New York City condos can be a great investment, which explains why many condo units are owned by individual investors and investment companies. Still, whether you're an investor or a resident owner, yielding a high return will likely rest on timing. So, how soon is too soon to sell a condo recently purchased from a developer? This article explores the key considerations and questions owners should contemplate before putting a nearly new condo on the market in New York City.

In this article:

Current market trends

Flipping properties can be a great way to make money, but doing so in New York City, especially in the new condo market, is considerably more complex than flipping a resale home or condo in most U.S. cities. Unlike other flips (e.g., buying an older home, investing in a few strategic renovations, and putting it back on the market), in the case of a nearly new condo, there are few ways to hedge your bets by investing in the property itself. Said differently, your ability to yield a return will likely depend nearly entirely on market trends.Historically, condos purchased early in the life cycle of a development tended to accrue value as the development inched toward completion, offering a strong return on investment for anyone who closed early and sold once construction reached completion. Recently, this trend hasn't necessarily held true, largely due to the surplus of luxury condos currently on the market. So, if you want to sell a nearly new condo, it will likely depend on whether or not there is a current surplus and market demand for the type of condo you're listing (e.g., is there high demand in the building or the condo's price range or location?).

Taxes

If you’re selling a condo in New York City, you’re going to pay. Local transfer taxes are 1% (for properties valued under $500,000) and 1.425% for properties valued at or over $500,000. At the state level, properties under $3 million pay an additional .040% and .065% if they are sold for $3 million or higher. Mansion taxes kick in at $1 million, which now includes most units sold in New York City – one expert points out that some studios meet this threshold – and start at 1% for units valued between $1 million and $1,999,999, rising as high as 3.9% for units valued over $25 million.In addition to transfer taxes, if you’re selling an investment property and not reinvesting the money in a comparable U.S. investment property, you’ll also be on the hook for capital gains. If, however, you’re selling a personal residence, as per IRS guidelines, you may qualify to exclude up to $250,000 of the gain from your income (and up to $500,000 if you file a joint return with your spouse), but there’s a catch. To qualify for the IRS exemption, you must have owned and occupied the home for at least two years over the past five years. This means that if you're flipping a condo shortly after purchasing it, even if your intent was originally to live in it, you're unlikely to avoid paying capital gains at the federal level.

Finally, depending on the development, flip taxes may also apply. While they are usually lower in condos than in coops (in most cases, roughly half a percentage point), any flip tax will chip away at your profit margin on the sale.

75 Kenmare Street, #6D

$4,950,000 (-5.7%)

NoLiTa/Little Italy | Condominium | 3 Bedrooms, 3.5 Baths | 1,791 ft2

Monthly Taxes: $3,469/month

75 Kenmare Street, #6D (Douglas Elliman Real Estate)

Impact on other units

If you invested in more than one unit in a specific condo development, there is one final consideration—the impact that selling sooner rather than later may have on the overall value of units in the development. While one unit going up for sale may or may not impact the value of other units in the development, especially if it is a large development, if a high proportion of units turn over quickly, the optics may look bad and subsequently drive down the overall value of units in the building. After all, a surge in sales in a new building is often a red flag to potential buyers that something is wrong with the building (e.g., a construction error or subpar services).Key questions to ask

So is it strategic to sell a nearly new condo in New York City? There is no rule of thumb, but in general, potential sellers need to consider the following factors:- Has the average price per square foot increased or decreased since the purchase?

- Are units currently in high demand in the building, and is the unit likely to sell quickly?

- What will the tax liability be on the unit based on the expected sale price?

- If you're a resident owner, will there be considerable savings if you occupy the unit long enough to avoid or lower the capital gains tax?

- If you're an investor and own other units in the same building, will the sale hurt the value of your other units?

