The Beekman 575 Park Avenue, #809 | https://cityrealty.com/n/I2646243

The Beekman 575 Park Avenue, #809 | https://cityrealty.com/n/I2646243

Purchasing an apartment in New York City through a trust has many advantages. Likewise, transferring property to loved ones through a trust can be advantageous. This may explain why purchases and transfers through trusts are on the rise. According to Bloomberg, Manhattan home sales involving a trust spiked to 28 percent in 2024.

Whether you are considering a purchase or transfer, however, trust-related transactions of properties do present increased complications and restrictions. This article examines the pros and cons of this increasingly common practice.

Whether you are considering a purchase or transfer, however, trust-related transactions of properties do present increased complications and restrictions. This article examines the pros and cons of this increasingly common practice.

In this article:

The benefits of purchasing or transferring properties through a trust

There are several advantages to buying a New York City property through a trust, making it a compelling option, especially for high-net-worth buyers and anyone looking to protect their privacy or assets.

Increased privacy

One of the most compelling reasons to buy or transfer property through a trust is that it offers increased privacy. When real estate is purchased through a trust, the property records show the trust name, not the individual buyer’s or transferor’s name.

This was always the case, but trusts became more attractive in the wake of the recently passed LLC Transparency Act. This requires all LLCs seeking to do business in New York to submit information on the owners to the New York Department of State, but entities like limited partnerships and trusts are exempt. For obvious reasons, this makes buying property through a trust especially appealing to celebrities and anyone else seeking increased privacy.

One of the most compelling reasons to buy or transfer property through a trust is that it offers increased privacy. When real estate is purchased through a trust, the property records show the trust name, not the individual buyer’s or transferor’s name.

This was always the case, but trusts became more attractive in the wake of the recently passed LLC Transparency Act. This requires all LLCs seeking to do business in New York to submit information on the owners to the New York Department of State, but entities like limited partnerships and trusts are exempt. For obvious reasons, this makes buying property through a trust especially appealing to celebrities and anyone else seeking increased privacy.

Tax advantages

Buying through a trust can also help mitigate one’s tax liability, especially in cases where the owner has a large estate (e.g., one that exceeds the federal estate tax threshold of $11 million). In such cases, putting a property into a trust can bring one below the threshold and substantially reduce the tax liability on their estate.

Buying through a trust can also help mitigate one’s tax liability, especially in cases where the owner has a large estate (e.g., one that exceeds the federal estate tax threshold of $11 million). In such cases, putting a property into a trust can bring one below the threshold and substantially reduce the tax liability on their estate.

No probate

It is not unheard of for probate, a process in which a judge validates a deceased person’s will before any assets are distributed, to take months or even years to complete. Purchasing a property with a trust is a convenient way to transfer property directly to beneficiaries, bypassing the cost and time associated with probate.

It is not unheard of for probate, a process in which a judge validates a deceased person’s will before any assets are distributed, to take months or even years to complete. Purchasing a property with a trust is a convenient way to transfer property directly to beneficiaries, bypassing the cost and time associated with probate.

Protecting assets from creditors

Putting assets in a trust can be a strategic way to protect one’s assets under some conditions. For example, if you purchase a condo or co-op for a child or grandchild through a trust, even if you eventually end up owing creditors, the property purchased through a trust is protected.

Putting assets in a trust can be a strategic way to protect one’s assets under some conditions. For example, if you purchase a condo or co-op for a child or grandchild through a trust, even if you eventually end up owing creditors, the property purchased through a trust is protected.

The challenges of purchasing or transferring properties through a trust

Increased complexityFew real estate deals in New York City are fast or straightforward but buying or transferring a property through a trust is even more complex. In most local real estate deals, there are already many players, including the buyer, seller, co-op or condo board, and their accompanying attorneys (in other words, three stakeholders and three legal counsels). If you’re purchasing or transferring property through a trust, you’re adding yet another layer to an already complex process.

Lending Restrictions

While most people who purchase or transfer property through a trust don’t require financing, those who do are bound to run into challenges. Many lenders don’t work with trusts or impose restrictions (e.g., limited financing or less preferable mortgage rates).

While most people who purchase or transfer property through a trust don’t require financing, those who do are bound to run into challenges. Many lenders don’t work with trusts or impose restrictions (e.g., limited financing or less preferable mortgage rates).

Would you like to tour any of these properties?

Just complete the info below.

Or call us at (212) 755-5544

Higher closing costs

Like any unconventional purchase, anyone looking to buy through a trust should also expect higher legal fees and, in general, higher closing costs.

Like any unconventional purchase, anyone looking to buy through a trust should also expect higher legal fees and, in general, higher closing costs.

Co-op complications

Historically, co-ops have steered clear of purchases through trusts, but times are changing; though this may simply reflect the fact that in a sluggish market, co-ops are currently becoming more open to alternative purchasing schemes. Even as co-op boards warm up to the idea of purchases through trusts, restrictions persist (e.g., many boards still only allow trust purchases and transfers if immediate family members will live in the unit, and even then, board approval for the occupants is still expected).

Historically, co-ops have steered clear of purchases through trusts, but times are changing; though this may simply reflect the fact that in a sluggish market, co-ops are currently becoming more open to alternative purchasing schemes. Even as co-op boards warm up to the idea of purchases through trusts, restrictions persist (e.g., many boards still only allow trust purchases and transfers if immediate family members will live in the unit, and even then, board approval for the occupants is still expected).

