252 East 57th Street, #59A (Douglas Elliman Real Estate) | https://cityrealty.com/n/I2731561

252 East 57th Street, #59A (Douglas Elliman Real Estate) | https://cityrealty.com/n/I2731561

Manhattan real estate is widely regarded as a safe long-term investment, but occasionally, rare and compelling scenarios arise, such as sellers willing to take a loss on their home purchase. Even during the depths of the COVID years in 2021, more than 75% of Manhattan apartments last purchased between 2014 and 2020 resold at a gain. Fast-forward to today: of nearly 9,000 active sale listings across core NYC neighborhoods, we found fewer than 500 are priced below their previous sale price.

So, why would anyone willingly take a loss in one of the world’s most expensive and resilient housing markets? The reasons vary. The reasons vary. Some sellers are under financial pressure, whether from business setbacks or rising carrying costs (especially in land-lease buildings). Others may be making personal or strategic exits or have discovered that renting out their apartment wasn’t as profitable as hoped.

In this article:

A closer look at the roughly 500 listings now asking less than their last sale show some trends: many were purchased at the height of the market between 2014 and 2017. Certain properties, such as within Trump-branded buildings, for instance, have average prices down by over 25% since 2016. And some neighborhoods, including East Harlem, Hell’s Kitchen, and the Financial District, have yet to fully recover from the pandemic for reasons ranging from less of a need to be close to the office to quality-of-life issues that increased during the pandemic.

Meanwhile, recently constructed units with generic white box designs, units in need of renovation/updating, overly efficient layouts, and fixtures and flourishes that may become dated once newer product hits the market, also seem to hold their value less than their timeless or more traditionally designed counterparts.

Brooklyn, on the other hand, has almost no “underwater” listings. as prices have been dramatically increasing over the last two decades. But still, Manhattan, the island that it is, remains a market unto itself: where housing is scarce, cranes are bewilderingly few, demand is constant, and the housing crisis trudges on, all of which help keep the soil fertile for long-term appreciation.

Meanwhile, recently constructed units with generic white box designs, units in need of renovation/updating, overly efficient layouts, and fixtures and flourishes that may become dated once newer product hits the market, also seem to hold their value less than their timeless or more traditionally designed counterparts.

Brooklyn, on the other hand, has almost no “underwater” listings. as prices have been dramatically increasing over the last two decades. But still, Manhattan, the island that it is, remains a market unto itself: where housing is scarce, cranes are bewilderingly few, demand is constant, and the housing crisis trudges on, all of which help keep the soil fertile for long-term appreciation.

For buyers, these rare loss listings offer a potential window of opportunity, especially in today’s high-interest-rate, low-inventory environment, where contract activity is cooling and many sellers are more negotiable than usual.

Of course, some owners might have simply overpaid for the unit at the time of purchase, since not every sale is about timing the market and thinking of the unit as an investment vehicle. Nevertheless, homes in well-run buildings with solid financials, distinctive layouts, and proximity to transit, dining, and cultural centers are best positioned to hold their value over time.

Below, you'll find a table and select listings currently asking less than their last recorded purchase price.

Of course, some owners might have simply overpaid for the unit at the time of purchase, since not every sale is about timing the market and thinking of the unit as an investment vehicle. Nevertheless, homes in well-run buildings with solid financials, distinctive layouts, and proximity to transit, dining, and cultural centers are best positioned to hold their value over time.

Below, you'll find a table and select listings currently asking less than their last recorded purchase price.

Select listings selling at a loss

-19% off from 2018 closing price of $524,399

305 West 150th Street, #501

$424,000 (-4.5%)

Harlem | Condominium | 1 Bedroom, 1 Bath | 526 ft2

-19% off from 2018 closing price of $524,399

305 West 150th Street, #501

$424,000 (-4.5%)

Harlem | Condominium | 1 Bedroom, 1 Bath | 526 ft2

305 West 150th Street, #501 (Corcoran Group)

-1% off from 2022 closing price of $455,000

811 Cortelyou Road, #2L

$450,000

Kensington | Cooperative | 1 Bedroom, 1 Bath | 720 ft2

811 Cortelyou Road, #2L (Compass)

-17% off from 2022 closing price of $715,000

Castle Village, #72

$595,000 (-8.5%)

Washington Heights | Cooperative | 1 Bedroom, 1 Bath | 920 ft2

Castle Village, #72 (Compass)

-29% off from 2018 closing price of $842,115

The Style, #5C

$599,000 (-19%)

