119 Waverly Place, #34 (Compass)

119 Waverly Place, #34 (Compass)

Whether you're buying a luxury condo or an entry-level co-op, bidding wars have become common for approachably-priced units in sought-after locations. While elevated interest rates have priced out some buyers, in some markets they’ve only made bidding wars less intense—not eliminated them altogether. As more people have turned to renting instead of buying, a new challenge has emerged: bidding wars in the rental market. This article explores how to win a bidding war, whether you're buying or renting, and more importantly, how to avoid getting caught in one in the first place.

In this article:

Bidding Wars on the Buying Side of the Market

When you're looking to buy a property in a high-demand and low-inventory market, bidding wars are often a factor with which you must contend. Unique to the pandemic market has been the number and intensity of bidding wars.

Early in the pandemic, as many New Yorkers fled the city, bidding wars surged over suburban homes and rural properties. As time went on, they became common in popular Brooklyn neighborhoods, with buyers seeking larger apartments and townhouses. Since 2022, rising mortgage rates have made bidding wars less frequent. However, activity has picked up in recent months, and new supply—especially in Manhattan—remains limited. As buyers adjust to higher rates and the rental market stays red-hot, competition for well-priced units in prime locations is expected to intensify. So, how do you win a bidding war??

Early in the pandemic, as many New Yorkers fled the city, bidding wars surged over suburban homes and rural properties. As time went on, they became common in popular Brooklyn neighborhoods, with buyers seeking larger apartments and townhouses. Since 2022, rising mortgage rates have made bidding wars less frequent. However, activity has picked up in recent months, and new supply—especially in Manhattan—remains limited. As buyers adjust to higher rates and the rental market stays red-hot, competition for well-priced units in prime locations is expected to intensify. So, how do you win a bidding war??

#1. Bid high, but not over your threshold or the home’s appraised value

Don't go bargain hunting if you're likely to face a bidding war. Under-bidding won't get you anywhere. That said, also avoid going to the opposite extreme and bidding well over the asking price. If you do and you require financing, you may not be approved, even if you previously prequalified.#2. Consider writing a homeowners’ “love letter”

As stated on the National Association of Realtors' (NAR) website: “To entice a seller to choose their offer, buyers sometimes write ‘love letters’ to describe the many reasons why the seller should ‘pick them.’” Some families go further, including pictures and even video testimonies of their families. While they may appear harmless, as the NAR further notes, “these letters can actually pose fair housing risks because they often contain personal information and reveal characteristics of the buyer, such as race, religion, or familial status, which could then be used, knowingly or through unconscious bias, as an unlawful basis for a seller’s decision to accept or reject an offer.” In fact, buyers’ love letters are so controversial that in recent years several states, including Oregon, Washington, and California, have imposed bans on the letters. However, in March 2022, a federal judge overturned the state bans, concluding that banning buyers’ love letters violates First Amendment rights. So, do they work? In the case of a multi-offer situation, the reality is that a personal appeal to the owner can be a criteria factor.#3. Let the seller set the timeline for closing

Although some advice on how to win a bidding war on a home suggests waiving contingencies (e.g., your home inspection or financing contingency), waiving contingencies designed to protect you and your money is never advisable. In most cases, potential buyers do this to ensure a quick close. A better strategy is to maintain all the contingencies in your contract but commit to the fastest possible close. After all, most sellers' are eager to close as soon as possible. If the seller, however, needs more time, also agree to work with the timeline. Letting them move out when they are ready (e.g., when they have found a new home) is another great way to secure a home when facing tough competition from other buyers.#4. Look for whisper listings

The best way to win a bidding war is to never enter one in the first place. In fact, this is one of the reasons that whisper listings or pocket listings have become increasingly popular over the past two years. In a nutshell, these listings are never publicly listed (e.g., on the MLS), and as a result, attract fewer buyers, reducing the likelihood of a multi-offer situation.Bidding Wars on the Rental Side of the Market

As buying a home becomes more difficult due to higher interest rates, strong demand, and low

inventory, it is no surprise that the demand for rental units is also surging, and this is creating bidding wars on the rental side of the market. In fact, according to Douglas Elliman's January 2025 Market Report, "The market share of bidding wars rose to 31.4%, a new high, up from 20.5% in the same period last year.". For renters, finding and securing an apartment isn't the only challenge. As bidding wars heat on the rental side of the market, brokerage fees are also surging.

