New Progressive Mansion Tax for New York State (CityRealty)

New Progressive Mansion Tax for New York State (CityRealty)

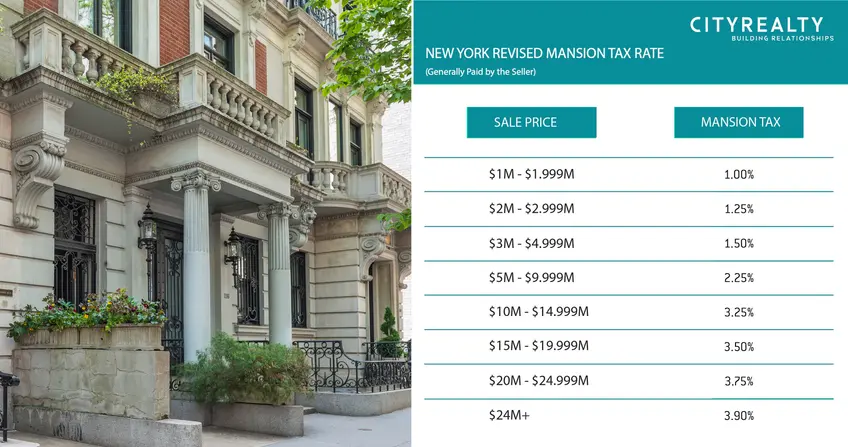

An initial proposal would have levied a hefty pied-a-terre tax on property owners who don’t live in New York City on a full-time basis. This proposal fell through after a successful lobbying effort on behalf of New York City’s real estate sector. But in its place, another proposal, which will come into effect in 2020, emerged. The proposal expands an already existing “mansion tax,” but in this case, the tax only impacts property owners in New York City (the existing “mansion tax” applied to all New York State properties worth more than $1 million) and places the greatest tax burden on buyers in the ultra-luxury real estate market. As stated in the New York State 2020 budget released on April 1, “To raise resources for the MTA, the Enacted FY 2020 Budget implements a progressive transfer tax with a combined top rate of 4.15% on the sale of residential properties valued at $25 million or above in New York City.”

The new tax on luxury properties is expected to raise $365 million from high-end property transfers. But the money still won’t cover all the required MTA upgrades. According to the budget, the total cost of upgrading the MTA will be $5 billion, which means the expanded real estate transfer tax will really just be a drop in the bucket.

220 Central Park South where many sales would have had to pay the steepest mansion tax rates. Image via Vornado Realty Trust and Robert A.M. Stern Architects.

220 Central Park South where many sales would have had to pay the steepest mansion tax rates. Image via Vornado Realty Trust and Robert A.M. Stern Architects.

In this article:

New York’s Pre-existing Mansion Tax

New York’s original real estate transfer tax on luxury properties was rolled out by Governor Mario Cuomo in 1989. At the time, the elder Cuomo levied a 1% tax on homes statewide that sold for $1 million or more. Back in 1989, referring to the state’s real estate transfer tax as a “mansion tax” made sense since few people were buying or selling properties worth $1 million or more.

As time passed, however, the average price of properties, especially in New York City, crept up, subjecting more middle-income buyers to the so-called mansion tax. At the same time, more foreign buyers arrived, including those buying high-valued investment properties. Under the existing transfer tax, foreign buyers, even those in the ultra-rich category, are subject to the same transfer tax as many middle-income New Yorkers purchasing a property they intend to use as their primary residence. The proposed change won’t eliminate the 1% tax that already impacts anyone purchasing a property worth more than $1 million but it will require people purchasing real mansions to pay a much higher transfer tax at the time of purchase.

high-priced townhouses on the Upper East Side (CityRealty)

high-priced townhouses on the Upper East Side (CityRealty)

What Changed July 1, 2019

The revised “mansion tax” is a straight-forward way to tax buyers in the luxury market and tax buyers in the ultra-luxury market at a much higher rate than anyone else. As previously noted, New York buyers already pay a luxury tax of 1% on all home purchases of $1 million or more. The proposed budget changes simply up the ante. If you purchase a home worth $2 million or more, you’ll now be expected to pay a tax of 1.25%. If you purchase a home worth $10 to $15 million, you’ll be expected to pay a tax of 3.5%. If you purchase a home worth $25 million or more, the proposed tax rate will be 4.15%.

