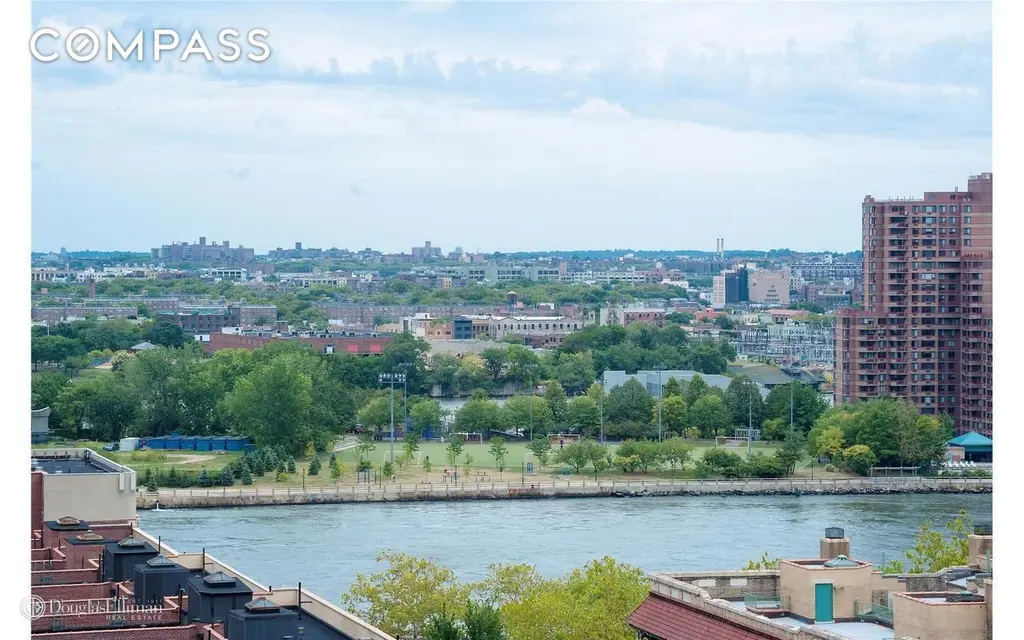

640 West End Avenue, #12C | BHS | https://www.cityrealty.com/nyc/riverside-dr-west-end-ave/640-west-end-avenue/8347/12C/uMEMirLbyPX

640 West End Avenue, #12C | BHS | https://www.cityrealty.com/nyc/riverside-dr-west-end-ave/640-west-end-avenue/8347/12C/uMEMirLbyPX

A key point of contention during the 2025 federal tax bill debate was the cap on the State and Local Tax (SALT) deduction. In short, the deduction allows taxpayers who itemize to deduct at least a portion of their state and local income, sales, and property taxes from their federal taxable income. Since 2018, the cap has been set at $10,000 per return for married couples filing jointly and $5,000 for those filing separately. Prior to 2018, the SALT deduction was effectively uncapped.

While the cap has not been eliminated, it will increase substantially under the new tax bill, which is welcome news for New Yorkers, particularly the city’s more than 1.1 million homeowners. This article examines how the SALT deduction cap increase will affect New Yorkers and explains who stands to benefit the most.

In this article:

How the SALT Deduction Works and What’s Changing for 2026

In early 2026, when New Yorkers file their 2025 tax returns, they will be eligible for a significantly higher SALT deduction cap than at any point since 2017. Under the One Big Beautiful Bill Act, the cap has increased from $10,000 to $40,000 per tax return for married couples filing jointly and to $20,000 for single filers. The cap will increase by approximately 1 percent annually between 2026 and 2029. After 2029, it is scheduled to revert to the limits established in 2018, although lawmakers may choose to extend or further raise the cap.

While the increase on the SALT cap deduction is good news, there are a few important restrictions. The full benefit of the higher cap is available only to filers whose modified adjusted gross income (MAGI) does not exceed $500,000 or $250,000 for married filing separately. Above these thresholds, the $40,000 cap is gradually reduced. For every dollar of income over $500,000, the SALT cap is reduced by 30 cents, but never below the original $10,000 floor (or $5,000 for single filers).

Who Benefits Most from the Higher SALT Deduction Cap

The primary beneficiaries of the increased SALT deduction cap are likely to be middle income and upper middle-income homeowners in high tax states such as New York, particularly those whose state and local tax bills already exceed $10,000 and who itemize their deductions. However, not all middle-income homeowners will see a benefit.

For example, the standard deduction for married couples filing jointly for the 2025 tax year will be $31,500. The higher SALT deduction cap is advantageous only if a household’s total itemized deductions exceed this amount. Eligible itemized deductions include state and local income and sales taxes, real estate and personal property taxes, mortgage interest, personal casualty and theft losses, such as those resulting from federally declared disasters, charitable contributions, and unreimbursed medical and dental expenses that exceed 7.5 percent of adjusted gross income.