After attempts by the city and state to ban brokerage fees in cases where brokers are representing a landlord (the state regulation was quickly overturned after the Real Estate Board of New York and the New York State Association of Realtors filed a lawsuit) brokers are reporting some of the highest fees ever on rentals. According to one account, some brokers are now charging renters as much as 18-20% of the first year’s rent to help secure a unit (in the past, the average has been closer to 8.5%, with high brokerage fees peaking around 15%).

Unsurprisingly, the current situation is leading many renters to adopt strategies not unlike that of desperate buyers (e.g., offering to pay more than the asking price, renting apartments that haven't yet gone on the market and renting apartments site unseen and writing renter "love letters"). There are also a few other things one can do to win a bidding war on the rental side of the market.

After attempts by the city and state to ban brokerage fees in cases where brokers are representing a landlord (the state regulation was quickly overturned after the Real Estate Board of New York and the New York State Association of Realtors filed a lawsuit) brokers are reporting some of the highest fees ever on rentals. According to one account, some brokers are now charging renters as much as 18-20% of the first year’s rent to help secure a unit (in the past, the average has been closer to 8.5%, with high brokerage fees peaking around 15%).

Unsurprisingly, the current situation is leading many renters to adopt strategies not unlike that of desperate buyers (e.g., offering to pay more than the asking price, renting apartments that haven't yet gone on the market and renting apartments site unseen and writing renter "love letters"). There are also a few other things one can do to win a bidding war on the rental side of the market.

#1. Get your paperwork in order and bring it to the open house

In today's rental market, no one has time to wait for a prospective tenant to get their paperwork together. If you're on the rental market, know your price range (remember that it will be tough to rent anything that exceeds a third of your monthly income) and come in with proof you are making what you claim to be making. Among other things, be prepared to share your recent tax records with W2s or 1099s, recent paystubs, and potentially even bank statements. Having all this paperwork on hand and ready to hand over at a showing is a great way to get to the front of the line.#2. Create a renter resume

In addition to showing up with your required financial paperwork in order, create a renter resume, essentially a one- to two-page overview listing all your addresses in recent years with contact information for all your past landlords and other pertinent information (e.g., your current employer, length of employment, etc.). It's not a requirement, but most landlords and management companies—not to mention the brokers who will present your case to these owners—will appreciate the effort to be fully transparent.#3. Show up as a model tenant

Although subject to ongoing debate, in most cases, landlords can reject tenants with pets or certain types of pets (e.g., dogs over 20 pounds), unless the pet is a service animal. Likewise, landlords have considerable leeway to select tenants for other reasons (e.g., to rent to a librarian with a full-time position over a self-employed drummer). The more you can do to show looking like a model tenant, the better off you'll be.

Would you like to tour any of these properties?

Just complete the info below.

Or call us at (212) 755-5544

Discounted listings with open houses that just might spark a bidding war

100 Remsen Street, #5H

$419,000 (-6.7%)

Brooklyn Heights | Cooperative | 1 Bedroom, 1 BathOpen House: Sunday, March 9

100 Remsen Street, #5H (Corcoran Group)

The Penny Lane, #101

$675,000 (-8.2%)

Gramercy Park | Cooperative | 1 Bedroom, 1 Bath

Open House: Sunday, March 9

The Penny Lane, #101 (Compass)

Majestic Towers, #5B

$700,000

Broadway Corridor | Cooperative | 1 Bedroom, 1 BathOpen House: Sunday, March 9

Majestic Towers, #5B (Douglas Elliman Real Estate)

(Common Terrace)

575 Fourth Avenue, #6A

$870,000 (-8.3%)