East Harlem | Condominium | 2 Bedrooms, 2 Baths | 858 ft2

The Style, #5C (Next Stop NY)

-2% off from 2018 closing price of $665,000

Gramercy Arms, #8H

$649,995

Gramercy Park | Cooperative | Studio, 1 Bath

Gramercy Arms, #8H (Compass)

-10% off from 2016 closing price of $779,000

The Peter James, #7F

$699,000 (-10.3%)

Gramercy Park | Cooperative | 1 Bedroom, 1 Bath | 750 ft2

The Peter James, #7F (Compass)

-4% off from 2021 closing price of $885,000

2 Fifth Avenue, #2E

$850,000 (-14.6%)

Greenwich Village | Cooperative | Studio, 1 Bath

2 Fifth Avenue, #2E (Douglas Elliman Real Estate)

-22% off from 2016 closing price of $1,150,000

432 West 52nd Street, #7H

$895,000 (-8.2%)

Midtown West | Condominium | 1 Bedroom, 1 Bath | 682 ft2

432 West 52nd Street, #7H (Brown Harris Stevens Residential Sales LLC)

-5% off from 2015 closing price of $999,999

The Adlon, #10D

$945,000

Midtown West | Cooperative | 1 Bedroom, 1 Bath

The Adlon, #10D (Corcoran Group)

-13% off from 2017 closing price of $1,150,000

100 Avenue A, #2B

$995,000 (-11.6%)

East Village | Condominium | 1 Bedroom, 1 Bath | 678 ft2

100 Avenue A, #2B (Compass)

Would you like to tour any of these properties?

Just complete the info below.

Or call us at (212) 755-5544

-15% off from 2016 closing price of $1,175,000

London Terrace Towers, #6J

$999,000 (-4.9%)

Chelsea | Cooperative | 1 Bedroom, 1 Bath

London Terrace Towers, #6J (Compass)

-21% off from 2017 closing price of $1,270,000

Coda Condominium, #11A

$999,000 (-8.8%)

Gramercy Park | Condominium | 1 Bedroom, 1 Bath | 770 ft2

Coda Condominium, #11A (Compass)

-16% off from 2021 closing price of $1,425,000

The Alameda, #2D

$1,199,000 (-7.7%)

Riverside Dr./West End Ave. | Cooperative | 2 Bedrooms, 2 Baths

The Alameda, #2D (Douglas Elliman Real Estate)

-15% off from 2016 closing price of $1,471,371

325 Lex, #27D

$1,250,000 (-20.9%)

Murray Hill | Condominium | 1 Bedroom, 1 Bath | 643 ft2

325 Lex, #27D (Nest Seekers LLC)

-14% off from 2016 closing price of $1,624,109

The Beekman Residences, #21B

$1,395,000 (-12.5%)

Financial District | Condominium | 1 Bedroom, 1 Bath | 855 ft2

The Beekman Residences, #21B (Compass)

-11% off from 2023 closing price of $1,750,000

993 Park Avenue, #8E

$1,550,000 (-11.4%)

Carnegie Hill | Cooperative | 2 Bedrooms, 2 Baths

993 Park Avenue, #8E (Brown Harris Stevens Residential Sales LLC)

-15% off from 2021 closing price of $1,934,675

North Park Tower, #17A

$1,650,000

East Harlem | Condominium | 3 Bedrooms, 3 Baths | 2,018 ft2

North Park Tower, #17A (Bond New York Properties LLC)

-22% off from 2019 closing price of $2,150,000

Trump Parc East, #11D

$1,670,000 (-11.9%)

Midtown West | Condominium | 1 Bedroom, 1 Bath | 838 ft2

Trump Parc East, #11D (Trump International Realty New York)

-20% off from 2017 closing price of $2,199,420

50 West, #17C

$1,749,000 (-2.3%)

Financial District | Condominium | 1 Bedroom, 1 Bath | 1,080 ft2

50 West, #17C (Time Equities Brokerage LLC)

-10% off from 2017 closing price of $2,167,000

51 Jay Street, #5D

$1,950,000 (-10.3%)

DUMBO | Condominium | 2 Bedrooms, 2.5 Baths | 1,382 ft2

51 Jay Street, #5D (Compass)

-13% off from 2017 closing price of $2,853,850

551W21, #3E

$2,475,000 (-10%)

Chelsea | Condominium | 1 Bedroom, 1.5 Baths | 1,521 ft2

551W21, #3E (Douglas Elliman Real Estate)

-17% off from 2017 closing price of $3,000,000

12 East 88th Street, #2D

$2,500,000 (-9.1%)