While it is difficult to estimate potential savings with precision, households that itemize and take advantage of the expanded SALT deduction will be paying federal taxes on a smaller portion of their income, which could result in meaningful tax savings.

Why the SALT Deduction Matters to New Yorkers

In many states, state and local taxes are relatively low or, in some cases, nonexistent. By contrast, New York City residents pay both state and city income taxes, in addition to substantial property taxes. As a result, their combined itemized deductions are far more likely to exceed the standard deduction of $15,750 for single filers and $31,500 for married couples than in most other parts of the country.

It is therefore unsurprising that New York’s elected officials have been

among the most vocal critics of the SALT deduction cap. In a 2022 Supreme Court appeal seeking its removal, Governor Kathy Hochul described the cap as “nothing

less than double taxation on New Yorkers.” New York Attorney General Letitia

James echoed this sentiment, calling it an “unfair cap” that has “placed a

significant financial burden on countless hardworking, middle-class families.”

The Broader Impact of the SALT Deduction Increase

Raising the SALT deduction cap has the potential to strengthen New York City’s real estate market in several ways. Most notably, it reduces the effective cost of living for some households by allowing them to deduct a larger share of the taxes they already pay. This change may make New York City a more attractive option for middle income and upper middle-income households considering whether to remain in or relocate to the city.

Whether the increase will meaningfully influence long term housing or migration decisions remains to be seen. What is clear is that when tax season arrives in early 2026, at least some New Yorkers will see a reduced federal tax bill, likely for the first time since the original $10,000 SALT deduction cap took effect in 2018.

Would you like to tour any of these properties?

Just complete the info below.

Or call us at (212) 755-5544

Manhattan condos under $1M

63 West 107th Street, #24

$675,000 (-3.4%)

Broadway Corridor | Condominium | 2 Bedrooms, 1 Bath | 615 ft2

63 West 107th Street, #24 (Brown Harris Stevens Residential Sales LLC)

Hudson Tower, #4R (Corcoran Group)

The Beekman Condominium, #2B (Compass)

40 Broad Street Condominium, #28E

$839,000 (-2.3%)

Financial District | Condominium | 1 Bedroom, 1 Bath | 801 ft2

40 Broad Street Condominium, #28E (Serhant)

The Collection, #2207

$845,000 (-5.6%)

Financial District | Condominium | 1 Bedroom, 1 Bath | 926 ft2

The Collection, #2207 (Digs Realty Group LLC)

Cambridge Club Condominium, #3B

$849,000 (-5.1%)

Financial District | Condominium | 2 Bedrooms, 2 Baths | 1,140 ft2

Cambridge Club Condominium, #3B (Brown Harris Stevens Residential Sales LLC)

Cambridge Club Condominium, #3B

$849,000 (-5.1%)

Financial District | Condominium | 2 Bedrooms, 2 Baths | 1,140 ft2

Cambridge Club Condominium, #3B (Brown Harris Stevens Residential Sales LLC)

The Delegate, #10E

$875,000 (-12.4%)

Turtle Bay/United Nations | Condominium | 2 Bedrooms, 1 Bath | 800 ft2

The Delegate, #10E (Sothebys International Realty)

The West Residence Club, #203 (Corcoran Sunshine Marketing Group)

The Elysabeth, #12B (Compass)

The Platinum, #308 (Yoreevo LLC)

40 Broad Street Condominium, #19B

$975,000 (-2.4%)

Financial District | Condominium | 1 Bedroom, 1.5 Baths | 1,066 ft2

40 Broad Street Condominium, #19B (Station Cities)

Gregory Towers, #15F (Compass)

640 West End Avenue, #12C (Brown Harris Stevens Residential Sales LLC)

Bloom on 45th, #202 (Triumph Property Group Ltd)

Worldwide Plaza, #TH1 (Douglas Elliman Real Estate)

305 West 52nd Street, #2J (Compass)

425 Central Park West, #3J (Time Equities Inc)

The Lex 54 Condominium, #16E (Serhant)

Hudson View West, #7I

$999,999 (-16.7%)

Battery Park City | Condominium | 3 Bedrooms, 2 Baths | 1,118 ft2

Hudson View West, #7I (Howard Hanna NYC)

15 William NY, #31G (Corcoran Group)

Would you like to tour any of these properties?

Just complete the info below.

Or call us at (212) 755-5544

Would you like to tour any of these properties?

6sqft delivers the latest on real estate, architecture, and design, straight from New York City.

6sqft delivers the latest on real estate, architecture, and design, straight from New York City.