Ready to buy your dream NYC home? Not so fast. (2 West 67th Street, #67B, (BHS))

Ready to buy your dream NYC home? Not so fast. (2 West 67th Street, #67B, (BHS))

Buying an apartment can be a long and stressful experience, especially for first-time buyers. For this reason, by the time an offer is accepted, most buyers are already breathing a huge sigh of relief. Unfortunately, having an offer accepted is by no means the end of the apartment-buying journey. Between the offer acceptance and the deal closing, a lot of things need to happen and a lot of things can go wrong. Not surprisingly, the more active the market, the more likely it is that even a small misstep during this short window of time will result in the seller pulling out and going down their list to the next prospective buyer. To ensure your dream home doesn’t slip away after your offer has been accepted, be prepared to quickly complete the following five must-do steps.

In this article:

#1. Get a Mortgage

It is generally advisable to be pre-approved for a mortgage because once your offer is accepted, you’ll need to immediately get a mortgage. Given that time is of the essence here, you may want to go directly to a mortgage broker rather than shop around yourself for the best deal. Brokers work with multiple lenders and will be better positioned to find you the very best deal in the shortage amount of time. While the broker will need to be paid by someone, the broker’s fee is, in many cases, paid by the lender, not the client, so relying on a broker won’t necessarily add to your closing cost. If you can, also lock in your interest rate to ensure you don’t end up with a much higher rate than the one to which you initially agreed.

#2. Hire an Attorney

While it is often possible to close real estate deals without an attorney in some parts of the country, that is simply not the case in New York City. Where there is a deal closing, there are at least two attorneys. However, in most cases, attorneys come on the scene long before any money changes hands at a closing. To ensure you’re not missing any critical steps, it is advisable to contract with a real estate attorney sooner rather than later. They are familiar with all the steps you’ll need to go through to close a deal in a timely manner, including the next three essential steps.

#3. Carry Out an Inspection and Appraisal

When buying a used car, one typically looks for a certified vehicle. When buying an apartment or house, there is no equivalent. This means the only way to find out whether the apartment or house is in sound condition is to hire an inspector. Inspectors are trained to check for things that most buyers are unlikely to notice during an open house or even upon a closer second look. These are generally the sorts of problems that lurk well behind the fresh paint and fancy staging—things like faulty wiring, water damage, and mold. Inspectors can also let you know if there are any other, less serious issues with the home (e.g., whether the air conditioning will likely need to be replaced in the near future). Most home inspections take two to three hours and cost on average $300 to $400 (per HomeAdvisor). If the inspector finds major problems with the unit, you’ll have the option of pulling out of the deal or putting in a lower bid.

#4. Do a Title Search and Acquire Title Insurance

In addition to carrying out a home inspection, you’ll need to hire a certified appraisal to complete a home appraisal. In fact, most lenders require an appraisal before finalizing financing deals. Appraisers, who typically charge between $300 and $400 (per HomeAdvisor), take a number of factors from the age and location of the home to its square footage to its current condition into account to appraise the home’s actual value.

A title search is essentially a search to confirm that the property you are buying is owned by the seller and that no other entity has interests in or rights to the property. In most cases, title searches don’t yield surprises in New York City. This is not always the case in more rural areas, where a title search might reveal that the property you’re buying has an established access rights agreement that gives someone else (e.g., a local farmer) the right to transport equipment across your property or even use it for some purposes. Nevertheless, whether you’re living in upstate or in Manhattan, you will need to complete a title search before closing and acquire title insurance. Title insurance is essentially insurance that protects you from past claims to the property. This means that if a relative inherited the property in the past but didn’t claim it before it went on the market, they can’t come forward years later and make a claim on your new home.

#5. Acquire Home Insurance

You wouldn’t drive a car off the lot without insurance, and you also certainly shouldn’t acquire a new home without insurance. Before you close any deals, ensure you have adequate house insurance. Depending on where your home is located, you may also want to consider acquiring related types of insurance, including flood insurance. In fact, if you live in one of New York City’s FEMA-defined flood districts, flood insurance is required.

There is no question that it is challenging to find a lender, attorney, inspector, appraiser, and insurer in the short period of time one usually has between having an offer being accepted and closing a deal. However, everyday New Yorkers, including first-time buyers, do manage to find all the people they need to complete the must-do steps connected to closing deals on new homes. If you’re thinking about going on the market for a new home or are in the process, the best way to ensure you don’t experience any delays once an offer is accepted is to put financing in place and have a referral list in place long before your offer is accepted.

Exquisite super-luxury homes listed in September 2024

Aman New York Residences, #18A

$39,995,000

Midtown West | Condominium | 3 Bedrooms, 3.5 Baths | 3,746 ft2

Aman New York Residences, #18A (Douglas Elliman Real Estate)

1125 Fifth Avenue, #10 (Douglas Elliman Real Estate)

Would you like to tour any of these properties?

Just complete the info below.

