In a time of rapid global change and uncertainty, New York City’s economic indicators and robust business environment continue to reinforce its status as a leading global economic powerhouse. With a gross city product of over $2.5 trillion, the city's metropolitan area exceeds the economic output of South Korea. In 2023, the five boroughs recorded a new high of $1.286 trillion, with Manhattan contributing 73% ($939 billion); meanwhile, Brooklyn and Queens grew fastest at 3.7% and 3.2%, respectively, while the Bronx remained 2% below its 2019 levels.

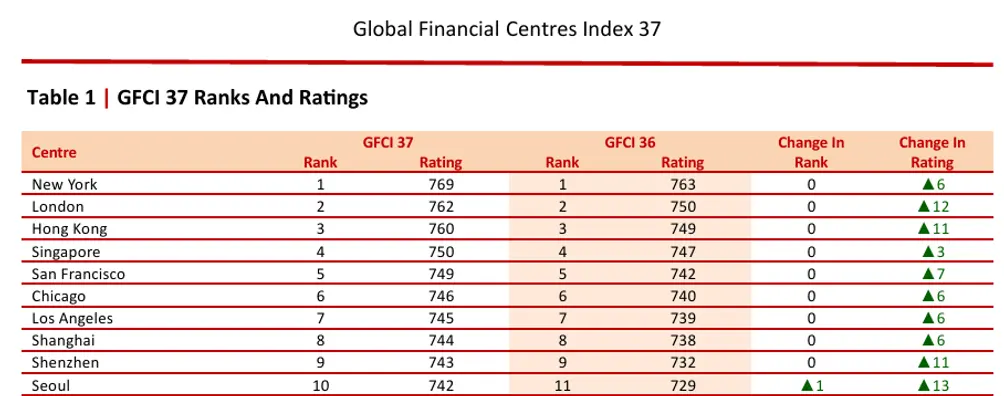

With over 50 Fortune 500 companies, including financial giants like JPMorgan Chase and Citigroup, the city drives significant global business activity, fostering innovation and maintaining its competitive edge. Last week, Z/Yen and the City of London released the 37th edition of the Global Financial Centres Index (GFCI), a bi-annual report evaluating and ranking major financial hubs worldwide. As of 2025, the New York metropolitan area remains the world’s leading fintech and financial center, followed by London and Hong Kong.

In this article:

The Global Financial Centres Index 37 | March 2025 | https://www.longfinance.net/media/documents/GFCI_37_Report_2025.03.20_v1.1.pdf

The Global Financial Centres Index 37 | March 2025 | https://www.longfinance.net/media/documents/GFCI_37_Report_2025.03.20_v1.1.pdf

The NYC Comptroller’s March 2025 New York by the Numbers Monthly Economic and Fiscal Outlook Report noted the city had a record 4.861 million jobs in January 2025—up 148,000 since February 2020 and 119,000 year-over-year. Private-sector employment increased by 112,000, driven by growth in health and social assistance, financial activities, and professional services, although manufacturing, construction, and retail remain moderately below pre-pandemic levels.

According to the NYC Department of City Planning, in 2024, the city added more housing units than in decades with nearly 40,000 new housing units coming online. However, rental demand continues to exceed supply. As of March 2025, CityRealty reported fewer than 3,000 market-rate rentals available in Manhattan—a record low that has contributed to record-high rental prices.

Broadway attendance and tourism have been strong, supported by the city's hotel capacity growing faster than any other U.S. city and with occupancy at 85%, well above the national average of 63%. Since the introduction of congestion pricing, subway ridership has recovered to 76% of pre-pandemic levels, with subway and bus ridership increasing by three and four percent, respectively.

JP Morgan Chase's new world headquarters at 270 Park Avenue | https://www.fosterandpartners.com/projects/270-park-avenue

JP Morgan Chase's new world headquarters at 270 Park Avenue | https://www.fosterandpartners.com/projects/270-park-avenue

Earlier today, a press release from the New York State Comptroller Thomas P. DiNapoli, reported that the Wall Street’s bonus pool hit a record $47.5 billion in 2024, a 34% increase from the previous year's $35.4 billion and the highest on record since 1987. Wall Street profits also surged by 90% in 2024. In parallel, Manhattan’s office market has continued its gradual recovery since spring 2023, while the outer boroughs’ office markets have remained largely flat. Financial services firms have played a key role in new leasing activity. DiNapoli notes, "Twenty-one other major financial firms are also active in the market, such as BlackRock, which is increasing its footprint in Hudson Yards to over a million square feet."

The state comptroller report also says Wall Street employment rose to its highest annual level in nearly three decades, with 201,500 finance industry jobs, up from 198,400 the previous year, surpassing the peak seen in 2000. JPMorgan Chase’s decision to return staff to a new 60-story headquarters in Midtown has further spurred economic growth.

As office attendance in New York City nears pre-pandemic levels, the shift is challenging for those who purchased homes in more distant and greener pastures boroughs to maximize space. However, Ryan Serhant, star of Netflix’s Owning Manhattan, told Bloomberg he expects the city to become “the pied-à-terre capital of the United States” by 2030, citing the persistence of hybrid work schedules.

Nevertheless, tor those seeking a quicker commute to their Midtown or Downtown offices, the following listings are conveniently located within a few blocks of New York's 20 largest Fortune 500 companies.