Impact on the New York City Real Estate Market

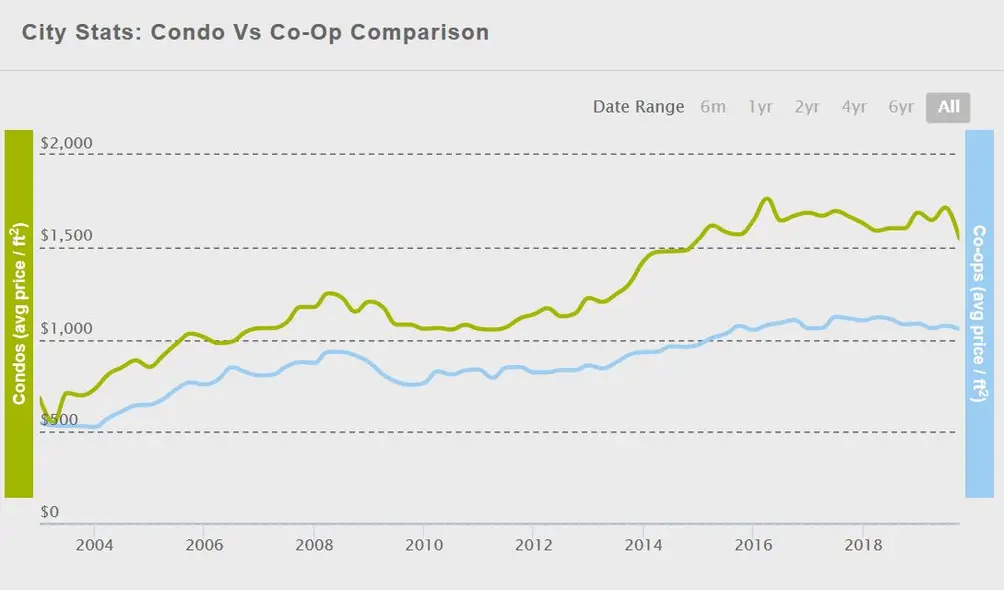

While the general consensus is that the proposed tax will at least not be as devastating as the originally proposed pied-a-terre tax likely would have been. The original proposal would have disproportionately targeted foreign buyers by requiring them to pay higher property taxes annually. Given existing restrictions both at home and abroad, local real estate professionals had reason to believe this pied-a-terre tax might drive away even remaining foreign buyers. Several brokerages and publications have already reported a dramatic drop in sales volume and prices on properties that would be impacted by the new tax. CORE reports that Manhattan median closing sale prices have dipped below the $1 million mark to $999,950, the first time since 2015. In the third quarter of 2019, sale prices dropped 17% from a year ago and sales volume of condominiums and cooperatively owned apartments, or co-ops, fell 6% to 2,299.

First, given that the highest value properties will now be hit with the highest transfer taxes, there is no question that New York City is no longer quite as attractive to buyers in the luxury market as it was in the past. Second, since the tax only applies to New York but not to suburbs in other states within the region, the tax may be good news for the luxury real estate market located just outside New York City, in New Jersey and Connecticut. But if someone is really looking to buy in the luxury market, will any of this matter? To put things into perspective, had the revised mansion tax already been in place when Ken Griffin bought at 220 Central Park South for $238 million in January, according to Frederick W. Peters—Warburg Realty’s CEO—he would have been slapped with an additional $7.2 million in taxes. But would this have stopped Griffin from closing the deal? Likely not.

In the end, the revised mansion tax has the biggest impact on the glut of high-priced condos already sitting on the market that are priced above $3 million. Given that it may become even harder to move those units once the new tax kicks in, it seems likely that price drops on at least some higher-end condos may be coming to the city shortly.

Manhattan condo and co-op sales market as of October 1, 2019 (CityRealty)

Manhattan condo and co-op sales market as of October 1, 2019 (CityRealty)

6sqft delivers the latest on real estate, architecture, and design, straight from New York City.

6sqft delivers the latest on real estate, architecture, and design, straight from New York City.