Park Slope | Condominium | 1 Bedroom, 1 Bath | 670 ft2Open House: Sunday, March 9

575 Fourth Avenue, #6A (Brown Harris Stevens Residential Sales LLC)

Hudson View Gardens, #D11

$755,000 (-2.6%)

Washington Heights | Cooperative | 2 Bedrooms, 1 Bath | 1,000 ft2Open House: Sunday, March 9

Hudson View Gardens, #D11 (Brown Harris Stevens Residential Sales LLC)

330 Third Avenue, #2C

$950,000 (-13.6%)

Gramercy Park | Cooperative | 2 Bedrooms, 2 Baths | 1,100 ft2Open House: Sunday, March 9

330 Third Avenue, #2C (Brown Harris Stevens Residential Sales LLC)

The Forum, #503

$998,000 (-5%)

Central Park West | Condominium | 1 Bedroom, 1 Bath | 825 ft2Open House: Sunday, March 9

The Forum, #503 (Corcoran Group)

124 East 84th Street, #8D

$999,000 (-8.8%)

Carnegie Hill | Cooperative | 2 Bedrooms, 1.5 BathsOpen House: Sunday, March 9

124 East 84th Street, #8D (Compass)

The Club at Turtle Bay, #18E

$1,300,000 (-3.7%)

Turtle Bay/United Nations | Condominium | 2 Bedrooms, 2 Baths | 1,040 ft2Open House: Sunday, March 9

The Club at Turtle Bay, #18E (Brown Harris Stevens Residential Sales LLC)

New West, #11H

$1,649,000 (-4.4%)

Riverside Dr./West End Ave. | Condominium | 2 Bedrooms, 2.5 BathsOpen House: Sunday, March 9

New West, #11H (Brown Harris Stevens Residential Sales LLC)

Carlton Regency South, #2C

$999,000 (-23.1%)

Murray Hill | Cooperative | 2 Bedrooms, 1 BathOpen House: Sunday, March 9

Carlton Regency South, #2C (Corcoran Group)

254 Park Avenue South, #6C

$1,299,950 (-13.3%)

Flatiron/Union Square | Condominium | 1 Bedroom, 1 Bath | 669 ft2Open House: Sunday, March 9

254 Park Avenue South, #6C (Douglas Elliman Real Estate)

Chelsea Mews, #PH12C

$1,475,000 (-10.6%)

Chelsea | Cooperative | 1 Bedroom, 1.5 BathsOpen House: Sunday, March 9

Chelsea Mews, #PH12C (Serhant)

400 East 59th Street, #15F

$1,595,000 (-11.1%)

Beekman/Sutton Place | Cooperative | 2 Bedrooms, 2 BathsOpen House: Sunday, March 9

400 East 59th Street, #15F (Nest Seekers LLC)

301 East 50th Street, #9C

$2,275,000 (-8.8%)

Turtle Bay/United Nations | Condominium | 2 Bedrooms, Unknown Baths | 1,459 ft2Open House: Sunday, March 9

301 East 50th Street, #9C (Sothebys International Realty)

Manhattan House, #B205

$2,288,000 (-4.6%)

Lenox Hill | Condominium | 3 Bedrooms, 2 Baths | 1,450 ft2Open House: Sunday, March 9

Manhattan House, #B205 (Compass)

The American Thread Building, #4G

$2,795,000 (-15.2%)

Tribeca | Condominium | 3 Bedrooms, 2 Baths | 1,450 ft2Open House: Sunday, March 9

The American Thread Building, #4G (Corcoran Group)

The Cass Gilbert, #PHA

$4,000,000 (-19.2%)

Chelsea | Condominium | 3 Bedrooms, 3.5 Baths | 2,988 ft2Open House: Sunday, March 9

The Cass Gilbert, #PHA (Coldwell Banker Warburg)

131 East 38th Street, #TH

$4,499,999 (-9.1%)

Murray Hill | Townhouse | Studio | 4,250 ft2Open House: Sunday, March 9

131 East 38th Street, # (EXP Realty NYC)

One Prospect Park West, #6G

$5,695,000 (-12.3%)