The advantages, including enhanced privacy, potential tax savings, streamlined inheritance processes, and asset protection, can make buying or transferring property through a trust an attractive practice, particularly for parents and grandparents looking to buy on behalf of adult children. For buyers in need of financing and for anyone looking to buy or transfer shares in a co-op, the practice can be much more complex. As a result, the decision to buy and transfer property through a trust is best determined on a case-by-case basis.

Select listings where buying with a trust is permitted

The Beekman, #809 (Douglas Elliman Real Estate)

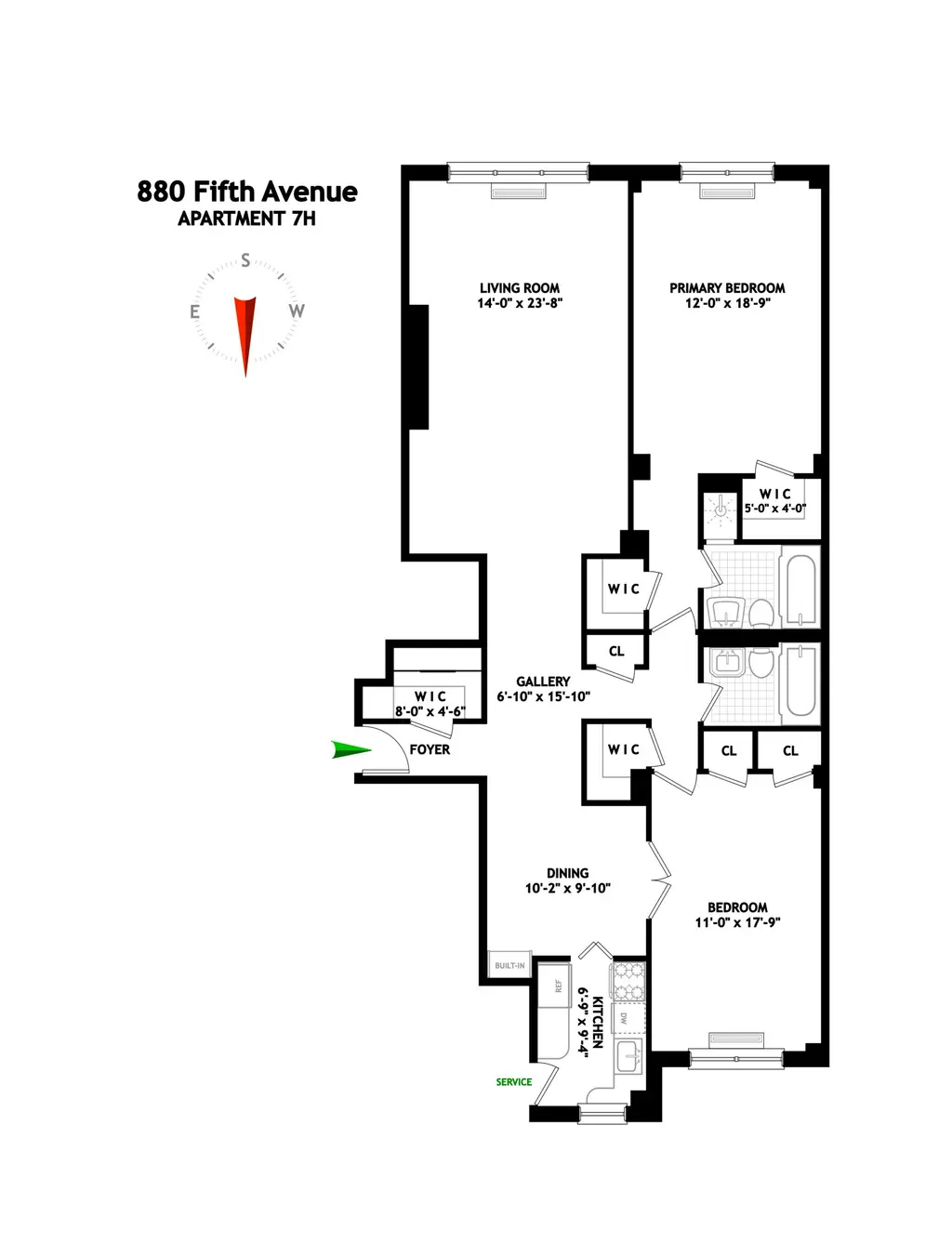

880 Fifth Avenue, #7H

$1,585,000 (-3.2%)

Park/Fifth Ave. to 79th St. | Cooperative | 2 Bedrooms, 2 Baths

880 Fifth Avenue, #7H (Brown Harris Stevens Residential Sales LLC)

11 East 92nd Street, #1 (Brown Harris Stevens Residential Sales LLC)

84 Mercer Street, #4 (Compass)

2 Fifth Avenue, #14R (Brown Harris Stevens Residential Sales LLC)

Medium Lipstick, #PH (Sothebys International Realty)

Would you like to tour any of these properties?

Just complete the info below.

Or call us at (212) 755-5544

Would you like to tour any of these properties?

Contributing Writer

Cait Etherington

Cait Etherington has over twenty years of experience working as a journalist and communications consultant. Her articles and reviews have been published in newspapers and magazines across the United States and internationally. An experienced financial writer, Cait is committed to exposing the human side of stories about contemporary business, banking and workplace relations. She also enjoys writing about trends, lifestyles and real estate in New York City where she lives with her family in a cozy apartment on the twentieth floor of a Manhattan high rise.

6sqft delivers the latest on real estate, architecture, and design, straight from New York City.

6sqft delivers the latest on real estate, architecture, and design, straight from New York City.