Or call us at (212) 755-5544

140 Franklin Street, #2B (Compass)

100 Eleventh Avenue, #17B18 (Serhant LLC)

The Spears Building, #3AF (Compass)

The Residence on Madison, #5A (Corcoran Group)

Infinity Flats, #PH

$7,750,000

Flatiron/Union Square | Condominium | 4 Bedrooms, 4.5 Baths | 4,109 ft2

Infinity Flats, #PH (Brown Harris Stevens Residential Sales LLC)

The Fairchild, #5A (Serhant LLC)

48 Bond Street, #Unit9 (CORE Group Marketing LLC)

60 Gramercy Park North, #PHA (Sothebys International Realty)

114 Liberty Street, #7

$6,500,000

Financial District | Condominium | 6+ Bedrooms, 4.5 Baths | 5,400 ft2

114 Liberty Street, #7 (Compass)

One United Nations Park, #28E

$6,150,000

Murray Hill | Condominium | 3 Bedrooms, 3.5 Baths | 2,835 ft2

One United Nations Park, #28E (Brown Harris Stevens Residential Sales LLC)

466 Washington Street, #3W (Compass)

The Park View, #4A (Sothebys International Realty)

176 Duane Street, #4 (Douglas Elliman Real Estate)

554 Broome Street, #PH (R New York)

35 West 23rd Street, #3

$5,495,000

Flatiron/Union Square | Condominium | 3 Bedrooms, 2 Baths | 3,400 ft2

35 West 23rd Street, #3 (Corcoran Group)

22 Warren Street, #PH6 (Douglas Elliman Real Estate)

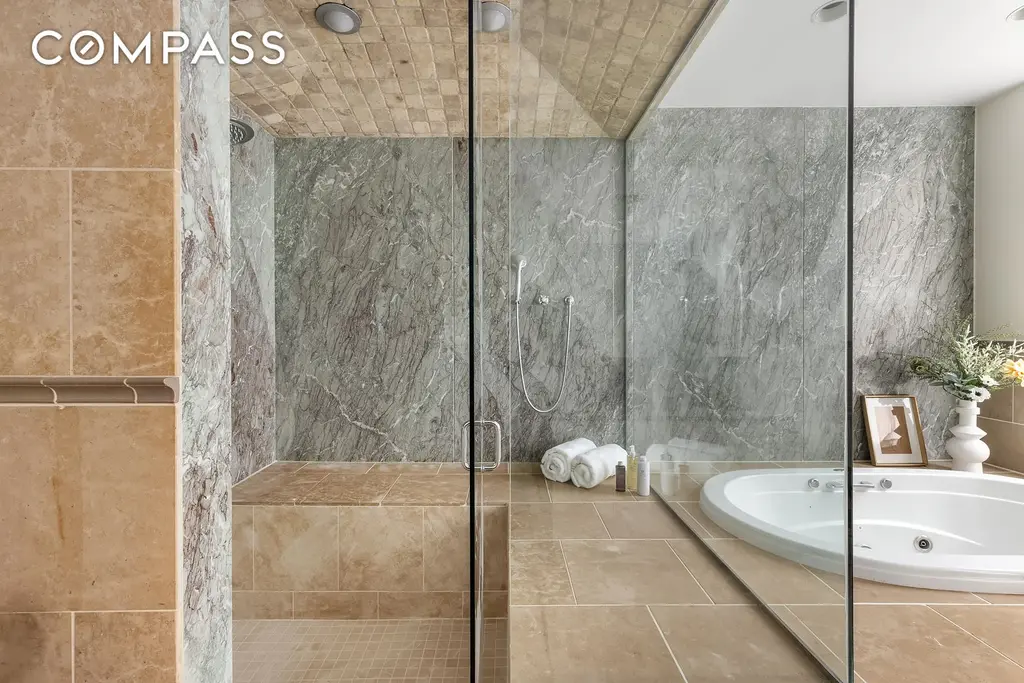

2 West 67th Street, #67B

$5,000,000

Central Park West | Cooperative | 2 Bedrooms, 2.5 Baths | 2,515 ft2

2 West 67th Street, #67B (Brown Harris Stevens Residential Sales LLC)

The Gotham, #E8E (Douglas Elliman Real Estate)

374 West 11th Street, #5 (Corcoran Group)

Walker Tower, #9C (Compass)

74 Warren Street, #PH (Compass)

Windsor Tower, #PH5 (Compass)

Would you like to tour any of these properties?

Just complete the info below.

Or call us at (212) 755-5544

Would you like to tour any of these properties?

Contributing Writer

Cait Etherington

Cait Etherington has over twenty years of experience working as a journalist and communications consultant. Her articles and reviews have been published in newspapers and magazines across the United States and internationally. An experienced financial writer, Cait is committed to exposing the human side of stories about contemporary business, banking and workplace relations. She also enjoys writing about trends, lifestyles and real estate in New York City where she lives with her family in a cozy apartment on the twentieth floor of a Manhattan high rise.

6sqft delivers the latest on real estate, architecture, and design, straight from New York City.

6sqft delivers the latest on real estate, architecture, and design, straight from New York City.