Carnegie Hill | Condominium | 2 Bedrooms, 2 Baths | 1,449 ft2

12 East 88th Street, #2D (Compass)

-1% off from 2021 closing price of $3,035,000

11 Hoyt, #39F

$2,995,000

Downtown Brooklyn | Condominium | 3 Bedrooms, 3 Baths | 1,743 ft2

11 Hoyt, #39F (Elegran LLC)

-15% off from 2015 closing price of $3,750,000

130 East 75th Street, #5A

$3,195,000 (-3%)

Park/Fifth Ave. to 79th St. | Cooperative | 3 Bedrooms, 2.5 Baths

130 East 75th Street, #5A (Douglas Elliman Real Estate)

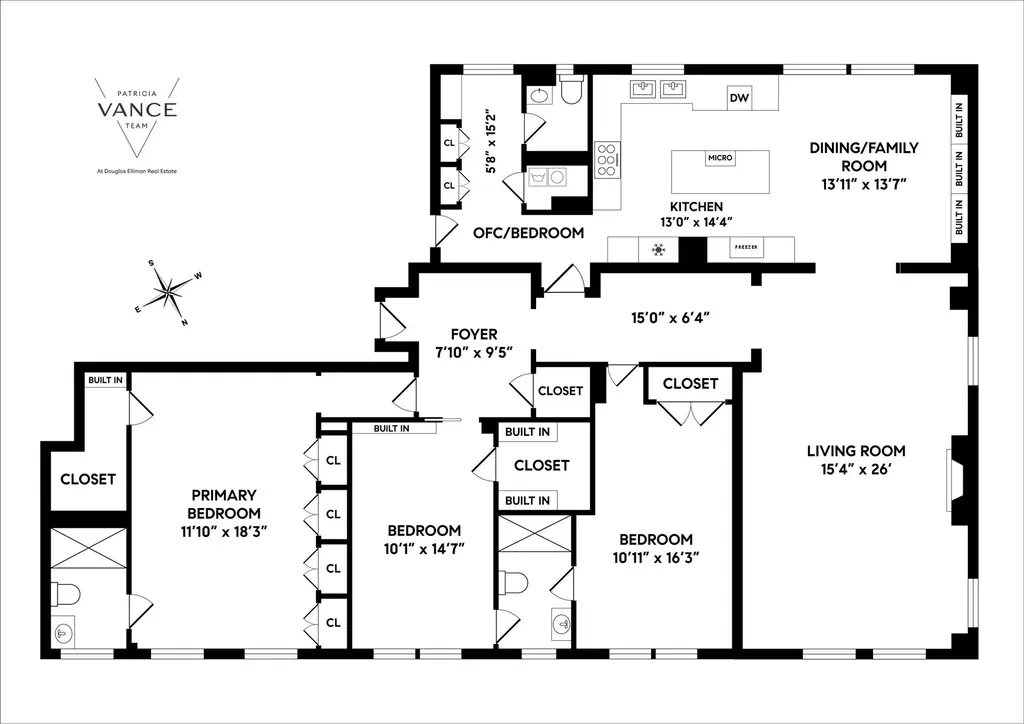

-26% off from 2017 closing price of $6,112,500

252 East 57th Street, #59A

$4,500,000

Midtown East | Condominium | 3 Bedrooms, 3 Baths | 2,246 ft2

252 East 57th Street, #59A (Douglas Elliman Real Estate)

-34% off from 2019 closing price of $7,004,719

Fifteen Hudson Yards, #63A

$4,600,000 (-16.4%)

Midtown West | Condominium | 2 Bedrooms, 2.5 Baths | 2,080 ft2

Fifteen Hudson Yards, #63A (Brown Harris Stevens Residential Sales LLC)

-22% off from 2016 closing price of $6,417,500

One Vandam, #9B

$4,999,000 (-9%)

SoHo | Condominium | 3 Bedrooms, 3.5 Baths | 2,221 ft2

One Vandam, #9B (Serhant)

-18% off from 2018 closing price of $10,500,000

101 West 78th Street, #3A

$8,650,000 (-3.8%)

Broadway Corridor | Condominium | 4 Bedrooms, 3.5 Baths | 4,050 ft2

101 West 78th Street, #3A (Compass)

Would you like to tour any of these properties?

Just complete the info below.

Or call us at (212) 755-5544

Would you like to tour any of these properties?

6sqft delivers the latest on real estate, architecture, and design, straight from New York City.

6sqft delivers the latest on real estate, architecture, and design, straight from New York City.