Park Slope | Condominium | 4 Bedrooms, 3.5 Baths | 2,458 ft2Open House: Sunday, March 9

One Prospect Park West, #6G (Corcoran Group)

114 Liberty Street, #7

$5,999,000 (-7.7%)

Financial District | Condominium | 6+ Bedrooms, 4.5 Baths | 5,400 ft2Open House: Sunday, March 9

114 Liberty Street, #7 (Compass)

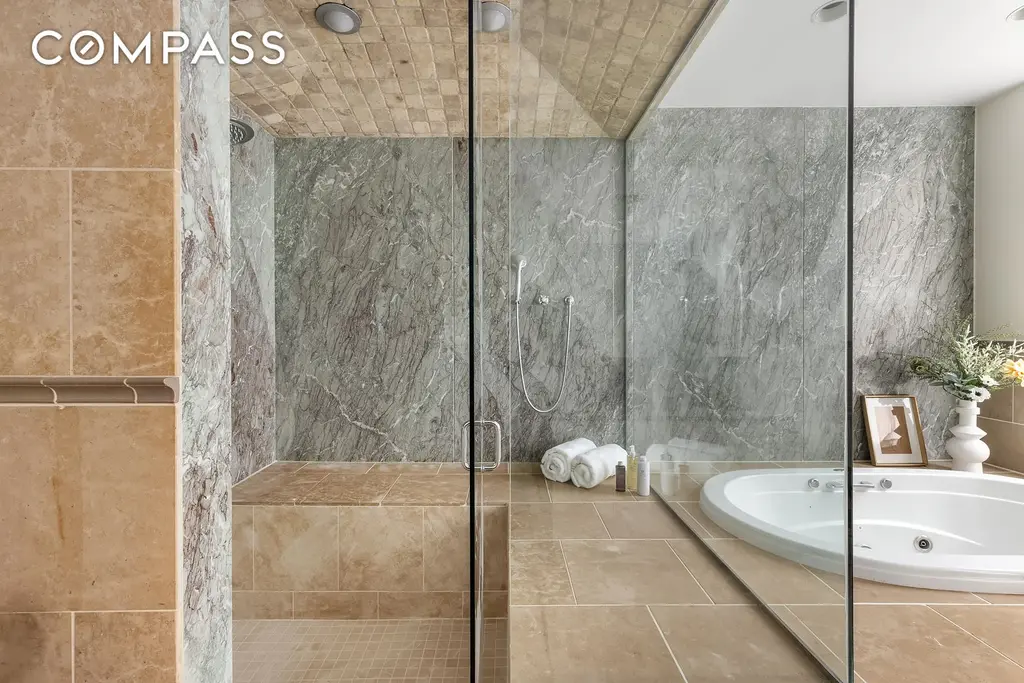

119 Waverly Place, #34

$6,495,000 (-43.5%)

Greenwich Village | Cooperative | 4 Bedrooms, 4 Baths | 3,600 ft2Open House: Sunday, March 9

119 Waverly Place, #34 (Compass)

The Centrale, #64

$6,895,000 (-13%)

Midtown East | Condominium | 3 Bedrooms, 3 Baths | 2,756 ft2Open House: Sunday, March 9

The Centrale, #64 (Douglas Elliman Real Estate)

Would you like to tour any of these properties?

Just complete the info below.

Or call us at (212) 755-5544

Would you like to tour any of these properties?

Contributing Writer

Cait Etherington

Cait Etherington has over twenty years of experience working as a journalist and communications consultant. Her articles and reviews have been published in newspapers and magazines across the United States and internationally. An experienced financial writer, Cait is committed to exposing the human side of stories about contemporary business, banking and workplace relations. She also enjoys writing about trends, lifestyles and real estate in New York City where she lives with her family in a cozy apartment on the twentieth floor of a Manhattan high rise.

6sqft delivers the latest on real estate, architecture, and design, straight from New York City.

6sqft delivers the latest on real estate, architecture, and design, straight from New York City.