability for $1.3 million

974 Bergen Street (Corcoran Group)

974 Bergen Street (Corcoran Group)

974 Bergen Street is a boutique condo conversion located at the nexus of Prospect Heights, Crown Heights, and Clinton Hill. The exterior offers a contemporary take on prewar brownstones, and interiors marry Old World details and modern luxury with sleek chef's kitchens under beamed ceilings. Additional perks include spa-like primary baths, generous storage space, and private outdoor space in every unit.

974 Bergen Street, #2 (Corcoran Group)

The OpenAire

26-15 4th Street, Astoria

Developed by Ming & Garden Realty | Design by HCD Architect

13 stories | 143 units

Occupancy Early 2026

3 public availabilities from $1.799 million

Developed by Ming & Garden Realty | Design by HCD Architect

13 stories | 143 units

Occupancy Early 2026

3 public availabilities from $1.799 million

The OpenAire is a new development condominium near Astoria's Hallets Point waterfront, which allows for close proximity to the Astoria ferry landing. Apartments feature oversized soundproof windows, custom kitchens with premium appliances, contemporary baths, generous closet space, and private balconies in many units. Amenities include an attended lobby, a fitness center, a lounge with space for relaxing and coworking, a second-story terrace, and a roof terrace with BBQ grills and beautiful skyline and river views. The building also offers shuttle service to area subways.

The OpenAire

The OpenAire

The OpenAire, #7-L (Modern Spaces)

Would you like to tour any of these properties?

Just complete the info below.

Or call us at (212) 755-5544

Would you like to tour any of these properties?

Contributing Writer

Cait Etherington

Cait Etherington has over twenty years of experience working as a journalist and communications consultant. Her articles and reviews have been published in newspapers and magazines across the United States and internationally. An experienced financial writer, Cait is committed to exposing the human side of stories about contemporary business, banking and workplace relations. She also enjoys writing about trends, lifestyles and real estate in New York City where she lives with her family in a cozy apartment on the twentieth floor of a Manhattan high rise.

6sqft delivers the latest on real estate, architecture, and design, straight from New York City.

6sqft delivers the latest on real estate, architecture, and design, straight from New York City.