(20.) #188. KKR, 30 Hudson Yards,

Midtown West

Sector: Securities

Revenue (millions): $21,685

Employees: 4,490

Soori High Line, #PH9C (Compass)

(19.) #180. Marsh & McLennan, 350 Madison Avenue,

Midtown East

Sector: Diversified Financials

Revenue (millions): $22,736

Employees: 85,000

The Perrie, #1501 (Corcoran Group)

(18.) #172. Macy's, 151 West 34th Street,

Midtown West

Sector: General Merchandisers

Revenue (millions): $23,866

Employees: 85,581

241 West 36th Street, #7R (Compass)

(17.) #142. Paramount Global, 1515 Broadway,

Midtown West

Sector: Entertainment

Revenue (millions): $30,610

Employees: 24,150

LightSquare, #704 (Corcoran Group)

(16.) #136. Apollo Global Management, 9 West 57th Street,

Midtown West

Sector: Securities

Revenue (millions): $32,644

Employees: 6,855

The Plaza, #803 (Compass)

(15.) #130. Bank of New York Mellon, 240 Greenwich Street,

TriBeCa

Sector: Commercial Banks

Revenue (millions): $33,805

Employees: 53,400

200 Chambers Street, #4D (Sothebys International Realty)

(14.) #106. Warner Bros. Discovery, 230 Park Avenue South,

Flatiron -Union Square

Sector: Entertainment

Revenue (millions): $41,321

Employees: 35,300

The Randolph, #4E (Corcoran Group)

Would you like to tour any of these properties?

Just complete the info below.

Or call us at (212) 755-5544

(13.) #105. Travelers, 485 Lexington Avenue,

Midtown East

Sector: Insurance: Property and Casualty (Stock)

Revenue (millions): $41,364

Employees: 33,133

Monogram New York, #16D (Douglas Elliman Real Estate)

(12.) #96. TIAA, 730 Third Avenue,

Midtown East

Sector: Insurance: Life, Health (Mutual)

Revenue (millions): $45,735

Employees: 16,023

The Centrale, #41B (Douglas Elliman Real Estate)

(11.) #94. AIG, 1271 Avenue of the Americas,

Midtown West

Sector: Insurance: Property and Casualty (Stock)

Revenue (millions): $46,802

Employees: 25,200

53 West 53, #72B (Douglas Elliman Real Estate)

(10.) #78. New York Life Insurance, 51 Madison Avenue,

NoMad

Sector: Insurance: Life, Health (Mutual)

Revenue (millions): $54,317

Employees: 15,384

15 West 24th Street, #3

$4,300,000

Flatiron/Union Square | Cooperative | 4 Bedrooms, 3.5 Baths | 4,100 ft2

15 West 24th Street, #3 (Compass)

212 Fifth Avenue, #17A

$24,500,000

Flatiron/Union Square | Condominium | 4 Bedrooms, Unknown Baths | 4,155 ft2

212 Fifth Avenue, #17A (Sothebys International Realty)

(9.) #69. Pfizer, The Spiral, 66 Hudson Boulevard,

Midtown West

Sector: Pharmaceuticals

Revenue (millions): $58,496

Employees: 88,000

355 West, #8A (Corcoran Group)

(8.) #66. StoneX Group, 230 Park Avenue,

Midtown East

Sector: Diversified Financials

Revenue (millions): $60,856

Employees: 4,137

Waldorf Astoria Residences New York, #3005

$6,000,000

Midtown East | Condominium | 2 Bedrooms, 2.5 Baths | 1,560 ft2

Waldorf Astoria Residences New York, #3005 (Douglas Elliman Real Estate)

(7.) #60. MetLife, 200 Park Avenue,

Midtown East

Sector: Insurance: Life, Health (stock)

Revenue (millions): $66,905

Employees: 45,000

520 Fifth Avenue, #PH79 (Corcoran Sunshine Marketing Group)

(6.) #58. American Express, 200 Vesey Street,

Battery Park City

Sector: Diversified Financials

Revenue (millions): $67,364

Employees: 74,600

Riverhouse - One Rockefeller Park, #15R

$5,750,000

Battery Park City | Condominium | 3 Bedrooms, 3 Baths | 2,156 ft2

Riverhouse - One Rockefeller Park, #15R (R New York)

(5.) #41. Morgan Stanley, 1585 Broadway,

Midtown West

Sector: Commercial Banks

Revenue (millions): $96,194

Employees: 80,006

200 Central Park South, #29C (Compass)

(4.) #35. Goldman Sachs Group, 200 West Street,

Battery Park City

Sector: Commercial Banks

Revenue (millions): $108,418

Employees: 45,300

50 West, #18B

$4,950,000 (-3.9%)

Financial District | Condominium | 3 Bedrooms, 3.5 Baths | 2,309 ft2

50 West, #18B (Time Equities Brokerage LLC)

(3.) #31. Verizon Communications, 1095 Avenue of the Americas,

Midtown West

Sector: Telecommunications

Revenue (millions): $133,974

Employees: 105,400

The Bryant, #27B (Keller Williams NYC)

(2.) #21. Citigroup, 388 Greenwich Street,

TriBeCa

Sector: Commercial Banks

Revenue (millions): $156,820

Employees: 237,925

16 Jay Street, #1 (Compass)

(1.) #12. JPMorgan Chase, 270 Park Avenue,

Midtown East

Sector: Commercial Banks

Revenue (millions): $239,425

Employees: 309,926

432 Park Avenue, #54A (Douglas Elliman Real Estate)

Would you like to tour any of these properties?

Just complete the info below.

Or call us at (212) 755-5544

Would you like to tour any of these properties?

6sqft delivers the latest on real estate, architecture, and design, straight from New York City.

6sqft delivers the latest on real estate, architecture, and design, straight from New York City.