Mint-condition resales

Brooklyn

205 MacDougal Street, #3B (Douglas Elliman Real Estate)

42 Rochester Avenue, #3 (Compass)

90 Troy Avenue, #3 (Berkshire Hathaway HomeServices New York Properties)

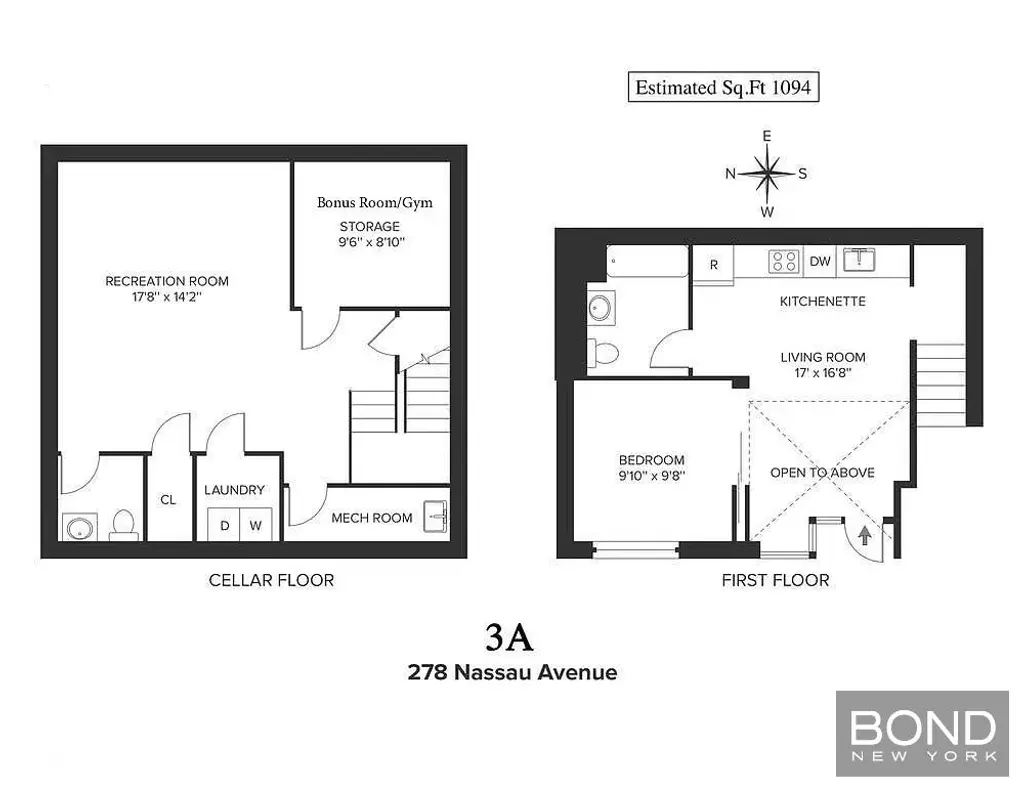

278 Nassau Avenue, #3A (Bond New York Properties LLC)

Oosten, #L32 (Compass)

Queens

12-15 Broadway, #705 (Bond New York Properties LLC)

Murano, #3H (Brown Harris Stevens Brooklyn LLC)

Would you like to tour any of these properties?

Just complete the info below.

Or call us at (212) 755-5544

Uptown

Vitre, #1403 (The Agency Brokerage)

Citizen360, #7D (Real New York)

554 East 82nd Street, #12 (Compass)

Midtown

The Dillon, #301 (Serhant)

540West, #104N (Serhant)

30E31, #18 (Brown Harris Stevens Residential Sales LLC)

The Dillon, #412 (Corcoran Group)

Griffin Court, #PHC (Compass)

301 East 50th Street, #4D

$2,998,000 (-14.2%)

Turtle Bay/United Nations | Condominium | 3 Bedrooms, 3.5 Baths | 2,405 ft2

301 East 50th Street, #4D (Berkshire Hathaway HomeServices New York Properties)

Downtown

Boutique 67, #3B (Corcoran Group)

W Residences, #PH53G (Corcoran Group)

287 East Houston Street, #3B

$1,195,000 (-7.7%)

Lower East Side | Condominium | 1 Bedroom, 1 Bath | 750 ft2

287 East Houston Street, #3B (Douglas Elliman Real Estate)

Norfolk Atrium, #301 (Brown Harris Stevens Residential Sales LLC)

50 Clinton Street, #2D (Brown Harris Stevens Residential Sales LLC)

50 West, #30A (Elegran LLC)

265 East Houston Street, #4

$2,000,000

Lower East Side | Condominium | 2 Bedrooms, 2 Baths | 1,400 ft2

265 East Houston Street, #4 (Compass)

The Beekman Residences, #21A

$2,575,000

Financial District | Condominium | 2 Bedrooms, 2.5 Baths | 1,625 ft2

The Beekman Residences, #21A (Serhant)

Would you like to tour any of these properties?

Just complete the info below.

Or call us at (212) 755-5544

Would you like to tour any of these properties?

Contributing Writer

Cait Etherington

Cait Etherington has over twenty years of experience working as a journalist and communications consultant. Her articles and reviews have been published in newspapers and magazines across the United States and internationally. An experienced financial writer, Cait is committed to exposing the human side of stories about contemporary business, banking and workplace relations. She also enjoys writing about trends, lifestyles and real estate in New York City where she lives with her family in a cozy apartment on the twentieth floor of a Manhattan high rise.

6sqft delivers the latest on real estate, architecture, and design, straight from New York City.

6sqft delivers the latest on real estate, architecture, and design, straight from New York City.